The notorious South Seas Bubble saw the creation of dozens of new companies that would invest in new ventures. Most were pie-in-the-sky, while some were outright frauds. You can see below (excerpt from Mackay’s classic book) the ones that were officially deemed “bubbles” by the authorities - one stands out for the astonishing audacity of its promoters: “For carrying on an undertaking of great advantage; but nobody to know what it is.”

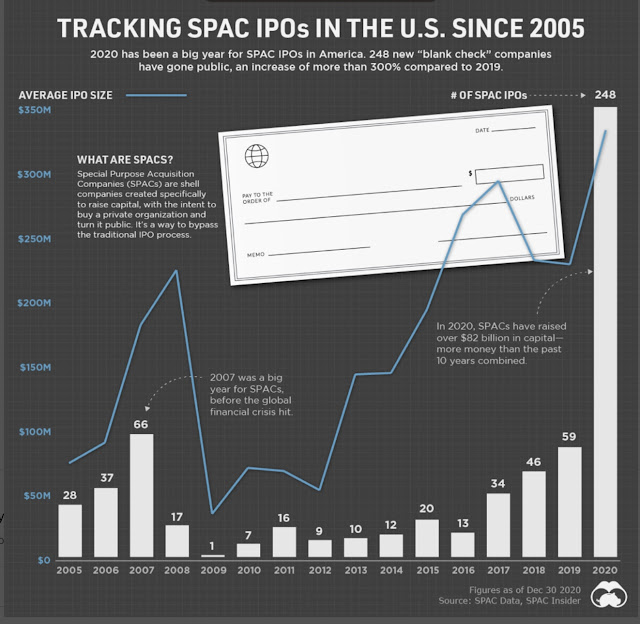

Today, the equivalent craze is called SPAC - Special Purpose Acquisition Company. Essentially, you are giving their promoters a blank check to acquire just about anything they see fit. Last year there were an astonishing 248 SPACs listed, up from just a handful a few years ago (Chart 1). Yes, amidst the COVID pandemic the public saw fit to throw $82 billion into “undertakings of great advantage”. Make no mistake, this is strictly a retail “product, no sane institution would ever participate. Why? Keep reading..

Chart 1

Why are SPACs so popular? Because they are highly profitable - not for the investors, however, but for their promoters. According to a recent Harvard Law School study 33% of the money raised is gone by the time the SPAC makes its first acquisition: fees, expenses, selling commissions take an enormous bite. Worse yet, the median SPAC performance 12 months after their merger with a target company is -56% and even worse when compared to other IPO benchmarks (see below).

The Harvard study concludes:

The SPAC-mania vividly reminds me of the CMO, CLO, CDO craze of 2005-07. And we all know how that ended...

No comments:

Post a Comment