These are truly weird times. In fact, it is the only time in my memory that it makes more sense to pay attention to what people are saying, instead of doing. Allow me to explain.

On the first chart we see that consumer expectations are at a record low, on the same level as the dark days of 1970s double digit inflation, the 1987 Crash and the Great Debt Crisis. Notice how Americans’ expectations dropped during the pandemic and then recovered slightly, only to plunge to the bottom immediately after, despite the trillions showered upon them by the Government/Fed.

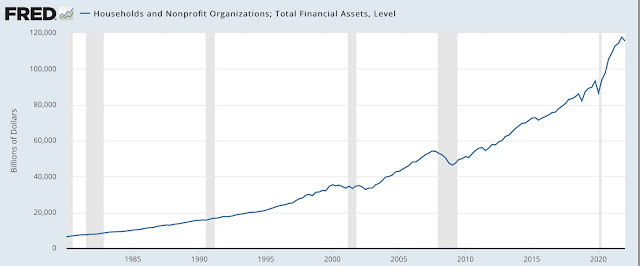

And showered by trillions they were, indeed. Household financial assets jumped by an incredible $30 trillion in a matter of months, the largest increase in the history of the United States - see chart below. The country’s entire annual GDP is approx. $25 trillion, so it’s as if all of it - and more - went into peoples’ pockets as cash and financial asset appreciation. That’s absurd - or rather, absurdly sudden and very, very dangerous.

Household Financial Assets Soared

Americans became InstaRich (or felt like it), and naturally acted like it, spending with abandon. After a brief collapse during the pandemic, retail sales exploded upwards.

Retail Sales Explode

If there ever was a case of “watch what I do, not what I say” this would be it, right? Yes - up to now.

Because, things are now getting seriously ugly at the consumer inflation front, hitting Americans very, very hard where it hurts most: housing (mortgage rates have doubled), energy and transport (gasoline, electricity, heating and automobile prices are up 30-50%) and food (up 15-20%). Things are also getting very ugly at the stock market and cryptos, the unfortunate choice of many amongst the younger generation who have not experienced bubbles and their eventual sad outcomes.

So, this is why I think we should pay attention to what Americans “feel”: when people ultimately (soon?) combine their record low sentiment with present market ugliness destroying their InstaWealth, and then act on it, we may very well get a sudden denial to spend on anything and everything. We may also get a sudden rush for the markets’ exits in order to preserve whatever wealth can be preserved.

Bottom line: It is weird in the extreme to have record high household wealth, record high retail sales AND record low consumer sentiment, all at the same time. This situation will normalize, and it could do so abruptly - thus the dangerous part.

A final note: how is record low sentiment and record high wealth even statistically possible? I believe there is only one possible explanation: sentiment is measured for 330 million Americans, but wealth is concentrated at the top 1% of the population. In other words, the Gilded Age in extremis. Can the 330 million affect the wealth of the top 1%? You better believe they can, when they stop buying high-value, high-margin “unnecessary” items and services, and also stop being the marginal “top-of-the-bubble buyers” of stocks and become the “get-me.out.now” sellers.

No comments:

Post a Comment