We know that debt is not equally distributed across our society. That is to say, lots and lots of people OWE debt but very few, proportionally, OWN it as an asset. For example, everyone owes equally his/her portion of public debt through the issuance of Treasurys and other public-sector bonds (e.g. muni bonds), but a very small number of people ultimately hold most of those bonds in their portfolios, directly or indirectly.

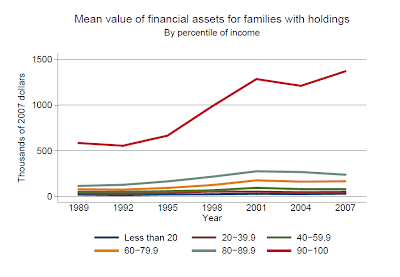

Here are three charts which point to this imbalance, from the Fed's Survey of Consumer Finances.

In the first chart, we see that debt OWED is pretty well distributed among all income groups.

The picture changes dramatically in the next chart, which shows the distribution of financial assets, used here as a more general proxy for debt OWNED.But even if look only at the distribution of bonds held directly by families, the picture does not change.

Poor, middle class and rich people all owe debt, pretty much alike. However, it is by far the rich that are owed this debt - and the gulf between them has widened enormously in the last quarter century. In 1989, 90% of the people owned bonds worth around $100,000, while the top 10% owned $300,000. In 2007 (latest data available) this picture has changed dramatically: 90% still own bonds worth around $150,000 but the top 10% holdings have soared to $900,000.

This enormous imbalance has serious social consequences, now plainly evident in Europe where people are being asked to slash their (formerly inflated) living standards in order to sustain a rickety debt structure. It can't be done and it should not be done - at least not in this way.