Milton Friedman once famously said:

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

IMHO his statement is self-evident.

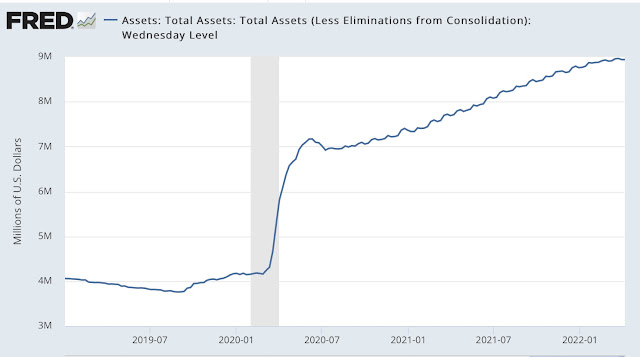

How is the US doing in this respect? Is the currently soaring inflation due to the pandemic "supply chain disruptions" and the war in Ukraine? Or is it "a more rapid increase in the quantity of money than in output"? I believe that the chart below makes things perfectly clear.

The line is the ratio of M3/GDP in current dollars, ie by Friedman's definition above, "the quantity of money" divided by "output". Notice how the line has varied very little for 50 years between 0.5 and 0.6, until around 2010 when the Great Debt Crisis forced the Fed to pump much more money into the system.

M3/GDP ($/$)

The pandemic then threw money creation into overdrive, as QE printed money in unprecedented quantities, justified (?) by the Modern (?) Monetary Theory (MMT) which claimed that the money tsunami is perfectly ok because GDP growth will eventually catch up.Well.... MMT is not working, at least not yet: the ratio soared to 0.90 and doesn't show any signs of going down fast, despite record GDP. Instead, inflation soared - as Milton Friedman would expect.

==> It is all the more urgent for the Fed to start QT-ing in size.