Extremely short post, I have been busy…

As the Omicron variant makes clear, money is not a panacea. The only thing that senseless money printing creates is inflation, while it is completely useless against pandemics. Our politicians and central bankers threw money at the virus, thinking it would solve all problems. They were, and still are, incredibly wrong…..

The pandemic rages on….

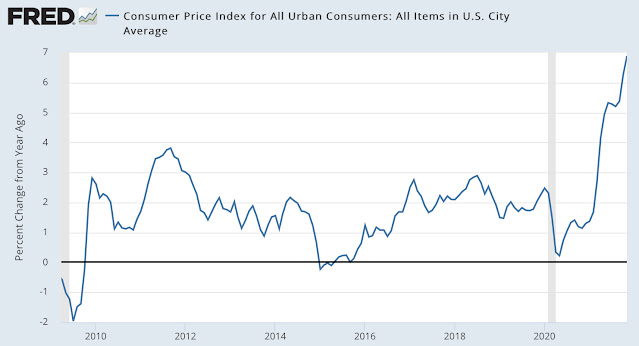

And so does inflation….

Curiously, or maybe not, both charts look “spikey” .

I’m no epidemiologist, but the cure for both conditions looks to me to be the same: slow down. Restrict activities, consume less, remove money from the system. Yes, it will mean a coal in the Christmas stocking, but it’s better than yet another viral explosion.

This is an excellent related read. Great Twitter account btw:

ReplyDeletehttps://www.investors.com/market-trend/the-big-picture/stock-market-falls-health-care-stocks-lift-russell-2000-watch-these-networking-stocks/

Sorry, wrong link. This is the correct link:

ReplyDeletehttps://northmantrader.com/2021/12/16/the-unraveling/

thanks man; that was a refreshing perspective... Yes, I concur with his psycho analysis of Powell and his implicit assumption that (today) all investing is basically a game of guess the Fed...

Deletemore worrying news

ReplyDeletehttps://www.straitstimes.com/business/banking/singapore-adds-to-its-gold-pile-for-the-first-time-in-decades

Singapore is not a gold bug country. This is what its gold reserves look like; as Hell says, spiky...

https://tradingeconomics.com/singapore/gold-reserves

At least they're not buying Bitcoins, lol.

DeleteThinking aloud... you know, I really dun hear about much inflation in Asia ex-China... Which leads me to suspect that the current inflation is a U.S., Europe problem... I think the answer is partly that the trade surplus nations are not longer re-investing their profits into U.S. bonds. They want assets instead.... Not really sure, just thinking...

ReplyDeleteSounds quite plausible indeed. Luxury goods are scarce the world over for quite some time now, and that's just for starters... Interesting stuff.

DeleteAye; interesting times... =)

DeleteI believe Western inflation has more to do with torrents of new liquidity than anything else.

DeleteIt kind of feels like there used to be a cycle, where Asian's would make stuff; the west would buy; and the Asian profits would be reinvested into the West... That cycle may be breaking down, with the profits reinvested into gold (heaven forbid bitcoin).... If so, money printing goes from a luxury to a necessity...

DeleteMoney printing feels more like a symptom (which makes the disease even worse), than a cause...

Hey Hell, Treasury yields are up quite a lot... you making lots of money? =)

ReplyDelete