With natural gas prices soaring, is consumer inflation about to soar too? Yes, of course.

Natural gas is used everywhere: power generation, heating, transportation, agriculture, metal and chemical production. It is very deeply entwined into the life of all consumers who, for the last 15+ years at least, didn’t have to worry too much about its price affecting their pocketbooks and living standards.

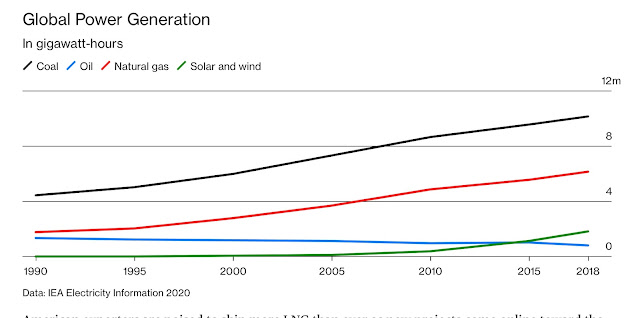

This is about to change, and radically so - see chart below.

The price for natural gas in Europe has exploded to unprecedented highs, more than tripling in just a few months. Very sharp hikes are already occurring in wholesale electricity prices, and many providers, particularly in the highly privatized and deregulated UK, are going out of business. Politicians are praying for a mild winter, but prayer does not make for good policy.

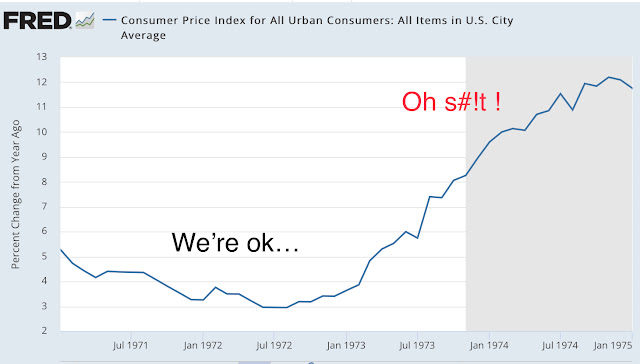

How will a sudden tripling of natural gas prices affect consumer inflation? We can look at history for a guide.

Back in 1973 crude oil was used everywhere, just like natural gas today. Believe it or not, natural gas was mostly considered a waste product and commonly “flared” on site (burned near the oil wells). When the Arab-Israeli conflict escalated into war, oil producers used oil as a weapon against the West and jacked up prices suddenly from $3/bbl to $10/bbl - see below.

Consumer inflation followed suit, going from 3% to 12%, bringing about a deep recession - see below.

Will 2021-22 be a repeat of 50 years ago? If we judge by what is going on now in the UK (petrol stations shutting down due to supply "imbalances") and China (widespread gas and electricity rationing is closing factories, reducing shopping hours and resulting in city brownouts), it is already happening. China's power rationing is certainly going to have a very serious global impact on the supply of all consumer goods, from T-shirts to Teslas. Like I said, gas is everywhere..

And now there is A LOT of fuel for an inflation conflagration. Money supply is simply through the roof, with M3 going from $15 trillion to $20 in 18 months - see below.

Is the bond market reacting? Given the constant manipulation by the Fed and ECB it is not easy to see the reaction - but it is happening. Just look at the 2-year Treasury yield making new 18 month highs.

Oh, and there is that pesky Debt Limit situation going on, too. Yesterday, the Senate rejected the Biden government's plan to, basically, ignore the debt limit until December 2022.

There may be a Perfect Storm brewing out there for financial markets.

the real kicker is I think the reaction of both China and the U.S. is to print yet more money...

ReplyDeletebut I think you are right Hell.... this is the trigger point... we (at least China) have just gone over the point of no return...

ReplyDeleteto explain... my guess... in China, local govt finance is very tied to land sales.... that has stopped and now there is no money to keep the lights on....

ReplyDeleteChina, being a "rational" authoritarian state is ... rationing (pun intended).

DeleteI remember Europe AND the US doing the same thing back in the 1970s and early 80s, albeit in different ways. Again, it was the UK that did power brownouts.

The only question remaining now in my mind is how quickly and how high will they raise interest rates once they panic.

oh, one more: Will China seize this opportunity to dethrone the US?

I dun have your experience; but I dun think they will rise interest rates... it will be the good old printing press again...

Deletedethrone US..... nah, the throne is yours; we wish you the joy of it. =)

If inflation spikes any further and the US does not raise rates then the dollar will tank, further inflaming domestic inflation. They will not have a choice, unless they don't care if the dollar loses its premier position as global reserve currency. I doubt anyone is willing to take that risk. And if they do, China will step in to fill the void and... sayonara Pax Americana.

DeleteGiven the U.S. budget; I dun think US can really raise the interest rate... given China's internal debt problems, it can't either. Sure inflation will spike; I suspect everyone will just pretend it did not really spike.... Same way we are still debating if the world is actually warming.... Or maybe they will bring out the old Weimar argument that printing money does not cause inflation (sounds a bit like MMT eh)....

DeleteChina is probably in so much trouble it is not going to challenge Pax America.. that said, China may become so desperate that it will. As Beria said, it is hard to make predictions, especially about the future.

It was Yogi Berra who said it :) Funny guy... said a lot of such aphorisms. Like, "it's daja vu all over again"

Deletethat is a new one for me... =)

Deletebtw... such statements only sound strange in English... in Chinese, it is actually grammatical to say "kill you dead"... =)

Deletewe are a very logical people; but strangely, Chinese (unlike English) is a very emotional language... the grammar almost insist on hyper-bole or exaggeration... for example, one seldom says something is good or bad... it is either very good or very bad... The idea is to convey the feeling rather than the logic...

Deleteyogi would feel right at home with us. =)

非常好

DeleteFēicháng hǎo ..... i hope this translates as "exceptionally good" :)

Exactly...... and that is how it should be used. =)

DeleteI thought the UK petrol station shortages were due to a lack of lorry delivery truck drivers due to Brexit? And not a petrol scarcity...

ReplyDeletehttps://www.bbc.com/news/explainers-58709456.amp

"There's an estimated shortage of more than 100,000 HGV drivers and petrol is only the latest industry to be hit."

That’s the story, yes. But at the end of the day the result is… no gas. And isn’t it weird that drivers disappeared just as prices went up? Hmmmmm

DeleteStrange indeed. Yes.

DeleteThis is from Dec 2018: https://www.bifa.org/news/articles/2018/dec/truck-driver-shortage-crisis-now-spreading-across-the-whole-of-europe

ReplyDeleteVery interesting, thank you!

Delete