John Maynard Keynes famously said:

- "Markets can stay irrational longer than you can stay solvent" and

- "In the long run we are all dead"

Likewise, just because household debt is at 131% of disposable income it doesn't mean it can't go to 150% before it collapses back to 65%. We need to look at other indicators to obtain a sense of timing for projections and predictions.

When it comes to servicing debt the most important factor is cash flow, i.e. having enough money to pay the lenders so they don't send out the repo man. We will first look at the overall cash position of US households vs. their liabilities. The chart below shows the amount of cash deposits and money market funds (i.e. liquid cash assets) held by households as a percentage of their debt. The picture is worrying, to say the least...CASH CRUNCH #1.

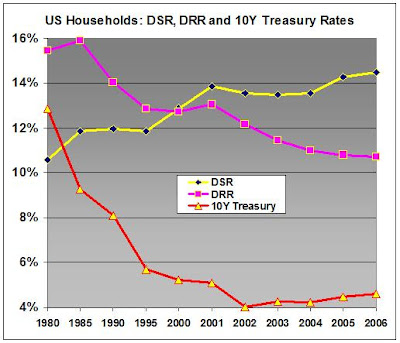

The next factor we need to examine is how much of that cash goes to service household debt. The debt service ratio (DSR: annual debt payments as a percentage of disposable income) is calculated by the Federal Reserve since 1980. In the chart below I have also included a Derived Repayment Rate (DRR: annual debt payments as a percentage of household debt) and the interest rate of the 10 year Treasury bond.

The next factor we need to examine is how much of that cash goes to service household debt. The debt service ratio (DSR: annual debt payments as a percentage of disposable income) is calculated by the Federal Reserve since 1980. In the chart below I have also included a Derived Repayment Rate (DRR: annual debt payments as a percentage of household debt) and the interest rate of the 10 year Treasury bond. The most important indicator is obviously DSR, or how much income goes every year towards servicing the debt load. Despite much lower interest rates DSR is at all time highs because total debt increased even faster. The Derived Repayment Rate (we could view it as a "gross" interest rate on all household debt) is still dropping since 2002 despite flat to higher long rates. This shows how borrowers switched to cheaper ARM's and other exotic mortgages during 2001-04 (FHLMC and MBA data show this, too).

The most important indicator is obviously DSR, or how much income goes every year towards servicing the debt load. Despite much lower interest rates DSR is at all time highs because total debt increased even faster. The Derived Repayment Rate (we could view it as a "gross" interest rate on all household debt) is still dropping since 2002 despite flat to higher long rates. This shows how borrowers switched to cheaper ARM's and other exotic mortgages during 2001-04 (FHLMC and MBA data show this, too).Short term interest rates are now back to the 2001 levels and as adjustable and exotic loans reset higher, DRR will soon move back to 13%. All other things being equal, this works out to a Debt Service Ratio of 18% over the next couple of years: Almost 1/5 of ALL income of ALL households in the US may thus go towards debt service .... CASH CRUNCH #2.

Another way to look at debt payments is as a percentage of liquid cash assets. The chart below shows how annual debt payments have progressed over the years as a percentage of deposits and money market funds held by households. Right now debt service requires 22% of all liquid cash assets, up from less than 15% in 1980.

Assuming a DRR of 13% as rates reset higher, we may soon see debt service taking up 26.5% of all cash balances... CASH CRUNCH #3.

Assuming a DRR of 13% as rates reset higher, we may soon see debt service taking up 26.5% of all cash balances... CASH CRUNCH #3.Another worrisome factor is that 1% of Americans own 38% of all assets and 2% own 55%, i.e. the richest 3 million people own $8.2 million of assets each, the next 3 million own $3.7 million, but the other 294 million people on average just $100,000. This huge dichotomy of American society speaks loudly to the destruction of the once mighty middle class and has serious implications for debt repayment. There is simply very little cash left to the "bottom" 98% of the population: the top 2% possess $1.17 million each in liquid cash assets, whereas the rest a measly $9,800 each, on average. Even as debt soared, cash assets for the vast majority of the people are very small... CASH CRUNCH #4.

In Summary: It is apparent that we are rapidly moving towards a showdown. For the vast majority of the population debt service is taking up more and more of their liquid cash. The Debt Bubble is acting as a sump pump sucking up money from the bottom 98% to gush it onto the top 2% in the form of bond coupons, dividends and capital gains. Ignoring for a moment notions of morality and social justice, such a system will collapse once the pump has reached the bottom dregs. The awesome growth of sub-prime lending, interest only, negative amortization, reverse mortgages, cash-outs, etc. are flashing red signals that the "pump" is at the bottom and is starting to run dry. There is very little cash left in the 98% well - the system is "about" to seize up.

Did I hear you ask...WHEN? Well, "about" is a supremely useful word when used in projections. It has a lovely one-size-fits-all quality that can be pulled, stretched and shrunk to justify, verify or nullify all theories. Who needs time travel when we already have "about"? (Smile).

Therefore, to answer "When?" I shall finish as I started, with another page from the life of Keynes. As you may know, he was an avid speculator in everything from commodities to securities. His style was one of taking large positions and sticking with them through thick and thin until he was proven right or until such time as his underlying suppositions were clearly proven wrong.

Current conditions are such that a "crunch" may occur at any time. Until and unless they go away, with even a modicum of sanity re-appearing in American finances, the timing is NOW.