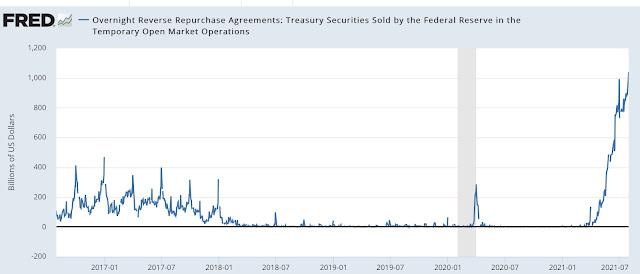

In this crazy time, the Fed is buying $120 billion of bills and bonds every month, including a lot of mortgage-backed securities, thus adding almost the same amount to the dollar money supply every month. Why? Because it says the economy is still not fully recovered. But, all this cash has nowhere to go so banks and money market funds give it right back to the Fed via the reverse repo.

All the while, the Fed’s balance sheet keeps ballooning, going from $4 trillion to $8.2 trillion in just 18 months.

To paraphrase Coleridge’s Ancient Mariner, “money, money everywhere and not any place to use it.” So, why keep printing it? Frankly, I am certain that the Fed has painted itself into a corner. It knows, without a shadow of a doubt, that its cash torrent is creating a speculative bubble of unprecedented size across all asset classes, from lumber, cryptos and penny stocks all the way to real estate and Treasurys. It knows that the bubble will eventually blow up, but it doesn’t want to be blamed for bursting it by tapering. So it keeps pumping, hoping the bubble will, somehow, deflate gradually.

And here’s something almost no one is talking about: the Fed is a BANK. Yes, a bank… with assets and liabilities, and as such it can go bankrupt if its assets stop performing and it can’t easily refinance itself. I think it is high time that we start looking at the Fed’s risk profile, no? Is anyone doing a stress test on the Fed - or the ECB?