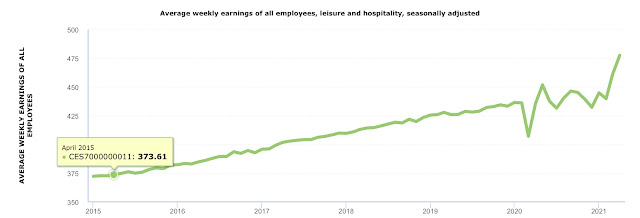

The Fed is between a rock and a hard place. They know that the torrent of cash they have unleashed will necessarily lead to inflation, most likely much more than their target 2-2,5%, but they are also very weary of overtly easing off their massive QE because a) it will burst the asset bubble and b) drive interest rates up, increasing debt service costs for the Treasury. Are they doing anything about it?

Maybe.

The question on everyone’s mind is when will the Fed reverse its radical QE strategy? But, the proper question may be has the Fed already started tapering, albeit under the radar?

In my previous post I wrote about the Fed’s overnight reverse repo operations that is removing some $400 billion from the system. As of yesterday the amount reached $433 billion, up from $175 billion two weeks ago and nearly zero last month. That’s serious money. If you’re not familiar with reverse repo, the Fed is borrowing money from banks for one to three days (overnight includes weekends on Fridays) against Treasury collateral. The Fed is accepting all amounts tendered and pays no interest at all (0.00%). And therein may hide the stealthy taper tale..

You see, the Fed isn’t obliged to accept (borrow) any specific amount - or even any at all. It is doing so solely at its discretion - so why is it accepting so much money? Again, it’s entirely voluntary, the Fed is not forcing banks to deposit the money, so no one can accuse the Fed of “active” tapering. Yet...

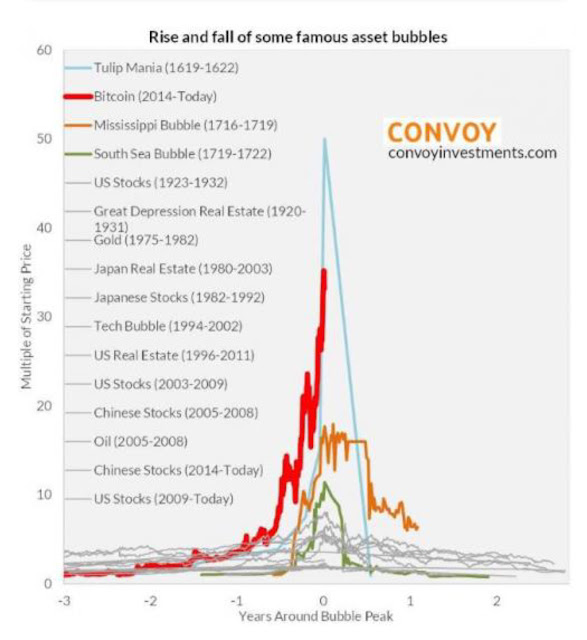

With markets so overextended and precarious, any overt tapering and/or increase in interest rates would likely lead to a crash as the asset bubble bursts. The Fed certainly does not want to be blamed for that. And even more importantly, it does not want to raise rates and put the Treasury in a tight spot with sharply rising debt servicing costs.

On the other hand, the Fed is certainly worried about inflation, no matter what they say (all the time) about “not being worried”. I mean, c’mon, just the fact that they have to keep on repeating “we’re not worried” means that they ARE worried. So, they have to do something.. something stealthy, so obscure and under the radar that most people won’t notice or be capable of interpreting.

Thus, the reverse repo... it is voluntary, reversible within just one day and at 0% below even Fed funds rates.. The Fed can easily wash its hands of all responsibility and walk away, if need be, But it does the job! Because when it is all said and done, the system is now drained of $433 billion. It’s really a matter of watch what I do quietly and stealthily, not what I say loudly and openly.