The Evergrande crisis is bringing back memories of 2006-08 and comparisons with Lehman’s collapse. Since I had a front seat to the Great Credit Bubble, I have a few observations.

The Credit Bubble of 2006-08 and the crash that followed were pretty easy to identify and to predict. I did it, and I’m no genius. All it took was some common sense and a bit of research. Not serious scientific research - finance is not quantum physics - just data put together from sources easily accessible to everyone. So, I looked; it was immediately obvious that residential mortgage lending had gone from a boring workaday business to a free-for-all, involving piles of obscure ultra leveraged derivatives.

The immediate culprit, over-leveraged real estate, led to a collapse that was easily understood and affected the wider public. I mean, everyone understood real estate and mortgages, even if they had no clue about MBS. CMO, CDS, CDO and the rest of the derivative alphabet soup.

The collapse immediately spread to the banking/financial system for a very simple reason: everyone trusted that a AAA or AA rated CMO or CDO meant it was gild-edged. In fact, it was an artificial construct that depended on very spurious assumptions. Basically, most of them were little pieces of mortgage bird$#it that were put into a pot, stirred vigorously and…. Voila, they were magically transmuted into foie gras. It was called structured finance and financial engineering; in fact, it was greedy loony alchemy.

Mark Twain said “it ain't what you don’t know that gets you into trouble. It's what you know for sure that just ain’t so”. In 2006-07 everyone knew for sure that they were buying expensive duck liver.

Before the Credit Bubble collapsed, everyone knew for sure that residential mortgages just didn’t default much - right?

But then, defaults soared - see chart below. The assumption upon which

all those alphabet soup securities were based was wrong, so they all

came crashing down like blocks in a Jenga game.

Delinquency Rate Of House Mortgages

Today, despite Evergrande’s troubles it is not really possible to point a finger to a single overpriced and over-leveraged asset class. Yes, there are NFTs and meme stocks that are priced absurdly, but they are not going to produce a systemic shock on their own. A can of “trading sardines” selling for $1 million won’t create a domino effect (see bottom of today’s post for an explanation). I think that while Evergrande may be in big trouble, it is pretty isolated. Crucially, it has not generated hundreds of billions in ultra leveraged credit derivatives which could annihilate bank and insurance company balance sheets all over the world. Evergrande is not Lehman. But something else may be an even bigger problem.

Back to the present: what is the biggest assumption that we make in markets? What is it that we all know for sure?

The US is rated AAA/AA+ and will never default, right?

The US government has never defaulted. Its bonds are considered ultra safe and act as the foundation of our global dollar-based monetary system. We know that they are safe, so we use them everywhere, from banking to pension fund assets. We also use them, one way or another, as benchmarks for just about every other financial product in existence. Treasurys are very, very deeply and widely interconnected with our global economic system. We take them for granted.

So, how safe are Treasurys, really?

Let’s start with the basics. Proper debt service is based on two things:

- The ability to easily cover interest payments.

- The ability to easily refinance.

Highly indebted borrowers are riskier and must pay higher interest rates and/or borrow less than they need. How is the US doing? Federal debt is now at 125% of GDP, just about the highest ever. But that by itself is not enough to spell trouble.

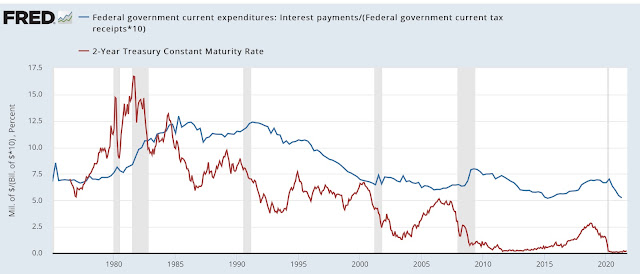

Let’s look at interest payments as a percentage of tax receipts. They have varied in a tight range between 5-7% for the last 20 years. But, today's 5% is not really as comfortable as it may seem because interest rates are near zero - see below. The US is still paying a chunky piece of tax revenue to cover interest payments, even though interest rates are near zero. What will happen if/when interest rates go up?

Point A: The US is very vulnerable to an interest rate increase

US Annual Interest Expense As % Of Total Tax Receipts (blue line)

Two Year Treasury Note Interest Rate (red line)

Another way to assess debt viability is to look at the ratio of total debt to annual tax receipts. It started rising in 1980 from 2.5x to around 7x in 2005, but then soared to 10x in 2010 as the government borrowed heavily to salvage the economy from the 2006-08 Credit Bubble. Dealing with the pandemic has now taken the ratio even higher to around 12x. If the government was a business, we would say that its debt load is 12 times its EBITDA, a very high multiple, indeed. For example, the S&P500 is around 2-3x, although that's nor a very relevant comparison; still, it provides a sort of yardstick.

- Point B: The US federal govt. is very highly indebted versus its income

Federal Debt/Annual Tax Receipts

Another way to look at US debt service is how much money is left over to cover interest payments after basic expenses are paid, eg salaries. For Fiscal Year 2022 the government projects receipts of .$4.12 trillion and outlays of $6.01 trillion. The budget deficit is thus estimated at $1.89 trillion. It was much worse for FY2020 due to COVID, but even so the 2022 deficit will be enormous by historical standards.

US Federal Budget Balance

Salaries and national defense outlays for 2022 are budgeted at $4.86 trillion. In other words, just paying for those two wipes out all revenue: $4.12-4.86 trillion = - $740 billion. The US is running a huge deficit before interest payments, ie it has a very large primary budget deficit. Outlays for interest for FY22 are estimated at $305 billion and will obviously have to be covered by more debt. Again, if this was a business banks would be very leery to lend.

- Point C: The US cannot cover interest without going deeper into debt, or slashing expenses and/or raising taxes significantly

Finally, are investors taking all of the above into account when lending to the US? Yes, to a limited extend they are getting more cautious. The "purest" way to look at default risk is through Credit Default Swaps (CDS). As of yesterday, the US is ranked #9 as a credit risk, below even Belgium and just a notch above Ireland (higher CDS prices equal higher default risk).

5 Year Sovereign CDS

It is interesting to note that US CDS prices have come up 32% in the last month alone.

Putting it all together....

Never mind Evergrande, maybe what we know but just ain't so is that the US cannot default. Or at least, that its debt is priced at a level that does not adequately reflect the risk of default. Given the upcoming debt limit process and the highly polarized political scene in Washington, we should maybe rethink what we know for sure.

————————————————-

The following was posted originally on Nov. 2, 2009

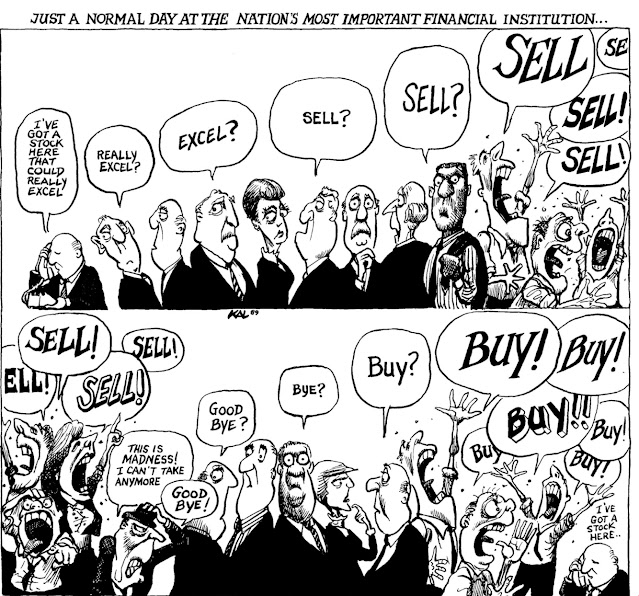

The Trading Sardine

Andy convinces Billy to buy a can of sardines at a high price by telling him how wonderful they taste. Billy, being greedy, decides to resell them to Charlie for a profit at an even higher price by convincing him, too, about how great these sardines are. The process is repeated several times until the last buyer, let’s call him Zebediah, pays a million bucks to Yorick for a can of the “world’s absolute best sardines – EVER”.

Well, Zebediah decides to open the can and eat the sardines, only to discover they are ordinary, plain sardines. Furious at being swindled, he yells at Yorick: “You crook! You liar! I paid you a million bucks for plain ordinary sardines. They were not the greatest tasting sardines - EVER”, yells Zeb.

Yorick shrugs and replies…

“Hey Zebediah, you are such a schmuck. Those were not eating sardines – them were trading sardines!"