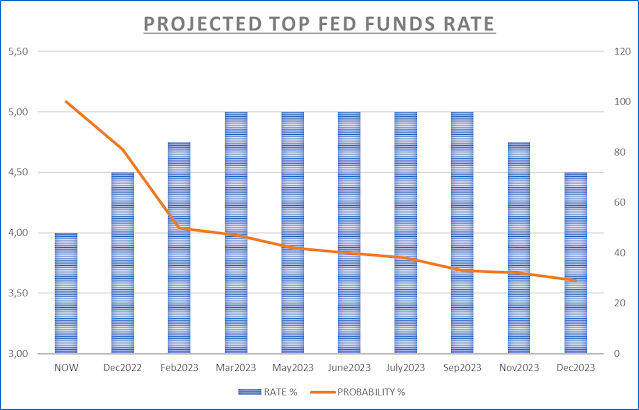

Seems like everyone in markets is hoping for a recession so that the Fed will stop raising rates. They point to the yield spread between 10 year and 2 year Treasuries as an accurate predictor of recessions. The spread is now at its most negative in 40 years, and a quick glance at the chart below confirms that a yield inversion accurately predicts recessions (grey areas in the chart).

From a fundamental perspective, it makes sense to expect a recession. Sharply higher prices for consumer essentials like energy, housing, food and transportation means that disposable income is curtailed for other expenses such as clothing, electronics, vacations, dining out, etc. So, yes, a recession is more likely than not.

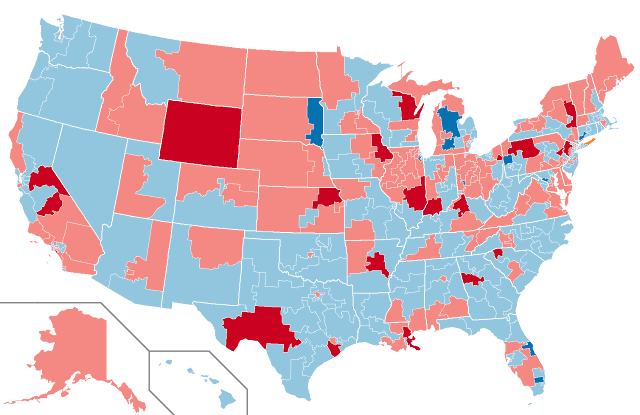

But, "markets" had better be very, very careful what they wish. For one, squeezing available incomes and raising unemployment in today's America is downright dangerous. The middle class has evaporated, replaced - mostly - by the working poor; and they cannot afford to see their incomes eaten away by inflation, because they simply cannot make ends meet living paycheck-to-paycheck. Labor actions are already in the works where unions still have a toehold, but if this negative income/expense balance continues for much longer there will be serious social trouble. At the very least, expect higher wage demands even where there is no unionization.

The government/Fed's record breaking largesse during COVID via QE helicopter money is now long gone, spent away on the likes of FAANG-type services and punting on scams like meme stocks, cryptos and NFTs. Moreover, the Fed has - finally - started to drain the excess liquidity at the rate of $95 billion/month. Not fast enough to kill inflation quickly IMHO, but this is money that will be increasingly "missed" from the economy.

Bottom line: I don't think this will be a recession like all others. It won't be the quickie down-and-up of old but a shallower and more prolonged affair, possibly marked by social unrest and political upheaval. Markets: Beware what you wish for!