Banking has always been considered a license to steal, assuming you could get a banking license to begin with. Because of the multiplier effect inherent in low regulatory deposit reserves, banks essentially create money and profits out of thin air, if they keep their operating costs low enough and their lending practices sound.

Global banking has changed radically in the past 20 years. Commercial and investment banking have once again become closely related, as corporate customers no longer wish to pay banks a spread for their traditional intermediation role (take deposit-make loan) and tap the securities markets directly for debt and equity capital. It came as no surprise that the 1933 Glass-Steagall Act separating commercial from investment banking was repealed in 1999.

Faced with rising competition, banks across the US merged in increasing numbers. There are now some 7.000 commercial banks vs. 14.000 22 years ago.

US Commercial Banks (St. Louis Fed)

US Commercial Banks (St. Louis Fed)But even as banks got fewer and bigger, competition for the remaining business - lending to households and small businesses - got even more competitive. Net interest margin (NIM), the most commonly followed gauge of banks' lending profitability, has come down dramatically, even as the risk profile of the borrowers has theoretically deteriorated. It is one thing to lend to solid blue chip corporate customers (however, note: are there any left?) and quite another to Mr. and Mrs. Jones, as the current mortgage mess clearly shows.

Even as NIM came steadily down, return on assets (ROA) stayed high, but flat. Increased fee and trading income balanced the steady erosion in net interest margins. Remember this when you get hit with a huge fee for being even one day late with a credit card payment

Despite the steady reduction in core lending profitability and stagnation in ROA, US banks found another way to boost reported profits: they simply cut loan loss reserves to the bone.

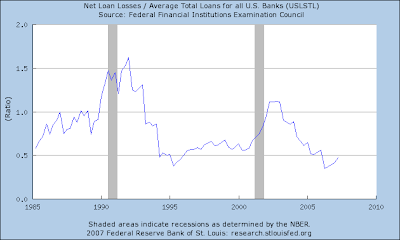

Banks weren't without justification for doing so, however. Reported net losses also came down at the same time - though not as fast, or as much, as loan reserves.

Even as NIM came steadily down, return on assets (ROA) stayed high, but flat. Increased fee and trading income balanced the steady erosion in net interest margins. Remember this when you get hit with a huge fee for being even one day late with a credit card payment

Despite the steady reduction in core lending profitability and stagnation in ROA, US banks found another way to boost reported profits: they simply cut loan loss reserves to the bone.

Banks weren't without justification for doing so, however. Reported net losses also came down at the same time - though not as fast, or as much, as loan reserves.

Therefore, it is no wonder that Return on Equity (ROE) for banks has stayed high, though it seems to be turning down a touch recently.

Therefore, it is no wonder that Return on Equity (ROE) for banks has stayed high, though it seems to be turning down a touch recently.It is pretty clear from the above that bankers and their shareholders are betting that losses won't increase much from these record-low levels. Given what is already happening in the residential and commercial mortgage market, plus the stirrings of higher credit spreads in the corporate market (see yesterday's post), such a bet carries long odds, in my opinion. And there is, unfortunately, more: the largest banks have vastly increased their exposure to hedge and private equity funds, lending lots against little and low-quality collateral. One of Bear Stearns' funds that went under used 17+ times leverage; an incredibly aggressive ratio of debt to assets that unfortunately in not all that uncommon in this "high liquidity" era.

Bottom line: In their quest to produce ever higher returns for their shareholders, banks have done away with considerable safety features in their lending practices and balance sheets. Thus the title of today's post, a throwback to Ralph Nader's 1965 book (Unsafe At Any Speed) dealing with the US auto industry.

he Fed is not intent on robbing anyone directly, so I have to believe their intentions are good, even if their choices are limited by current circumstances. Ever since the Great Depression the Federal Reserve's biggest nightmare has been a deflationary spiral - hence the cash helicopter that Mr. Bernanke is so famous for.

ReplyDeletekodak Klic-5001 battery

kodak KLIC-7000 battery

kodak KLIC7000 battery

kodak KLIC-7001 battery

kodak KLIC-7002 battery

kodak KLIC-7003 battery

kodak K7004 battery

kodak KLIC-7004 battery

kodak K7005 battery

kodak KLIC-7005 battery

jvc BN-V101 battery

jvc BNV101 battery

jvc GC-S5 battery

jvc MX-600X battery

jvc BN-VF815 battery

jvc BN-VF808 battery

jvc N-VF823 battery

panasonic CGR-S602E battery

panasonic DMW-BL14 battery

panasonic DMW-BC14 battery

panasonic CGA-S101SE battery

panasonic CGR-S101A battery

panasonic DMW-BC7 battery

panasonic CGA-S001 battery

panasonic DMW-BCA7 battery

panasonic DMW-BM7 battery

panasonic CGA-S002 battery