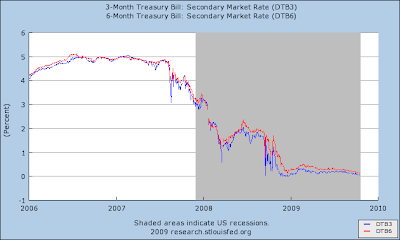

The US Treasury auctioned three and six month bills yesterday. Interest rates came in at 0.08% and 0.17% respectively (these are annual rates) and demand was very strong; the bid/cover ratio was around 4x. Apart from this and the previous two auctions, such bill rates were last seen in the depths of the Great Depression. One could be tempted to interpret this as flight to safety, fear of the credit crisis, etc. But it's not that at all - in fact, it's the exact opposite.

Investors and speculators are now so convinced that the economy will rebound strongly in the very near future, and therefore rates will rise, that they want to stay as short as possible duration-wise in their bond portfolios. Thus, they fall all over themselves to bid and buy the shortest possible paper available, i.e. T-bills. The same bullish consensus has also gripped Europe, where similar instruments are going for 0.40-0.50% (ECB's official rates are slightly higher than the Fed's, 1% vs. 0.25%).

Among other things, such almost-zero bill rates serve as a bullish sentiment indicator. People are willing to accept a near zero return now, in order avoid losses when rates go up (bond prices drop as the economy grows and rates rise).

Another indicator is the spread between current rates for longer-term instruments and their forwards. For example, 10 year interest rate swaps (IRS) are trading at 3.54% in the spot market, whereas their one year forwards are at 4.00% and two years at 4.32%. This means that speculators expect 10-year rates to be significantly higher two years from now. The spot-2 year spread for 10 year IRS is currently at 78 basis points, very near its record high (see chart below).

It is interesting, too, how the same levels for T-bills and swap spreads which existed about a year ago, indicated a completely different expectation: back then low bill rates came from a flight to safety and higher spreads happened because interbank markets were frozen due to counterparty fears. Same numbers, different explanation..

Among other things, such almost-zero bill rates serve as a bullish sentiment indicator. People are willing to accept a near zero return now, in order avoid losses when rates go up (bond prices drop as the economy grows and rates rise).

Another indicator is the spread between current rates for longer-term instruments and their forwards. For example, 10 year interest rate swaps (IRS) are trading at 3.54% in the spot market, whereas their one year forwards are at 4.00% and two years at 4.32%. This means that speculators expect 10-year rates to be significantly higher two years from now. The spot-2 year spread for 10 year IRS is currently at 78 basis points, very near its record high (see chart below).

It is interesting, too, how the same levels for T-bills and swap spreads which existed about a year ago, indicated a completely different expectation: back then low bill rates came from a flight to safety and higher spreads happened because interbank markets were frozen due to counterparty fears. Same numbers, different explanation..

Why bother going to gamble in Las Vegas when you can do it through your broker ???

ReplyDeleteOne of the problems is that we are no longer investing... we are gambling.

It must be my Christian heritage. I don't really care for gambling...

Debra:

ReplyDelete"Making people behave by threatening punishment is LESS EFFECTIVE than allowing them to participate in a common goal where they can experience shared joy.

I know that you are sneering Marcus."

So you are a seer besides a benevolent communist?

My, you are a talented person, you should be proud.

Does everyone get to vote on the "common goals"? If so is this not what we now have?

"Voting" of course for GS and GE comes in increments of millions of dollars, but that is me just being negative again. God I hate myself when I'm negative, oh help me to see great Seer!

People are willing to accept a near zero return now, in order avoid losses when rates go up (bond prices drop as the economy grows and rates rise).

ReplyDeleteI disagree. Interest rates are made up from three components; Inflation, Whatever the Central Bank Does, and Risk of Default.

IMO Risk of Default is what will soon drive the rates higher and what drives people into short durations. Nobody wants to be holding anything long because it will blow up.

Las Vegas is Spanish for Little League. Goldman Sachs is derived from the Hebrew for Major League. Investing in the truest sense is just simply out of fashion. Buy and hold simply can't compare to the beauty of Forex, alluring options, and sexy derivatives. Debra, you sound like you are suffering from nostalgia of way things used to be. Reminds me of this clip.

ReplyDeletehttp://www.youtube.com/watch?v=suRDUFpsHus

Anonymous, I watched your link..

ReplyDeleteYou should come join us on SuddenDebt's Spawn off to discuss this link.

I will say that...

the juxtaposition of THIS link with.. my current TV love, the Japanese series, Nodame Cantabile says quite a lot in my mind about what it means to be American.

As Thai would say, every advantage has its disadvantage...

Oh, and my apologies, Marcus, that was a cheap shot below the belt on my part.

ReplyDeleteMea culpa...

anonymous, I have just written a post on your link on Sudden Debt Spawn Off. Enjoy...

ReplyDelete(I hope you don't mind if I do a little... advertising on your blog, Hell.)

We kids keep trying to trip up the old man, but still he is not so easily beaten.

ReplyDeleteTouche and point (yet again) to you Hell.

Kudos

Highly recommended, watch this...!

ReplyDeleteI highly recommend watching this episode of Frontline from PBS... It played tonight and it features as villains the likes of Bob Rubin, Alan Greenspan and Larry Summers. With innuendo directed at Tim Geithner.... Poor Obama, what is he thinking, surrounding himself with people like these? If I was an advisor to him I would tell him....

"Mr. President with all due respect, there hasn't been a lynching in this country since the 1960s, however with the likes of Summers, Geithner and Bernanke guiding your policy, you may very well be the next one...?

I think that Obama is completely clueless....

THE WARNING

Frontline

http://www.pbs.org/wgbh/pages/frontline/warning/

"We didn't truly know the dangers of the market, because it was a dark market," says Brooksley Born, the head of an obscure federal regulatory agency -- the Commodity Futures Trading Commission [CFTC] -- who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. "They were totally opposed to it," Born says. "That puzzled me. What was it that was in this market that had to be hidden?"

In The Warning, veteran FRONTLINE producer Michael Kirk unearths the hidden history of the nation's worst financial crisis since the Great Depression. At the center of it all he finds Brooksley Born, who speaks for the first time on television about her failed campaign to regulate the secretive, multitrillion-dollar derivatives market whose crash helped trigger the financial collapse in the fall of 2008.

Best regards,

Econolicious

It is obvious that sentiment is very high but long term treasury investors are less sanguine. If bond investors were optimistically pricing in a strong recovery then the ten year treasury would be much higher, would it not? In fact, it seems that the curve is flattening. Maybe bond investors believe we will have a double dip recession.

ReplyDeleteYou are speculating causality.

ReplyDeleteOnce one incorporates intentional devaluation, the deflationist theory is over.

Allen C wrote:

ReplyDelete"Once one incorporates intentional devaluation, the deflationist theory is over."

Bingo! We have a winner. That is exactly what the dastardly pricks in D.C. (acting on behalf of the bigger dastardly pricks on Wall Street) have in mind. A slow dollar death.

But the even bigger dastardly pricks beyond U.S. borders, and a host of other factors, will conspire to reduce that rickety apple cart of a plan to an apple sauce covered rubble.

Things will be inordinately hairy here in Freedom's Land before the non-change agent in chief's first (and likely only) term is up.

Do you mean that the demand for these bills mostly represent an expectation of better opportunities later? This collective wish to postpone investments is a driving force of downturns.

ReplyDeleteInflationary expectations would prompt people to put money into actual assets. This has been happening in the stock market and in commodities.

Are people who put their money into short term debt expecting rising interest rates without actual inflation? Are the Treasury markets expecting a premature tightening of monetary policy?

What would be the result if the government simply stopped issuing these short term bills? Where would the savings in search of a temporary safe haven go then and what would come of it?

What is your own view? After short term Treasury bills, what would be the next best thing in this environment?

Dear Sir/Madam,

ReplyDeleteRecently we visited your website http://suddendebt.blogspot.com/ and found it very interesting. Given the relevance of your website to our business, we would like to offer an advertisement opportunity to you. We would like to put a text link ad on your homepage/main page. Our advertisement format is generally 15 words long and it will contain one to three text links, which we provide.

About our business,we offer consumers a safe and easy way to apply for short-term loans . Please let us know how much would you charge for this kind of ad. We look forward to your reply and the opportunity to work with you.

Thank you,

Jessica Moser

Senior Marketing Associate

Kaushik,LLC

573-424-0068

" Allen C said...

ReplyDeleteOnce one incorporates intentional devaluation, the deflationist theory is over."

Very bright. Once the sun stops moving in its own direction and changes course, it will rise from the west.

Um, Allen C, or someone else, could you please expound a little more on the rather... sibylline proclamation about deflation ?

ReplyDeleteI would love to understand, but this is beyond my grasp.

Edwardo... your prose is just stunning. I admire.

Deb, I totally agree with you re: Edwardo's prose/writing. I love reading his comments.

ReplyDeleteThanks, and I'm glad you enjoy my style of writing.

ReplyDeleteDeb, re: inflation/deflation

ReplyDeleteRead this.

Regards

Check this out, this is going to get large in the following weeks!

ReplyDeletehttp://www.youtube.com/watch?v=wDQ6nIsgKW0

... even if suddendebt seems to be a place of smarter than average folks and therefore the info presented might turn out to be nothing entirely new.

Optimism is a good thing. Will it last? Will it be abused?

ReplyDeleteGood one Greenie, thanks for the laugh:

ReplyDelete"Very bright. Once the sun stops moving in its own direction and changes course, it will rise from the west."

I'm working toward the goal of returning all people to the garden of Eden so I can lose my cynicism.

I'm glad to hear that, Marcus...

ReplyDeleteI think that's an admirable goal.

Thai, thanks for the link. It was good. Corresponded to my level, too...

The link on the Fall of the Republic was a little... apocalyptic for my tastes. Corruption has been around since the world began, and... the shenanigans of our ancestors when globalization was channeled through the Venetian empire sound pretty similar to OURS, you guys...

And so? Do nothing about it? Venetian backstabbing, Byzantine intrigue and even the miserable existence of serfs were all dreadful episodes of history, but now it's supposed to be different, it's supposed to be the age of democracy and freedom in the Western world, with some rotters telling you lies, banksters ripping you off and SWAT keeping you in line? Pay no attention and you get what you deserve - webcam in your toilet, mic under your bed and chip on your shoulder.

ReplyDeleteUm, Infowarrior, there are lots of delicate shades of nuance in the "do something about it".

ReplyDeleteWhat's your shade ?

One click on line activism to tell your senator that you're against the bank bailout ?

Marching with a billboard on Washington to protest the war ?

Blogging ?

Talking with people in the street, on the bus ?

Lots of different ways to be active about the issues that are preoccupying us.

For my part, I tend to like "acting" in the shadows/on the streets. It corresponds to my nature better... But... no protest marches any more. I have foot problems now. And one click stuff REALLY turns me off. It's so... IMPERSONAL.

"Investors and speculators are now so convinced that the economy will rebound strongly in the very near future, and therefore rates will rise, that they want to stay as short as possible duration-wise in their bond portfolios."

ReplyDeleteWell, that's certainly one interpretation. Another one would be that no one wants to be holding the bag on long treasuries @ 4%. Lots of money flooding into commodities these days (gold, oil, etc.) 'cos confidence in ANY paper money is low. it is rather challenging to preserve wealth when there's no secure store of wealth.