We know that debt is not equally distributed across our society. That is to say, lots and lots of people OWE debt but very few, proportionally, OWN it as an asset. For example, everyone owes equally his/her portion of public debt through the issuance of Treasurys and other public-sector bonds (e.g. muni bonds), but a very small number of people ultimately hold most of those bonds in their portfolios, directly or indirectly.

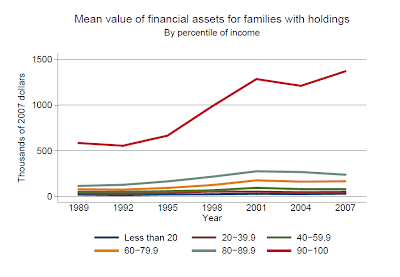

Here are three charts which point to this imbalance, from the Fed's Survey of Consumer Finances.

In the first chart, we see that debt OWED is pretty well distributed among all income groups.

The picture changes dramatically in the next chart, which shows the distribution of financial assets, used here as a more general proxy for debt OWNED.But even if look only at the distribution of bonds held directly by families, the picture does not change.

Poor, middle class and rich people all owe debt, pretty much alike. However, it is by far the rich that are owed this debt - and the gulf between them has widened enormously in the last quarter century. In 1989, 90% of the people owned bonds worth around $100,000, while the top 10% owned $300,000. In 2007 (latest data available) this picture has changed dramatically: 90% still own bonds worth around $150,000 but the top 10% holdings have soared to $900,000.

This enormous imbalance has serious social consequences, now plainly evident in Europe where people are being asked to slash their (formerly inflated) living standards in order to sustain a rickety debt structure. It can't be done and it should not be done - at least not in this way.

Interesting article, but with a bias because you've left items off the list.

ReplyDeleteFirst what matters is the net figure, the assets less liabilities. So when you say everyone owes equally their portion of government borrowing, you've omitted their share of pension liabilities.

Why equal (pro rata) shares? If you don't pay tax, you don't pay anything towards the debts. It's should be in proportion to the amount of tax you pay (direct or indirect).

Now why limit the assets to just owning bonds, and why limit it to owning directly? For example, in the UK lots of people 'own' bonds because their pensions, personal or company will own bonds, or own banks/insurers who own bonds etc.

Next, lots of people are 'entitled' to pensions on the basis of their contributions. Isn't that an asset in the same way that they owe a share of public liabilities?

For those living off benefits, isn't that likewise an 'asset'?

Debt distribution isn't the issue any more than some people earn more than others.

What matters is the size of the total debts.

It is interesting. Is it held in their 401's?

ReplyDeleteBecause I have this theory see.

That our own pension funds dwarf China and others in the imbalances this causes. Huge pools of savings that fail to trade in balance...just out there sniffing for yield and a return.

So they push up asset prices, they own property, they take profits, rents etc etc on the back of workers.

I actually have come to the conclusion that it may be safer to ban them and just have pay as you go pensions.

I'm UK based, where the vast majority are going to rely on PAYG pensions.

ReplyDeleteYou might think PAYG pensions mean you pay as you along in life, and get a pension at the end. In reality it means you pay, and the money goes, to someone else.

The tax income the government gets in the UK is 550 bn a year.

Present values of the civil service pensions (state workers who don't have a fund), 1,400 billion. Lots of other state workers have 'fully funded schemes' that in reality are just 50% funded.

Then there are two state pensions systems for all. State pension and state second pension.

State pension, liabilities of around the 2,400 bn mark. However, if people had put the contributions into the FTSE, they would have 19K a year, inflation linked, joint life annuities, at 65. Instead they get 5.4K, not fully inflation linked (lower index than above), at 67, and not fully joint life. That's for a median wage earner on 26K a year (now)

The reason is that the money went elsewhere and there is no compound interest. That is after crap performance of the FTSE over the last 15 years. For a fund, the money makes the most at the end, on average.

So they can't afford to pay out, the debts are too large.

That's why they hide them off the books. Same reason as Bernie Maddoff.