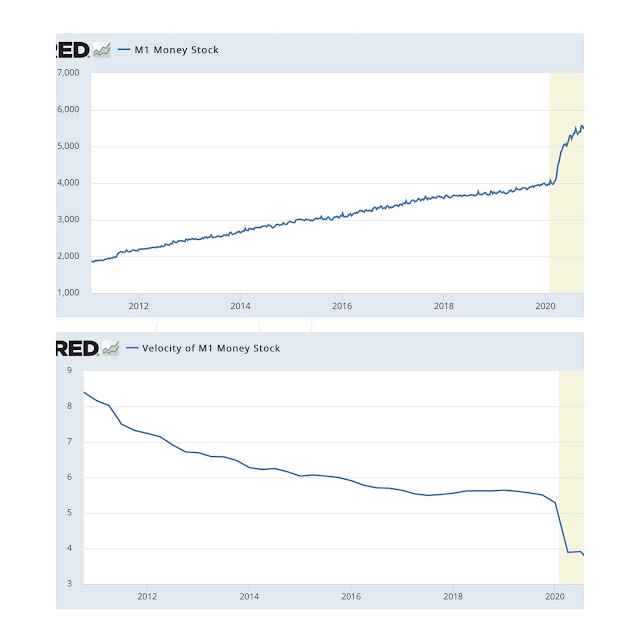

Yesterday a friend noted that while M1 money stock has zoomed up in the last year, its velocity has gone down and, therefore, inflation will remain muted (Chart 1). Although money velocity has been coming down gradually for years, the COVID pandemic reduced it sharply. Obviously, this is temporary as it is caused by businesses shutting down during lockdowns, etc.

What will happen to monetary inflation once the crisis passes? A much higher monetary supply, plus velocity back to normal, should result in higher inflation. The question is, how much higher?

Below, I will attempt to produce a back-of-the-envelope type "guessstimate".

First, I create a "money inflation" multiplier index as follows: I = M1 x Velocity

Before the pandemic:

I = 4.0 x 5.3 = 21.2 ( M1 in $trillion)

At present:

I = 6.9 x 3.5 = 24.1

In other words, my friend is, more or less, correct - the Index is only 14% higher.

However, as the crisis passes money velocity will surely come back to normal, therefore,

As the crisis ebbs the Index will rise:

I = 6.9 x 5.3 = 36.6

The Index value is 73% higher than before the pandemic (equal to the % rise in M1 stock).

Now, let's say that Mr. Biden's $1.9 trillion plan is passed. Just like the previous COVID support schemes, all of it will go directly to M1 and, therefore:

Crisis ebbs + Biden's plan:

I = 8.8 x 5.3 = 46.6

This Index is a whopping 110% higher than pre-pandemic.

Ok, let's translate this into "guesstimated" consumer inflation figures. From Chart 2 below we see that CPI inflation ran at an average 2% before the crisis (red line), it dipped down to almost zero and is now bouncing back. Where could it rise to, given the massive boost to M1 and assuming its velocity returns to normal?

For the calculation of the "guesstimated" inflation CPIg I use the following formula :

CPIg = CPI(pC) x I/I(pC)

where "CPI(pC)" is inflation pre-COVID (= 2%), I(pC) is the Index pre-COVID (= 21.2) and I is the value calculated above (= 36.6 or 46.6).

The formula results in two values for "guesstimated" CPI inflation caused by the Sudden Money boost in M1, one as is now and the other including the $1.9 trillion from Mr. Biden's plan.

CPIg = 3.45% and 4.40%

Both estimates are much higher than current projections (2.5%) and, if they materialize, could result in massive corrections in bond and equity markets. I think this is precisely what Mr. Summers is warning about.

Now, we all know that inflation isn't "baked in" until it passes through to higher wage demands and thus labor costs. In fact, the main reason (only reason, really) for the very subdued inflation during the past quarter century has been the unrelenting downward pressure exerted by cheap Chinese imports. Real labor wages have remained very low - the Federal minimum wage is at a laughable $7.25/hr, unchanged since 2009, the longest period ever.

Mr. Biden's plan calls for increasing it to $15/hr and there is a very good chance that it will happen - after all, state laws are already far more "generous" averaging $11.80/hr. Still, such a massive increase will send a powerful political signal to the working class, labor unions (such as they are nowadays) and activists - the middle class will rise again to demand a fairer share of American prosperity. Not to mention the real increase from $11.80 to 15.00, i.e. 27%.

Bottom line: watch out, inflation is getting ready to roar back. Markets beware.

Great analysis!

ReplyDeleteFunny that Bitcoin, etc. are rising more than gold... I guess it's easier and more convenient to buy than gold.

ReplyDeleteApart from BTC being pumped by the likes of EM and thousands of greedy, starry eyed retail "investors", it's my guess that gold prices are held in check because professionals see that interest rates can't go any lower.

DeleteGold has a "cost of carry" roughly equivalent to short term interest rates, so if rates go up gold would go down, all other things equal.

So the premise of BTC as digital gold has some truth to it then... no cost of carry. Like all bubbles, it is based on a real premise, but then it's taken to extremes. Though there is the fact, too, that BTC doesn't have any other usefulness. Thanks for the input.

Delete