One: Interest rates are at zero (and negative in the EU)

Two: The US corporate tax rate is the lowest in 80 years (21%) and tax receipts at just 1.5% of GDP

Both are in “it ain’t natural” levels, where they can’t remain for much longer without causing irreversible damage.

1. Real interest rates (adjusted or inflation) are already negative (Chart 1). If the the Fed wasn’t sweeping the bond market daily buying Treasurys, MBSs and corporates prices would be significantly lower.How much lower? Expected inflation is rocketing upwards, recently at 2.2% (Chart 2). Add just a bit of a premium, say 0.5%, and 10-year Treasurys should trade around 2.7-3.0% at the very least. Today they are at 1.17% in the secondary market, up from a COVID panic level around 0.50% last August.

Much more troubling is that the Fed’s most important policy rate, Fed funds, remains at near zero (0.09% last Friday), much lower than current and expected inflation, In the last seven months to December (latest available) monthly CPI inflation has averaged 0.343%, or 4.11% annualized (Chart 3). Much has to do with the flood of cash "printed" by the Fed - it is making its way into higher consumer goods and services prices, it's not just inflating stocks.

Chart 3 - Monthly CPI Inflation (BLS)

It’s pretty clear that rates can’t remain at zero for too much longer, not with trillions of new money being pumped into the system - and more expected soon if Mr. Biden's $1.9 trillion program passes Congress.

For one, monetary-driven inflation could set in, the worst kind of inflation as Weimar, Argentina, Zimbabwe, Brazil, Venezuela and many more can readily attest. For another, zero interest rates plus trillions in helicopter money are driving a speculative frenzy in stocks, commodities, and cryptos. GameStop is but a small example.

Therefore, the Fed has to act soon to take the proverbial punch bowl away by raising rates, well before things get out of hand, before it has to slam hard on the brakes. Punch one, so to speak, pun intended, of course!

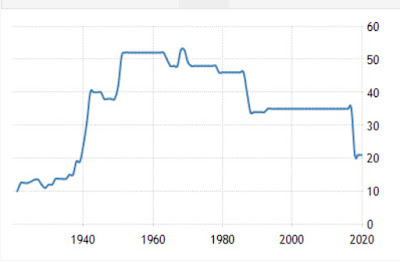

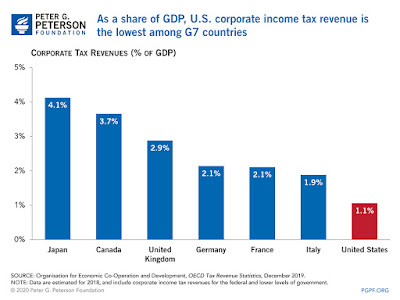

2. Corporate tax rates and receipts are at or near all time historic lows (Charts 4 and 5). The US now has the lowest, by far, corporate tax receipts as a percentage of GDP of all G7 nations (Chart 6).

Given unprecedented budget deficits (in 2020 15% of GDP, that's the level where Greece went bankrupt) and an exploding debt/GDP ratio (now at 140%, highest in US history), the Federal government needs to raise revenue fast. It is obvious where the money must come from: increased corporate taxation.

It is often said that the COVID crisis is the equivalent of war - and it certainly is for government finances. The government cannot treat this as business as usual, it must act swiftly to prevent a crisis in confidence in US public finances. It's not necessary to raise corporate taxes to "War" levels, but somewhere slightly above the pre-Trump era should be fair - say, around 35-40%. At least temporarily, until budget deficits and debt are reined in.

How likely is this One_Two punch, and how will it affect markets? I don't see how the Fed and Treasury have any other options left to them but to raise rates and taxes - IMHO the probability is well over 50% over the next 6-12 months, particularly if the COVID pandemic ebbs as vaccinations accelerate. As for the effect on markets.. well, let's just say that it won't be pretty.

30% of taxes go on debt servicing in the US.

ReplyDelete1. Will the public stand for more tax?

2. Will the public appreciate their retirement going down the river?

3. Will the public accept more cuts to their services whilst taxes go up?

Hmmm.

My view they are already past the limit. They have given or the state has taken its last chance.

4 year time, what do they do? Put someone in who will drain the swamp. Easy to do. No increase in the debt ceiling for 4 years bankrupts those working for the swamp.

Again, stupendous analysis. Much appreciated!

ReplyDelete