So called “core” inflation is used to measure price activity for a basket of goods and services excluding “volatile” food and energy. Focusing on this “core” to make monetary and fiscal policy decisions is wrong, in my opinion. After all, what is more “core” to life than these very basic necessities: food and energy.

We all absolutely need to eat, use energy and provide shelter for ourselves and our families. Sure, we also need education, entertainment, health services, travel… but only after taking care of the basics. Bread comes before Broadway, every time.

Politicians and analysts/traders always spin statistics in ways that fit their stories; in our business we call it "talking your book", ie arguing in favor of your securities' positions (book). In this case, if you are long bonds and stocks you avoid talking about the sky-high headline inflation, and focus instead on the somewhat lower "core" number. Does this make sense in today's environment? Absolutely not.

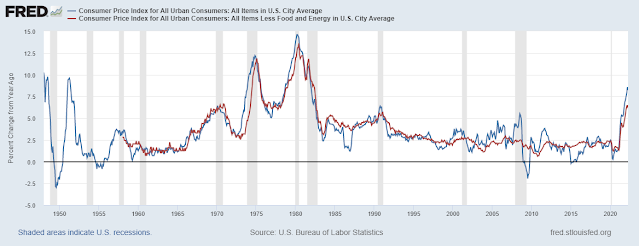

In the chart above we see that prior to around 2000 the two lines moved in tandem, with small differences between the two. Since then, however, core inflation was very tame, varying very little around an average of 2-2.5% - until very recently, that is. (The reason for the flat core inflation is China's powerhouse consumer goods export machine, but that's another topic). Then came the trillions of new dollars and euros unleashed on the global economy within months - and everything changed.

Think about it: food, energy and shelter are the real core, it is their prices that govern consumer attitudes and, ultimately, behavior. There are just so many repeated shocks one can take at the pump, the supermarket checkout, the gas, electric and mortgage bill, before he/she clamps down on less essential spending.

So, we really need to redefine Core Inflation. I suggest we replace it with a weighted index of Housing, Energy, Transportation and Food prices. After all, this is precisely where Americans spend most of their money (approx. 65%). In a previous post I calculated that in April such an index was up 11+% from last year, almost double the 6.1% reported for the current "core".

Another way to express it is let's get our priorities straight!

No comments:

Post a Comment