The shelter component makes up a massive 33% of the headline Consumer Price Index (CPI) in the US and 40% of the "core" CPI which excludes food and fuel. It is one of the least volatile contributors to inflation, ie once it starts going up (or down) it doesn't reverse course quickly.

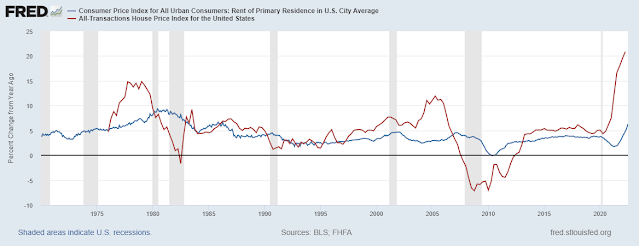

Thus, without much further ado, here is a chart that shows the rise in home prices and rents in the US. Home prices (red line) are rising at a record pace, fastest in history, and rents (following prices after a lag time) at the fastest rate in 40 years.

Today's CPI may show a slight de-escalation from lofty levels due to lower fuel prices - no surprise there, since with elections in less than 60 days the Biden administration has drawn down the Strategic Petroleum Reserve to its lowest level in 40 years by selling to the open market to push prices down (nod to AKOC for the heads up).

But core inflation is not going to go away any time soon - unless we get some sort of sudden asset crash. Which, as I've said before, I don't think is in the cards

thanks for the attribution hell... appreciate that and your writing... =)

ReplyDeleteThis being a debt-focused blog, credit where credit is due is a rule :)

Delete