In my last post I said that the Fed hasn't really started tightening yet, based on its still very bloated balance sheet. We know that ιτ has promised to increase Quantitative Tightening (QT) to a maximum of $95 billion per month, but judging from the numbers it hasn't done so yet.

But, let's say that it bites the bullet and it starts tightening for real.

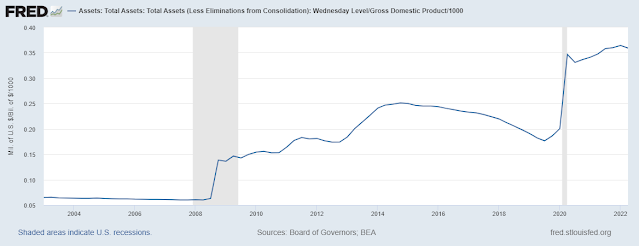

How long will it take it to reduce its balance sheet to some version of normalcy? The chart below helps put things in context - the Fed's assets as a percentage of GDP currently stand at a record 36%, double than in 2019 and a massive 7 times (!) higher than in 2009, when the Fed stepped in to avert what could have become a second Depression during the Great Debt Crisis.

Fed Assets As Percent Of US GDP

OK.. let's assume that the Fed wants to go back to "just" 18% and that nominal GDP will grow by 4% annually. If the Fed reduces its balance sheet at the maximum rate of $95 billion/month, it will take 3.5 YEARS of constant QT until its assets reach 18% of GDP.

In my opinion the Fed cannot afford to be so timid in attacking monetary inflation. For one, this drip method is akin to Chinese water torture for the economy. For another, the Fed will lose credibility as a committed inflation fighter.

With unemployment at record low levels, wages rising and productivity dropping, the Fed must increase its QT to a level that broadcasts loud and clear its determination to immediately kill inflation. Yes, it needs to keep money and bond markets operating smoothly, but it can do so through other means, even if it were to double its QT to around $200 billion/month.

===================================

PS Things are a lot worse in the eurozone. Just before the pandemic the European Central Bank's balance sheet assets amounted to 34% of GDP. Today they have reached an astonishing 60% - no wonder the euro is collapsing. Oh, and there is no indication of any QT happening there, not anytime soon anyway.

Why were things allowed to get so much out of hand? Why is the euro scorned as a global reserve currency? Because the ECB has been buying .. and buying and buying .. government bonds issued by essentially bankrupt countries, particularly Italy and Greece, bailing them out at the detriment of its own credibility.

While the Fed has retained a modicum of political independence, the ECB is 100% a political construct, caught in the crosscurrents of radically different priorities from each individual eurozone member. It's a central bank charged with producing a "one size fits all" monetary policy. But, monetary policy is a corset, not a nylon stretchy. The results are, sadly, apparent.

Could you explain how the fed actually tightens to an amateur? Like where does the assets on the balance sheet go after the Fed tightens it? Sorry if this is an elementary question.

ReplyDeleteBy H.

ReplyDeleteThanks for the question:

The Fed’s assets are bonds, almost entirely Treasurys and mortgage-backed. Its liabilities (well, mostly only one liability) is cash, dollars, liquidity.

The Fed can quantitatively tighten in two ways: allow the bonds in its portfolio to mature without renewing them, or sell bonds from its portfolio outright into the open market. Either way, it gets cash in return and the transaction shrinks the balance sheet and removes cash from the system, ie it tightens the quantity of money out there.

https://www.dw.com/en/former-adviser-sees-influence-by-chinese-president-xi-jinping-in-putins-recent-decisions/a-63217909

ReplyDelete