Credit Suisse is a fiduciary institution. Fiduciary is a word derived from the Latin fides, ie trust. The word Credit prominent in its name also derived from Latin: credo means belief. Like any financial institution, it bases its entire existence on the widespread belief that it can be trusted.

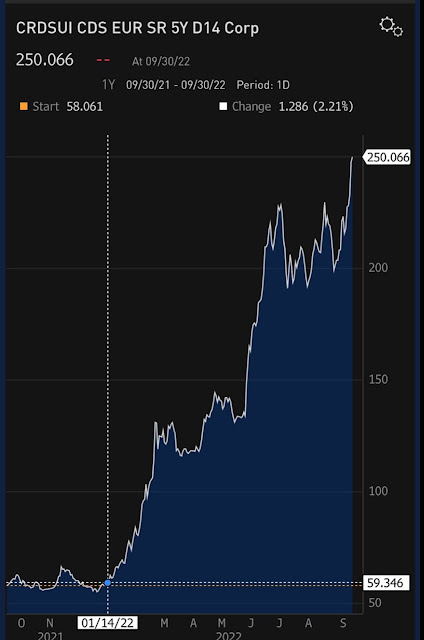

When the market prices its CDS (credit default swap) as in the chart below, it signals that it believes that it can’t be trusted. Any other explanation, like using Credit Suisse CDS as a vehicle for hedging the investment banking industry in general, while partly true, doesn’t begin to negate the overwhelming conclusion: Credit Suisse is in trouble.

DB or CS? With what's coming this winter my bet would be on DB going first.

ReplyDelete