Japan's Finance Minister just warned of increasingly precarious finances. The combination of enormous debt, rising inflation and higher interest rates will severely impact public finances in a country already struggling with a rapidly aging population and near zero economic growth.

While zero growth at a time of climate change and habitat destruction is desirable in my opinion, it is poison for debt service.

Here's a series of charts.

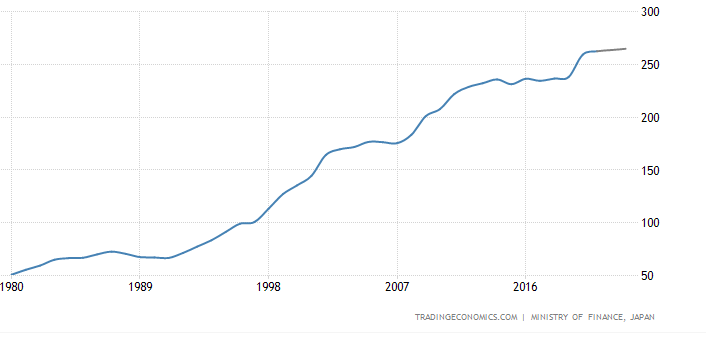

Debt To GDP At 250+%

The Bank of Japan (BOJ) has been engaging in the most massive "Yield Curve Control" (YCC) policy in history. YCC is a polite (obfuscatory?) way of saying that the central bank has been buying government bonds in ever increasing quantities, ie monetizing debt. It recently raised the upper limit of 10 year rates to 0.50% and precipitated an immediate market attack on JGBs. The BOJ panicked and is trying to talk rates lower, but it really can't defend its YCC policy for much longer - fundamentals always win in the end. I mean, with inflation at 4% who other than BOJ will buy 10 year bonds at or under 0.50%?

Here's where Japan stands today:

- Huge Debt

- Low Growth

- High Budget Deficits

- High Inflation

- Artificially Low Interest Rates

This is as black of a swan as I have ever seen. And keep in mind this: Japan is the world's third largest economy, and a major source of cheap liquidity found sloshing about in the global financial system (the yen carry trade).

Look in the East. That's not the Sun rising, it's a flock of black birds with unusually long necks.

Forecasting a black swan event is futile. Many people have made similar prediction for decades(?!) now. You are right that Japan has serious problems, but they are also not the only one. If they are in trouble, others will likely follow closely behind.

ReplyDeleteI certainly do not want to single out Japan, there are similar problems brewing elsewhere, from the US to Europe. If Japan stumbles the domino effect will surely be massive.

Deletekrugman has basically argued for real U.S. interest rates to be forever negative or near zero... which leads to the question of why anyone should buy U.S. bonds... remember his own argument against bitcoins was that they don't pay interest / dividend... so why is it ok for U.S. bonds to pay negative dividends...

ReplyDeletetruly wish our dear Nobel prize winner would put some effort into keeping his arguments consistent...

https://www.nytimes.com/2023/01/23/opinion/government-debt-deficit.html?unlocked_article_code=n_ovO3ycZGoZnXVD9vMYa-3D7HcSNTxMtgwBYHymLhp-2EsZE0XRzCtn_WgXGgpu3m5iAYNFgLXUrQF1pfhSWYopk15aA2N7yAVU9tK1LqIPvTv513vMRqbvT5wlfvtIi6ypRi1_vJW0zw_pMqM5vU-Sa-acjLw79SHsiDQ09sSxBQtyvvJgbrqutNMP1lfkIyM44cknrm8grkDciMQI2i918-Om48aAQDbzPWdnyMNv0jmd9ntjMJVrZbJWuLbzcxJWZexsvC1EBBJaMsod1pFt7h2VGokPN0hRnYhm09PvHHW09pN6PULbGB4pYYXvmKfeXMFwYU1RTOjG_bplYoEU&smid=share-url

Krugman is now as political as they come to the detriment of his objectivity. I no longer pay much attention to his editorials.

Delete