So, the US is getting closer to defaulting, Fitch threatens to cut its AAA rating on US government debt, the politicians are arm wrestling and... the Fed signals its willingness to intervene in case the worst happens? Seriously???

The Fed previously intervened in the Great Debt Crisis of 2007-10 by bailing out banks, mortgage lenders, insurance companies and foolish speculators (yup, some investment banks were exactly that). The Fed, basically, turned private debt into public by printing a (then) huge amount of dollars (see chart below). In the process, it ballooned its balance sheet from $900 billion to $2.2 trillion within months. It was the very first instance of Quantitative Easing (QE).

- Round One: The central bank funded the bailout of some speculators and a goodly number of players in the financial sector.

- Round Two: The central bank supported a portion of household spending for a year or two.

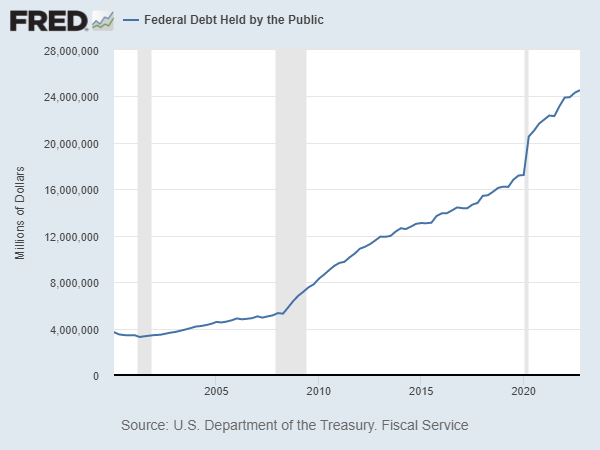

So, lemme get this straight: the Fed is now saying that it is ready to intervene again to do what exactly? Bail out the entire Federal Government? What will Round Three look like, if it comes to it? Purchase a portion of the entire federal debt (see chart below) and flood the world with worthless dollars?

Federal debt held by the public (ie excluding the Social Security Trust Fund) has exploded from $4 trillion to $25 trillion in just 15 years. How much of it is the Fed willing to buy? Some of ? All of it? The Fed already has $5.2 trillion of Treasuries in its balance sheet (ie it owns them) - that's 20% of all Treasuries (excluding the SS fund). Looking at it another way, it owns Federal debt equal to 22% of US GDP. How much more can it buy, before it turns the US into Zimbabwe?

OK, OK... I am being an alarmist here, so let me rephrase.

How much more can the Fed buy before it turns the US into the Weimar Republic. Now isn't that better?

No comments:

Post a Comment