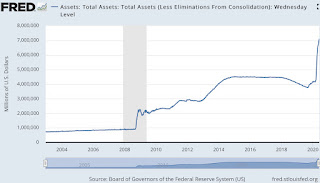

To combat the COVID19 crisis the US government has gone very deeply into debt through the Federal Reserve, which has ballooned its balance sheet by an astonishing $3 trillion in just 45 days.

The money has gone to individuals as $1.200 checks and to various businesses as subsidies. Consumer spending accounts for 70% of GDP, so the money was intended to sustain it and thus cushion the economy, even as unemployment soared. But, it didn’t.

Consumer spending collapsed by the most on record, as lots of people chose to play it safe and save it, instead. The strict lockdowns also played a role since most shops, restaurants, etc businesses were closed.

Consequently, the saving rate jumped.

FRB Assets (Government Bonds) Soar

The money has gone to individuals as $1.200 checks and to various businesses as subsidies. Consumer spending accounts for 70% of GDP, so the money was intended to sustain it and thus cushion the economy, even as unemployment soared. But, it didn’t.

Consumer spending collapsed by the most on record, as lots of people chose to play it safe and save it, instead. The strict lockdowns also played a role since most shops, restaurants, etc businesses were closed.

Consumer Spending Collapsed

Consequently, the saving rate jumped.

Saving Rate Jumps To 33%

Consumers will certainly resume spending as the lockdowns ease, but the crucial question is by how much and how fast?: In my opinion, not very much and rather slowly. After all, unemployment is huge and so is the fear of a second viral wave in a few months. People will play it safe, I think.

No comments:

Post a Comment