“Never fight the Fed” is one of the oldest and probably most valid adages on Wall Street. Apparently, it has just been proven true once again as $3 trillion were pumped into the economy in record time.

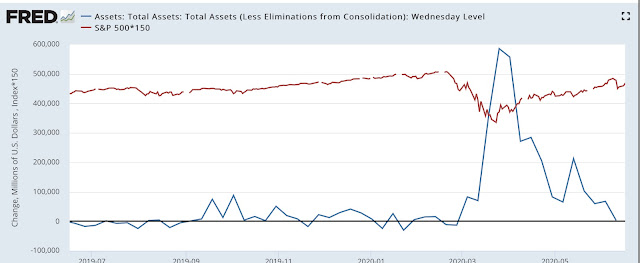

The short term correlation between added liquidity and share prices is 100%, as the next chart shows. The Fed’s weekly injection of huge amounts of money coincided with S&P 500 bottoming out and then sharply rebounding.

Now, speculators and investors alike are firmly convinced that the Fed has “put a floor” under the market and will continue doing whatever it takes to keep the market going higher. Notice, however, that new liquidity injections have now stopped completely.

Unlike what many may believe, the Fed’s stated objective is NOT to support stocks but to safeguard the smooth operation of the banking system and the economy as a whole. Thus, if there is to be a correction in stock prices do not expect the Fed to intervene - unless it is so sharp and violent that it poses a threat to the system.

That “floor” under the stock market is not made out of stone...

The Fed’s Balance Sheet Balloons to $7.2 Trillion

The short term correlation between added liquidity and share prices is 100%, as the next chart shows. The Fed’s weekly injection of huge amounts of money coincided with S&P 500 bottoming out and then sharply rebounding.

Pump It Up

Unlike what many may believe, the Fed’s stated objective is NOT to support stocks but to safeguard the smooth operation of the banking system and the economy as a whole. Thus, if there is to be a correction in stock prices do not expect the Fed to intervene - unless it is so sharp and violent that it poses a threat to the system.

That “floor” under the stock market is not made out of stone...

No comments:

Post a Comment