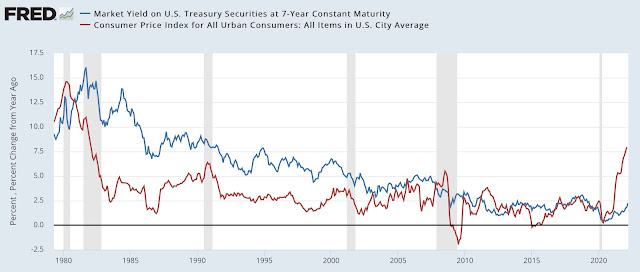

Inflation at the highest in 40 years. Government debt at the highest ever. Interest rates jumping.

What could possibly go wrong??? Put another way, at which point does the US debt become unmanageable?

I’ll let the charts tell the story.

USA: CPI inflation (red line) and Yield on the 7 year Treasury Note (blue line)

Average Maturity Of US Government Debt Held By The Public

Yield of the 7 Year Treasury Note (ie near the govt. debt average maturity)

Government Debt Interest Expense At Various Interest Rates

Charts with the yellow background are from Yardeni Research

Hi Hell, is it possible to print more money while simultaneously raising interest rates? i.e. is it possible to have an interest rate of 100%, while having a QE of a trillion dollars per month?

ReplyDeleteTheoretically, yes. And in the end that's what hyperinflation looks like (eg Zimbabwe some years ago). Practically, governments HATE to raise interest rates and only do so when the inflationary pressures get way too much (eg USA in the late 1970s - early 80s).

Deletethanks for the reply my friend. may fortune follow you through these hard times. =)

Delete