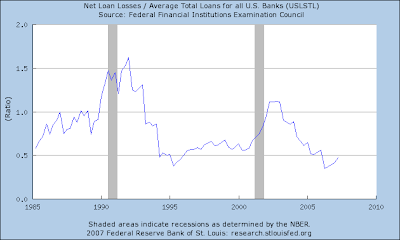

It is quite obvious that we are in the initial phases of a major credit crunch. However, this is not a "regular" credit contraction, where the Fed tightens in order to prevent or lower inflationary pressures. No, it's truly different this time.

As I have often laid out in previous posts, banking is not what it used to be. Credit institutions no longer loan money; rather, they act as salesmen of loans they have previously packaged and securitized as CDO's, CLO's, CPDO's, etc. The real lenders are the buyers of such securities. This process, combined with the waterfall tranche structure of asset-backed securities, allowed for credit conditions to become ultra loose, irresponsible even. Bankers did not care about loan quality, since they could turn even junk into 80% AAA-AA bonds, with the remainder off-loaded to the dozens of new yield-hungry hedge funds that were cropping up daily.

But just because there were buyers for such products (for a while), it did not mean that borrowers could service their debt. Quite the contrary, in fact. As the weakest individuals and companies were offered more and more debt without their incomes rising commensurately, it was only a matter of time before they would get into deeper trouble, faster. When this became obvious, the bond buyers suddenly disappeared; after all, they were just portfolio investors and unlike experienced bank credit officers they did not want, or have the ability, to gauge each borrower's creditworthiness inside those pools of thousands of loans.

In this crunch, the entire credit process is shutting down fast. It is not the cost for the use of money that is rising, but the cost of risk, i.e. the bond buyers are questioning the safety of their principal and this is the most potent deterrent to lending. The signs are everywhere: for example, if KKR and Cerberus can't get funding, then 99% of all other buy-out funds won't get any, either and the trillion-dollar-a-year LBO business is out of business - at least for now.

Let's look at the price of risk across all asset classes, as measured by their credit default swaps:

In a recent Bloomberg interview, US Treasury Secretary Hank Paulson acknowledged this fact, but at the same time he underplayed it: "All that is happening is that risk is being re-priced", he said. Well, yes, of course... but risk is being re-priced so fast and by so much that the effective cost of borrowing is gapping up, not rising gradually as in prior tightening events .

A move of 280 basis points in one month is not a mere "re-pricing of risk" - it is a bona fide crisis. In the past couple of weeks at least 40 deals have been delayed - and will likely be canceled, simply because such huge increases in financing costs in such a short period of time completely destroy their cash flow projections, i.e. the whole purpose for doing LBO's in the first place.

I intentionally chose a highly rated tranche to show that tightening is happening everywhere, not just the low end of the quality spectrum. The low end (BB) is a disaster - it has gone from 500 bp to 920 bp. Developing commercial real estate is completely governed by financing costs and there is no way such strong headwinds can be overcome.

I intentionally chose a highly rated tranche to show that tightening is happening everywhere, not just the low end of the quality spectrum. The low end (BB) is a disaster - it has gone from 500 bp to 920 bp. Developing commercial real estate is completely governed by financing costs and there is no way such strong headwinds can be overcome.

To compare what is happening today with "regular" credit contractions of the past, it would be the equivalent of the Fed raising rates by at least 150 b.p. in one move. Looking at Treasurys to gauge medium to long borrowing costs is useless.

As Greenspan would have put it if he was still at the helm of the Fed..."Markets are currently reversing the prior tendency of lenders to accept lower than normative risk premia and are adjusting towards a higher plateau of effective credit pricing and a lower plateau of credit availability, further adjusting of course for perceived creditworthiness. The Federal Reserve is keenly observing this process and as always may adjust its monetary aggregate targets to reflect this fact, though it cannot intervene directly into what is a self-correcting mechanism regulated by the free market". Translation: "I told you so, clean up your own mess".

Bernanke's likely reaction (privately): "Revv the helo".

There is further reason why this credit crunch is very dangerous: total US debt (federal, state and private) as a percentage of GDP is now at the highest level ever. It takes more total debt to create a unit of economic activity than ever before and its sudden constriction is simply going to have a bigger negative effect on the economy.

At the same time, there is less available income to back up the debt. The ratio of household debt to disposable income is also at the highest level ever.

Data: Federal Reserve

Data: Federal Reserve

As I have often laid out in previous posts, banking is not what it used to be. Credit institutions no longer loan money; rather, they act as salesmen of loans they have previously packaged and securitized as CDO's, CLO's, CPDO's, etc. The real lenders are the buyers of such securities. This process, combined with the waterfall tranche structure of asset-backed securities, allowed for credit conditions to become ultra loose, irresponsible even. Bankers did not care about loan quality, since they could turn even junk into 80% AAA-AA bonds, with the remainder off-loaded to the dozens of new yield-hungry hedge funds that were cropping up daily.

But just because there were buyers for such products (for a while), it did not mean that borrowers could service their debt. Quite the contrary, in fact. As the weakest individuals and companies were offered more and more debt without their incomes rising commensurately, it was only a matter of time before they would get into deeper trouble, faster. When this became obvious, the bond buyers suddenly disappeared; after all, they were just portfolio investors and unlike experienced bank credit officers they did not want, or have the ability, to gauge each borrower's creditworthiness inside those pools of thousands of loans.

In this crunch, the entire credit process is shutting down fast. It is not the cost for the use of money that is rising, but the cost of risk, i.e. the bond buyers are questioning the safety of their principal and this is the most potent deterrent to lending. The signs are everywhere: for example, if KKR and Cerberus can't get funding, then 99% of all other buy-out funds won't get any, either and the trillion-dollar-a-year LBO business is out of business - at least for now.

Let's look at the price of risk across all asset classes, as measured by their credit default swaps:

- Home mortgages, as measured by the ABX indexes, are now trading at spreads at least 2-3 letters below stated, i.e. AAA is trading like BBB, AA like BB, etc. The BBB and BBB- tranches are effectively trading as if already in default.

- Likewise for commercial real estate mortgages, as measured by the CMBX indexes. In fact, such mortgages appear even more distressed than residential ones.

- High yield bond spreads (CDX HY) have widened from 250 bp to 525 bp literally in days.

- Investment grade bond spreads (CDX IG) have widened from 35 bp to 77 bp, also within days.

- Syndicated leveraged loan spreads (LCDX) have gone from 90 bp to 370 bp, again in days.

In a recent Bloomberg interview, US Treasury Secretary Hank Paulson acknowledged this fact, but at the same time he underplayed it: "All that is happening is that risk is being re-priced", he said. Well, yes, of course... but risk is being re-priced so fast and by so much that the effective cost of borrowing is gapping up, not rising gradually as in prior tightening events .

- Look at LCDX - corporate leveraged loans, used for LBO's:

A move of 280 basis points in one month is not a mere "re-pricing of risk" - it is a bona fide crisis. In the past couple of weeks at least 40 deals have been delayed - and will likely be canceled, simply because such huge increases in financing costs in such a short period of time completely destroy their cash flow projections, i.e. the whole purpose for doing LBO's in the first place.

- Here's another example, the "A" rated tranche of CMBX (commercial mortgages):

I intentionally chose a highly rated tranche to show that tightening is happening everywhere, not just the low end of the quality spectrum. The low end (BB) is a disaster - it has gone from 500 bp to 920 bp. Developing commercial real estate is completely governed by financing costs and there is no way such strong headwinds can be overcome.

I intentionally chose a highly rated tranche to show that tightening is happening everywhere, not just the low end of the quality spectrum. The low end (BB) is a disaster - it has gone from 500 bp to 920 bp. Developing commercial real estate is completely governed by financing costs and there is no way such strong headwinds can be overcome.To compare what is happening today with "regular" credit contractions of the past, it would be the equivalent of the Fed raising rates by at least 150 b.p. in one move. Looking at Treasurys to gauge medium to long borrowing costs is useless.

As Greenspan would have put it if he was still at the helm of the Fed..."Markets are currently reversing the prior tendency of lenders to accept lower than normative risk premia and are adjusting towards a higher plateau of effective credit pricing and a lower plateau of credit availability, further adjusting of course for perceived creditworthiness. The Federal Reserve is keenly observing this process and as always may adjust its monetary aggregate targets to reflect this fact, though it cannot intervene directly into what is a self-correcting mechanism regulated by the free market". Translation: "I told you so, clean up your own mess".

Bernanke's likely reaction (privately): "Revv the helo".

There is further reason why this credit crunch is very dangerous: total US debt (federal, state and private) as a percentage of GDP is now at the highest level ever. It takes more total debt to create a unit of economic activity than ever before and its sudden constriction is simply going to have a bigger negative effect on the economy.

At the same time, there is less available income to back up the debt. The ratio of household debt to disposable income is also at the highest level ever.

Data: Federal Reserve

Data: Federal ReserveOne final point of opinion: I think this process of credit spread adjustment and tightening is in itself the initial stage of a wider move away from portfolio investments that will take many years. To draw a parallel, just as we have had a long-lasting bull market for such assets that started around 1982 with the inception of trickle down economics, major tax cuts, wealth and income divergences and so many other societal changes, I believe the process will shift to something else. My most likely candidate is a steadier-state economic model based on ecological concerns and depletion realities.