The Fed printed a gusher of money during 2020-21, and then hid its head in the sand ignoring inflationary pressures, labeling them “transitory”. Finally, they woke up from their dream state and started raising rates all in a rush. How much time did they lose, how far behind the curve were they? The short answer is they were at least 17 months late - way too late in my opinion.

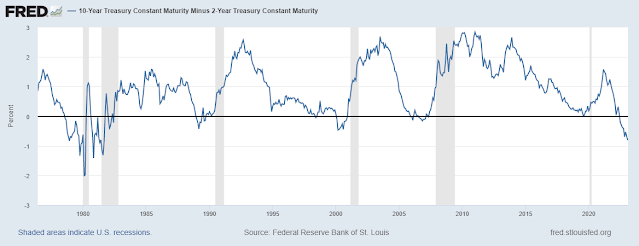

Here's a chart.

The blue line is the yield on the 2 year Treasury, which is anchored by the Fed funds rate. The red line is the yield of the 10 year Treasury which is entirely dependent on the market. Notice how the red line starts to creep higher starting in August 2021, even as the 2 year remains flat. Meaning, the market was already pricing in higher inflation, way before the Fed started raising rates in October 2022; that's a whole 17 months where the market was telling the Fed to get its head out of the sand - to no avail.

By the time the Fed acted, the 10-2 spread was already at 100 basis points (the black arrows). The Fed has been playing catch up ever since, causing the spread to - finally - go negative. Yet, rates are still lower than headline inflation and the ocean of liquidity created by the Fed is still almost entirely untrained. The “easy” part of inflation moderation is now finished as fuel prices have stopped dropping, and it is highly likely that inflation will, if anything, start rising again as higher wages kick in. And that’s when the Fed will, at last, truly wake up.

.png)