Take a look at the price of crude oil in the last 20 years: boom and bust, wild vertical swings up and down, even to (gasp) minus $40 per barrel. Why is that? Why does the price of arguably the most important commodity exhibit such radical volatility? Is it wild swings in supply and demand, or is it something else entirely?

Wild Price Swings In Crude Oil

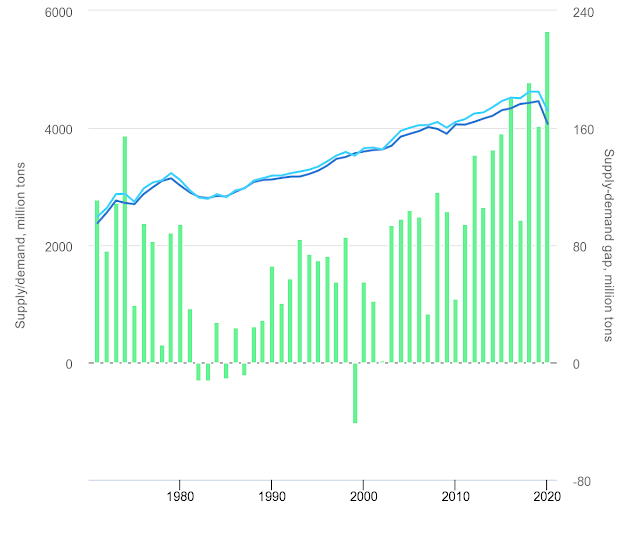

First, let's examine supply and demand. The chart below from the International Energy Agency shows that supply and demand have been rising in lockstep; indeed, supply (light blue line) has increasingly been outpacing demand (dark blue line) for years (supply gap in green bars).

Crude Oil Supply And Demand

So, if the wild price swings cannot be explained by fundamentals, they must be caused by something else. What? IMHO, it's the financialization of the entire global economy. Everything now has a "market", it trades on an exchange, it begets futures, options, CFDs, ETFs. Investors, speculators, hedge funds, private equity and pension funds have become the prime movers of prices of everything, instead of producers and end users.

Like I have said many times, financial markets were formed to help the economy allocate scarce resources in an organized and rational manner. Instead, they have now become the economy itself - the global economy is financialized. Prices are no longer set by the nexus of supply and demand, but by the flow of speculative money in and out of "markets".

Think of the economy as a train. Mr. Fundamental, the old engineer, sped up or slowed down according to the grade and the curves ahead. But now a new engineer has taken over: Ms. Market does not give a fig about the safety of the train and its passengers; all she cares about is to go as fast as possible. For her, there is only one setting: full speed. Derailments are much more frequent, and the train safety authorities are forced to come to the rescue more and more often.

To wit, markets swing wildly, the economy suffers and the central banks have to rescue it by printing ever more money. It is an untenable situation, obviously, and cannot last much longer. We have to replace the engineer...

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)