If nothing else, the coronavirus crisis has accelerated my conviction that our Permagrowth (tm) model is busted. What’s Permagrowth? Ever increasing consumer spending in the West on goods made cheaply in the East, all made possible by ever increasing debt. Some call it Globalization, but all it took was one microscopic virus to effectively kill it in a matter of days around the globe.

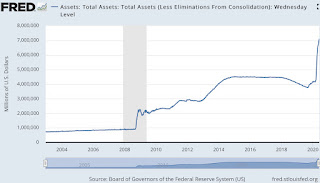

What is the cure currently used to revive it? More debt, of course, in the form of government bonds purchased (or financed) by central banks, almost exclusively. The situation is so dire that the most extreme measures are being used. For example, the ECB

pays banks 0.5% to go out and buy government bonds that yield anywhere from 0% to 1.50%. Yes, that’s right, the ECB lends at

negative interest rates, confounding anyone who espouses “neither a lender nor a borrower be.” In one transaction alone, the ECB is effectively both lender and borrower!! Double the sin, double the fun!!

Now, follow the trade: a bank can go to the ECB, borrow 10 billion euro and

receive 50 million annually. It then turns around and buys 10 billion worth of, say, Greek government bonds and receives another 150 million, for a total of 200 million per year. This is

literally free money, produced entirely out of thin air. No savings needed, no assets, no reserves..

nothing!

Obviously (to me alone??) this is a complete perversion of a proper financial system and a VERY loud alarm bell. Wake up, folks: “ Whatever it takes” are NOT soothing words, it’s a cry of desperation.

Anyway, back to the demise of Permagrowth. I believe we are now seeing its last hurrah, soon to be replaced with something else. What will that be? Hopefully, the Five R’s practiced by 8 billion consumers in the following order:

- Reject - don’t buy the new “phone” (shoe, watch, app, trinket)

- Reduce - one “phone” is enough

- Repair - fix the “phone” when it’s damaged, instead of replacing it

- Reuse - give the old “phone” to your daughter

- Recycle - finally, recycle it

The Five R Economy

The US, EU, China and Japan have a combined GDP of $60 trillion, a whopping 75% of global GDP even though they account for only 30% of global population. Consumption makes up almost 70% of GDP in the US, 60% in the EU and Japan - and (just) 43% in China, which exports lots of what the other three consume, taking their IOUs as payment.

Now, when and if Permagrowth is replaced by the 5R’s the effects will be enormous - assuming, of course, that the change will be accomplished peacefully (not a foregone conclusion). For one, deflation will be prevalent, resulting in sharply lower equity and corporate debt valuations. Energy sources will not need to be as “dense” as today (oil, natural gas, coal) and could more easily shift to renewables. The US dollar - petroleum relationship will come apart, leaving the dollar to fend for itself and the US government to seek a much more rational fiscal and monetary policy.

And that’s just for starters... it could get really nasty OR really spectacular out there. Hopefully, we will all realize our full potential as human beings and choose the latter.