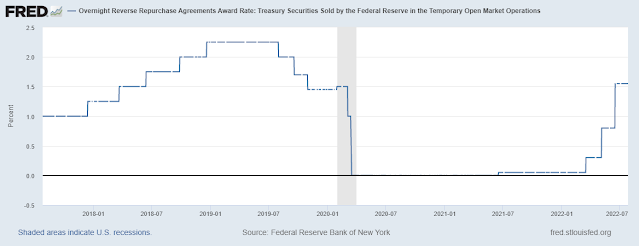

The Fed runs an overnight reverse repo facility for institutions like banks and money market funds. It works like a one day interest bearing deposit, secured by bonds held in the Fed's portfolio. The amount on deposit has now reached the astronomical amount of $2.2 trillion, and it currently collects interest at 1.55% which will likely go to 2.30% today when the Fed raises rates again.

Fed Reverse Repo Reaches $2.2 Trillion

Thus, the Fed will pay a huge $50.6 billion annualized in interest to banks and money funds. Why should it? If the Fed was a regular bank, the reverse repo would be a way to fund its existing bond portfolio, which probably earns more than 2.30% - at least for now. But unlike regular banks and institutional investors the Fed doesn't have to worry about funding anything - it just prints the money it needs, that's the whole idea of central banking.

When amounts deposited to the Fed via reverse repo were minute (usually around $1-2 billion before the pandemic) the rate paid didn't matter. But with $2.2 trillion now flooding the Fed the rate paid makes a very big difference, indeed.

Thus, the reverse repo is now nothing more than a direct "subsidy" to the financial sector and should be immediately stopped, or at least be modified to pay minimal interest well below market rates, say one tenth Fed funds, ie around 0.15-0.25%. Naturally, this will force financial institutions to seek other places to park their excess cash, driving short term rates lower, probably below where Fed wants them to be to fight inflation.

The problem, quite obviously, is the "excess cash" itself and this is another reason the Fed should start draining it aggressively from the system via Quantitative Tightening.

.png)