Those who forget History are fated to relive it, goes the saying.

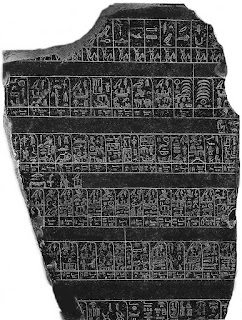

Financial markets, prone as they are to swings between boom and bust, are a particularly good case. Reasons for this reach at least as far back as Adam Smith’s “animal spirits”, and probably even further to ancient Mesopotamia and Man’s first go at organized agriculture. I bet the connection between water flow in the Tigris - Euphrates rivers and grain productivity soon became obvious to a few smart farmers. Ditto cornering the market. A few thousand years later, Egyptian bureaucrats kept accurate records of the Nile’s seasonal ups and downs.

The Palermo Stone, Egypt circa 25th Century BCE

Fast forward to the Fed as keeper of the floodgates. The chart below shows Fed Funds rates and recessions (shaded grey).

Every time the Fed starts tightening from a seminal low stocks drop and a recession follows. It’s not rocket science: interest rates are simply the price of money and as it goes up the marginal demand for investment goes down. Hence, Don’t Fight The Fed.

Presidents absolutely hate to be caught in the middle of a tightening cycle because they, at least, never forget that people vote with their wallets and Mr. Trump is no exception (except that his mouth and Twitter run faster than his common sense).

Ok, nothing new in all of the above, of course. Or.... is there?

In my opinion, there is. Rates bottomed out at 0%, an unprecedented low in history, and the Fed has ALREADY raised rates 9 times, succeeding - as it always ultimately does - in abating the market’s animal spirits. After the worst December since the Great Depression, IN JUST ONE MONTH!, stock indexes are now officially in bear market territory. Never mind Mr. Trump’s rantings, the Fed cannot but take heed of the direct connection between markets and the “real” economy, a connection that has only become stronger and more direct in the last 30-40 years.

In other words, yes, don’t fight the Fed - but the Fed increasingly understands (I hope) that it cannot and should not fight the Dow. As I have put it in several older posts, the tail (markets) wag the dog (the economy).

Financial markets, prone as they are to swings between boom and bust, are a particularly good case. Reasons for this reach at least as far back as Adam Smith’s “animal spirits”, and probably even further to ancient Mesopotamia and Man’s first go at organized agriculture. I bet the connection between water flow in the Tigris - Euphrates rivers and grain productivity soon became obvious to a few smart farmers. Ditto cornering the market. A few thousand years later, Egyptian bureaucrats kept accurate records of the Nile’s seasonal ups and downs.

The Palermo Stone, Egypt circa 25th Century BCE

Fast forward to the Fed as keeper of the floodgates. The chart below shows Fed Funds rates and recessions (shaded grey).

Every time the Fed starts tightening from a seminal low stocks drop and a recession follows. It’s not rocket science: interest rates are simply the price of money and as it goes up the marginal demand for investment goes down. Hence, Don’t Fight The Fed.

Presidents absolutely hate to be caught in the middle of a tightening cycle because they, at least, never forget that people vote with their wallets and Mr. Trump is no exception (except that his mouth and Twitter run faster than his common sense).

Ok, nothing new in all of the above, of course. Or.... is there?

In my opinion, there is. Rates bottomed out at 0%, an unprecedented low in history, and the Fed has ALREADY raised rates 9 times, succeeding - as it always ultimately does - in abating the market’s animal spirits. After the worst December since the Great Depression, IN JUST ONE MONTH!, stock indexes are now officially in bear market territory. Never mind Mr. Trump’s rantings, the Fed cannot but take heed of the direct connection between markets and the “real” economy, a connection that has only become stronger and more direct in the last 30-40 years.

In other words, yes, don’t fight the Fed - but the Fed increasingly understands (I hope) that it cannot and should not fight the Dow. As I have put it in several older posts, the tail (markets) wag the dog (the economy).