All The Best.

It is not because things are difficult that we do not dare, it is because we do not dare that they are difficult.

Thursday, December 24, 2009

Happy Holidays

All The Best.

Friday, December 18, 2009

The Euro's Trojan Horse

If you have been following European financial matters at all, you know by now that Greece is in dire straits. It is beset by that trio of trouble that gives finance ministers white hairs by the hundreds: huge public debt (~120% of GDP), huge budget deficit (~13% of GDP for 2009), huge current account deficit (~10% of GDP for 2009). Oh, and its private sector debt went from 38% of GDP to 100% in less than a decade, mostly because households jumped on the debt wagon: their debt went from 15% to 50% of GDP in the same period, mostly on mortgage borrowing and higher housing prices.

Does the pattern sound familiar? Of course it does... this model of "economic growth", which substituted increased borrowing for earned income, was repeated all over the western world.

The immediate result is that rating agencies have now cut their marks for Greek government debt to BBB+, the lowest in the eurozone (S&P and Fitch. Moody's is still A1 but will soon downgrade) and borrowing costs have soared. Greek government 10-year bonds are currently yielding 5.74%, 271 basis points (2.71%) over the equivalent German bunds. In the years of the credit boom, of easy money and bubbly assets, this spread was a mere 20-30 b.p.

Likewise, credit default swaps (CDS) for Greek sovereign debt have now soared to 275-285 points (late Fri. updt.), up from 10-15 (see chart below, click to enlarge). This means that the mathematically calculated Cumulative Probability of Default (CPD) comes in at 21.5%, the 8th highest amongst sovereign risks (for comparison, Dubai is 6th on the list with 26.2%). To give you an idea of other eurozone members' CPDs, France is at 2.6% and Spain at 9.1%.

Greek CDS: Nosebleed on Mt. Olympus

Greek CDS: Nosebleed on Mt. OlympusJust one month ago I sounded the bell of euro's overvaluation vs. the dollar, having just seen the movie 2012. To use another Trojan allusion, there were simply too many Dollar Cassandras around, and they had even made guest appearances in popular movies. A sure omen of reversal, if ever there was one...

Monday, December 14, 2009

Throwing Good Oil After Bad Debts

Ahhh, you will quickly say: it's only fiat money - book entries upon book entries. And Abu Dhabi still gets to physically keep its oil and can always hike the price it charges and get its money back from all the rest of us - including Dubai's lenders who are currently being bailed out (again).

Oh yeah? Not so fast..

In today's push-button interconnected global economy a bailed-out lender can immediately convert Abu Dhabi's pennies from heaven into a tangible commodity (say, crude oil), hire a VLCC and anchor the whole thing off the coast of Singapore. By bailing out Dubai and its lenders, Abu Dhabians are making a fool's bargain. They would have been much better off had they told everyone to take a hike, including those who kept building castles in the sand.

Ahhh, but what about the oil producers' ability to raise prices almost at will? Hah! And why do you think the US is sitting on Iraq, to mention just one geo-political petroleum pressure-point? Please note that Iraq has just announced plans to raise production to 12 mbpd in the future (it currently produces about 2.5 mbpd). If it succeeds (admittedly a huge if), it will surpass Russia and become the world's second largest producer of crude after Saudi Arabia. Kiss pricing power good-bye..

Friday, December 11, 2009

Revenge Of The Bond Nerds

The irony is that - for the moment - the bill is being thrown at the face of those far less responsible for the mess than the big-time orgiastes. And to add insult to injury, the bill is summarily and contemptuously presented by that troupe of orgy-organizers who arguably made the mess much worse.

But, let's explain things in plain Latin.

Recent days have seen a raft of sovereign-credit downgrades and warnings by Moody's, S&P and Fitch, causing sharp rises in government bond yields and credit default swaps (CDS) for those affected. No doubt goosed by the (near-sovereign) collapse of Dubai, rating agencies are belatedly falling all over themselves to kick weakest-link borrowers in the groin, i.e. countries like Greece and Spain. Other countries like Italy, Portugal and Ireland are seeing their bonds come under pressure, too.

For example, look at the chart below tracking 5-year CDS for Greek government bonds.

After settling down from the late 2008 - early 2009 global panic, credit concerns rose again following some domestic issues (elections, dodgy statistics); but the catalyst that really spooked the market was unquestionably Dubai's loud insolvency, which made everyone stand up and face facts.

The rating agencies are also dropping hints about the UK and US, but they are still far from daring (or foolish) enough to really step on such big toes, preferring instead the time-tested method of beating on black sheep (or scapegoats, if you are more classically educated in things Greek and Roman) in order to send veiled messages to the King.

So, what of the "bond nerds" in today's title? (Apologies to my erstwhile colleagues - I use the term affectionately, of course). They are those ladies and gentlemen on trading desks and investment committees who have the decidedly unglamorous job of making markets and selecting straight, boring government paper to invest in: Treasurys, gilts, etc. They are very, very far removed from the hustle, bustle and juicy bonus pools common to more "meaty" structured debt securities. That is, they were - until the spectre of sovereign default raised its ugly head; suddenly, the nerds are running the show.

A 50 basis point swing in, say, the spread between Greek and German bond yields is enough to send global bond, stock and FX markets gyrating, causing massive stress to mandarins from prime ministers and central bankers, to Brussels-based bureaucrats.

What are the bond nerds saying, every time they hit a bid on the 10-year GGB or buy a Spanish CDS?

Simply this: Enough already with being so free with the taxpayers' and our investors' money... You guys can't run massive budget deficits as far as the eye can see and raise debt levels to the sky, without paying the price. You can't bail out the global financial system and keep unemployment down and consumption up, without us questioning your 1+1=3 arithmetic. You can't have your cake and eat it, there's no such thing as a free lunch - and funny money is no money at all.

Yeah, we may be nerds, alright, but you better take good care of us because you need us big time. Unless you want to walk the Minsky Way, that is...

Have a pleasant weekend (pondering government finances, perhaps?).

Saturday, December 5, 2009

Dollar Survey

I have re-done the poll, using a different provider that does not limit the size of the answers.

Monday, November 30, 2009

Insolvency Vs. Illiquidity

The answer is, obviously, the latter: Dubai has a serious solvency problem, as can be seen from the see-through buildings dotting its shore and spiking its skies.

And why does it matter to the rest of the world what is going on in Dubai? Because it is the world's most glaring, most spectacularly obvious case of what is wrong in the real economy, all over the world. The quantities and prices of all kinds of assets rode high on a sea of easy credit with no regard to their end use. Assets were built and financed with an eye only to their immediate sale, to flipping them for an instant capital gain instead of operating them for real economic gain, like rents or dividends. That's the economic principle known as "the greater fool" or "the trading sardine". It works for a while and then always fails, quite often most spectacularly.

In my opinion, Dubai is the warning bell that the global economy has entered Phase B. The greater part of the liquidity crisis is over; but now starts the real pain of dealing with insolvency. Central banks and financial ministers did a creditable job of subduing illiquidity. They even fostered the view that the global Great Recession was over. That's a mistake.

Dealing with insolvency will require far greater political resolve and much different skills than merely lowering rates and opening credit facilities to all comers.

Thursday, November 26, 2009

The Value Of Money (Plus Bye-Bye, Dubai)

Nov. 25 (Bloomberg) Dubai World, the government-owned holding company struggling with $59 billion of liabilities, is seeking to delay repayment on all of its debt, even after Abu Dhabi banks provided $5 billion for Dubai’s support fund.

It didn't take long, did it, for the "pearl" to turn into a turkey?

---------------------------------------------------------

On with the value of money (Debra's comment on the last post made me do it, honest....).

They didn't look all that prosperous and I felt kind of sorry for them, when I noticed that what they were about to receive implied an original investment of over $1 million. Not exactly a pair of hoi polloi. But, anyhow...

We started talking while the lawyer was drafting a receipt and our discussion inevitably turned to money. I climbed onto my usual monetary affairs soap-box and started the dime speech on what constitutes money and banking in a fiat currency regime. Back I went into monetary history, watching their faces all the time... The link between dollars and gold (yes, yes of course we know this, signalled their nods), Bretton Woods (eh?), Nixon's final revocation of the gold standard in 1971 (whaaa..?), how money is created today (the government prints it, no?), the power of banks to create money out of thin air via credit demand (no, no, that's not possible!).

In this exchange, as in many before it, I once again witnessed the widespread ignorance about money and banking that permeates our society. Father and son, like 99% of all people, still hung on to a super-outdated notion that gold and money were - somehow - still connected. That money is still attached to (and thus reflects) some tangible "value", and that its creation is strictly regulated by a higher authority permanently answerable to society.

So, I explained to them that our money is like a ship: centuries ago it was firmly anchored (gold and silver coin), but that as time passed more and more cable was let out so the ship swung wider around its anchorage (gold standard). Finally, in 1971 Nixon let go the anchor altogether by shutting down the gold "window", so the ship is now completely untethered; it floats and rides the waves freely, counting solely on its captain's seamanship to stop it from running aground.

Though father and son listened attentively and even respectfully (probably a reflection of our legal surroundings and the fact they were about to receive a bunch of money they considered forever lost), I could see that they didn't really believe me.

I was not surprised; this is almost always the case: people find it extremely difficult to come to grips with the idea that today's money embodies nothing more than pure confidence, fides, credo.. That fiat money is a belief system; an organized, state-sponsored religion complete with high priests, acolytes and genuflecting flock.

In more scientific terms, the pair's aversion to the truth is similar to believing in a Newtonian/Einsteinian unitary "reality", as quantum uncertainty and multiplicity are swirling all around us.

So, what is the Value Of Money? Just like the quantum universe(s), simply what we think it is.

Happy Thanksgiving to all.

Friday, November 20, 2009

2012: Dollar At The End Of The World

A few days ago I saw 2012, the latest "end of the world" movie. Apart from the spectacular end-of-days visions (California slipping into the Pacific, mile-high tsunamis crashing on Mt. Everest), what really caught my attention was the mention of the dollar's low value against the euro; I believe it was highlighted three times. (Oh well.. my obsession with all things monetary is obviously well beyond redemption.)

The one I remember best is when an Arab sheik is asked to pay "a billion" per person to be saved; he responds that "he has a big family" and that "a billion dollars is a lot of money" - only to be told that the price is "a billion euro".

There are two possible interpretations :

a) The dollar's demise is now irreversible and will proceed as a natural catastrophe.

or,

b) The dollar's drop has gone so far that it permeates even the most popular global mass media. Therefore, it has nowhere else to go but up.

Being mostly a contrarian I favor choice (b), but not yet with any real conviction, i.e. I have not put my money where my bemused observations logically lead me.

However, I am also increasingly vigilant for other, more fundamental signs of trouble brewing in euroland, where several peripheral economies are in real danger of falling apart under the triple stress of a weak uncompetitive economy, huge debts and an overvalued currency.

Thursday, November 12, 2009

Calling Archimedes

Within 6 hours deserts receive more energy from the sun

than humankind consumes within a year.

The basic technology is quite old and proven: Concentrated Solar Thermal Power (CSP), i.e. using mirrors to concentrate sunlight, generate steam and thus drive turbines and electrical generators. The crucial difference between this and direct conversion of sunlight into electricity via photovoltaic panels, is that heat can be stored in media exhibiting high heat capacity (e.g. salts) and used to generate electricity 24/7, even when there is no sunlight. In addition, waste heat (i.e. lower enthalpy steam) can be used to desalinate water or drive cooling systems.

If you think that this sounds a bit like "pie from the sky" (sic), think again: a few days ago twelve of the world's largest companies signed on to the project, including the likes of Siemens, ABB, RWE, E.ON, MAN, Munich Re, Deutsche Bank and ABENGOA, bringing the project one step closer to becoming reality. The thumb-prints of Germany are all over this consortium, as one would expect from the largest EU member that is also forward-looking and firmly committed to alternative energy and infrastructure transformation.

This type of massive, game-changing project rings a huge wake-up bell: the days of debt-fuelled consumer spending growth are over. The economic paradigm for the next hundred years will be based on huge infrastructure spending, to radically transform energy sourcing, generation, transmission, storage and utilization.

Please keep this simple maxim in mind:

- Energy is the biggest business of them all, by a long shot.

I am hopeful that after wasting resources* on financial bailouts (perhaps a necessary evil), our societies will see the light and now shift to productive and responsible courses of action.

What does this mean for investors with longer-term horizons?

- Avoid the consumer non-essential sectors. By definition, societies will have to save more in order to finance these projects and will thus have less to spend on non-essentials.

- Avoid the consumer finance sector, for the same reason.

- Interest rates will have to rise from near zero, to induce savings.

- Grid-related technologies will become increasingly important.

- Let Gaddafi pitch his tent where he wants (smile).

Tuesday, November 10, 2009

Dubai's Shut Up Finance

The emirate's ruler just said the second half of its $20 billion bond program will be “well received,” and that those who doubt the unity of Dubai and Abu Dhabi (the United Arab Emirates' petro-wealthiest member) should “shut up”. The "unity" in question is, of course, all important since the first $10 billion was bought entirely by the U.A.E.'s central bank and has been used in part to bail out the developers of said artificial islands and other such hubristic extravaganzas.

The bailout money is sorely needed because Dubai is... well... broke. Since it has no hydrocarbons to call its own, the tiny nation first rose to prominence as the playground of other, notionally abstemious, Arabs residing next door. It then went on to blow its own bubble on a sea of easy credit, margin and rollickingly speculative share and real estate markets.

To grasp the magnitude of hubris at the Gulf bubbledom all we need do is compare "before" and "after" pictures from downtown Dubai.

Monday, November 9, 2009

Credit Crisis vs. Permagrowth Crisis

But unless you are amongst the bankers/traders/speculators who survived the bloodbath and is about to see his or her bonus rise once again, you really don't give a damn. Because for you what really matters is the Real Economic Crisis and the chart that really applies is unemployment (see below).

Unemployment Reaches 10.2% - Highest Since 1983

Unemployment Reaches 10.2% - Highest Since 1983Oh, really? What if this no longer applies? Today's economy is not characterized by fast-reacting manufacturing with short hiring/firing cycles that accommodate domestic production swings. We have exported this dynamic to China, along with much of our manufacturing base, so we are likely to see a very, very slow recovery in job creation.

And if no jobs are to be had, income will suffer and so will consumer spending, which is the foundation of our entire Permagrowth economy. Yes, there is a chance that we will revert to substituting consumer debt for earned income, as we increasingly did during the Bush II era. But if we do, then we will indeed have learned nothing and soon be responsible for our own demise... again.

Therefore, we should immediately start revamping our economy along Sustainable lines. For a model, perhaps we should start looking at Japan from a different perspective, outside the GDP-metric box. I mean, does anyone think that the Japanese are suffering, or are they enjoying a high living standard after well over a decade of so-called "stagnation"?

Let's bottom-line things: Permagrowth/Permadebt is like the high-wire acrobat who must forever keep moving in order to keep his balance and not plunge to the ground. Likewise, our economic model depends on ever more frantic activity to generate more debt and thus more "money" to service this debt. Debt conservation has replaced human development as the self-evident goal of governments.

If this were only a shocking ethical tragedy we could just shrug our shoulders and quote Cicero: O tempora, o mores! Unfortunately, Permagrowth/Permadebt is also completely antithetical to natural law, the simple truth of energy conservation and the constant increase of entropy.

Monday, November 2, 2009

About CIT And Sardines

In the chart below, let's take a look at CIT's balance sheet assets, its equity and the price of its shares - all at year-end except for the last two quarters of 2009 (click to enlarge), and ask ourselves this simple question: what is the probability these assets (mostly loans and leases) were really worth what the annual and quarterly reports said, particularly after 2006?

Judging from the share price: zero probability, of course.

But, this post is not really about CIT. Rather, it is meant as a general comment on financial company balance sheets. To wit, it is nearly impossible to properly value loans, leases and other more esoteric financial assets (e.g. CDO, CDS, IRS, FRA, etc.) when we are out in 3+ sigma territory in delinquencies, defaults, counterparty risk metrics and volatility. One day a company like CIT is supposed to be "worth" $6 billion according to its books, the next it's hyena food.

I've said it before and I'll say it again: a company that bases its valuation, indeed its entire business, on the Trading Sardine principle (see below) should be judged not by analysts but by fishmongers. Better yet, by their wives..

____________________________________

The Trading Sardine

Andy convinces Billy to buy a can of sardines at a high price by telling him how wonderful they taste. Billy, being greedy, decides to resell them to Charlie for a profit at an even higher price by convincing him, too, about how great these sardines are. The process is repeated several times until the last buyer, let’s call him Zebediah, pays a million bucks to Yorick for a can of the “world’s absolute best sardines – EVER”.

Well, Zebediah decides to open the can and eat the sardines, only to discover they are ordinary, plain sardines. Furious at being swindled, he yells at Yorick:

Yorick shrugs and replies…

“Hey Zebediah, you are such a schmuck. Those were not eating sardines – them were trading sardines!"

Saturday, October 31, 2009

A More "Personal" Look At Debt

- Debt per person and GDP per person.

- Debt per person and Disposable Personal Income per person.

Note: the Total Debt used to construct these chart does NOT include debt of the financial sector so as to avoid any double counting (e.g. a mortgage inside a CDO), even at the cost of somewhat understating the crush of debt. It's bad enough, anyway..

Thursday, October 29, 2009

Boundary Conditions

Let's look at the curve itself (see chart below).

The charts above, however, do not tell the whole story because they track the difference in rates without taking into consideration their absolute levels. Because nominal interest rates cannot go below zero, it makes a whole lot of difference if a spread of 340 b.p. is the result of 6.40% minus 3.00% or 3.50% minus 0.10%. These two situations describe completely different economic and financial market conditions, even if the spread is exactly the same. So, we need to look at the spread from another perspective.

- Let's chart the spread as a ratio of the 10-year bond rate, i.e. take the spread and divide by the 10-year rate at any point in time. This provides a better sense of how wide the spread is in relation to the absolute level of interest rates.

But, we have now demonstrably approached boundary conditions: T-bill rates are essentially zero, meaning that most speculators are 100% certain of the optimistic scenario. The only thing certain being that there are no certainties, I am more comfortable taking the opposite view, i.e. that the economy will weaken again and that the curve will flatten.

_______________________________________________________________

Addition by special request (Greenie): The 10y-3m spread for 1931-1952.

___________________________________________________________

GDP Addendum

Third quarter GDP came in at +3.5% (real, seasonally adjusted, annualized), as usual "higher than expected". Crunching through the full set of numbers we can immediately distill the whole report to the following:

- Cash for clunkers accounted for 1.7%, i.e. half of the increase.

- Inventory adjustments (lower liquidation of goods in stock) accounted for another 1%.

Wednesday, October 28, 2009

Lies And Headli(n)es

OK, so what are the numbers? Orders increased by a seasonally adjusted 1% from August - not exactly a bonanza, but OK in these hard times - one would think. Not so fast..

- First of all, August numbers were revised down from -2.4% to -2.6%, so the rise is smaller than it seems.

- Secondly, only two categories accounted for the entire $1.61 billion increase in orders: machinery with a gain of $1.7 billion (+7.9%) and defense aircraft with $618 million. (+12.5%).

- Just about everything else was down for the month: civilian aircraft (-2.1%), motor vehicles (-0.1%), computers and electronics (-0.2%), electrical equipment (-0.9%), all others (-1.4%). Metals were flat (+0.09%).

After all that is considered, I think the headline is a bit misleading, won't you say?

Friday, October 23, 2009

The Fisher-Bernanke Snake Oil

Mr. Fisher became justly infamous for his supremely ill-timed prediction of permanently high share prices just days before the Crash of 1929. What is less well known about him is that he lost his fortune in the Depression; not because he speculated heavily before the Crash, but because he kept buying all the way down afterwards and eventually had to be bailed out by his wealthy in-laws.

Well, as the saying goes, a recession is when your neighbour loses his money and a depression is when you lose your own, so it doesn't surprise me that Mr. Fisher finally "got religion" about debt's corrosive powers in 1933, four full years after the Crash.

Despite his claim of breaking new ground with his above study, the conclusion that over-indebtedness leads to liquidation, distress selling, a fall in the level of prices, unemployment and economic malaise was, in fact, very very old hat. Think of the Sumerians (5000 BC) and organized agriculture, spot and forward grain markets, loans of silver, the Code of Hammurabi fixing interest rates to avoid usury, etc.

Mesopotamian Contract For A Three-Month Loan Of Silver (1800 BC)

In any case, Mr. Fisher eventually figured out the cause of the Great Depression. Bravo, but what does that have to do with today's troubles? Enter Mr. Bernanke..

The current Fed chairman - himself an academic theorist from Princeton - is a great fan of the late Yale don and his remedies for debt-deflation depressions. Here is a revealing paragraph from Mr. Fisher's 1933 opus:

In other words, Mr. Fisher claimed that depressions could be prevented, or remedied once they were under way, "simply" with monetary policy. I strongly believe this to be utter nonsense.

The main reason is this: the production, distribution and consumption of real goods and services cannot be ultimately controlled by an artificially imposed mechanism such as money, which is, after all, a measurement and exchange convention. Claiming that money controls the real economy is like saying that how far we travel depends on how many miles we make available to measure distance with. Or, as a friend is fond of saying: "It's only money".

(In Mr. Fisher's defence, however, I must also note that he probably couldn't in 1933 imagine a currency regime so completely devoid of reality anchors; i.e. today's purely fiat money, which can be issued at will by the mere act of borrowing. Neither would he conceive of authorities so narrow-minded, so perniciously attached to free market dogma, that they would completely disavow their legally mandated regulatory and oversight responsibilities.)

My position is that the massive debt bubble created a similarly massive amount of malinvestment in surplus (and now useless) physical stock: housing, ships, office buildings, shopping centers, factories in China, call centers in India, vacation homes in Spain, and much more. Excess capacity is a common enough phenomenon of all run-of-the-mill recessions, being the result of fallible human beings optimistically extrapolating demand too far out of reality's reach. Usually, it is soon absorbed after a few quarters of creative destruction and increased demand from a rising population.

But this time it's different - very different - precisely because the huge global credit bubble blew this extrapolation, this excess capacity creation, way out of all previous experience. For example:

- Between 2000 and 2008 there were a total of 14.8 million new housing units completed in the U.S., versus the formation of only 5.7 million new households.

- Orders for new dry bulk ships and tankers zoomed, so that deliveries are scheduled to reach a combined 1,700 vessels in 2010 and 1,400 in 2011, versus 734 this year.

- In Dubai 3 million square meters of additional new office space is to be completed by 2011, versus 3.25 sq. mts. in existence today.

- In Spain, I saw with my own eyes hundreds of new "luxury" multi-unit vacation home developments, sprouting like mushrooms along the coast from Gibraltar to Almeria and further. One of them was, incredibly, located right around a polluting cement factory and the coal-fired power station of (aptly-named) Carboneras.

What needs to be done? I have laid out my proposals several times, so I will only provide the headlines here:

- Straight debt cancellation for a portion of debt, particularly for the "bottom" 80% of the population.

- Anchor the dollar and money supply to the real Green/Sustainable economy via The Greenback.

- Focus government action on income creation, instead of asset/credit/debt protection.

Tuesday, October 20, 2009

Bills And Swaps Indicate Great Optimism

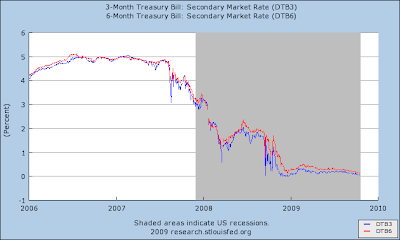

Among other things, such almost-zero bill rates serve as a bullish sentiment indicator. People are willing to accept a near zero return now, in order avoid losses when rates go up (bond prices drop as the economy grows and rates rise).

Another indicator is the spread between current rates for longer-term instruments and their forwards. For example, 10 year interest rate swaps (IRS) are trading at 3.54% in the spot market, whereas their one year forwards are at 4.00% and two years at 4.32%. This means that speculators expect 10-year rates to be significantly higher two years from now. The spot-2 year spread for 10 year IRS is currently at 78 basis points, very near its record high (see chart below).

It is interesting, too, how the same levels for T-bills and swap spreads which existed about a year ago, indicated a completely different expectation: back then low bill rates came from a flight to safety and higher spreads happened because interbank markets were frozen due to counterparty fears. Same numbers, different explanation..

Monday, October 19, 2009

It's The Banks (Plus Kissinger On The Dollar And China)

And it's not only happening in the United States. In the same period bank shares have broadly outperformed in Europe, too: the DJ EURO STOXX (Banks) index is up 175%, whereas the broader index is up 60%.

Such nearly identical behaviour between American and European markets is not a coincidence, of course. Even though the EU does not possess a common Ministry of Finance (Dept. of Treasury), it does have one European Central Bank. And it is acting just like the Fed - at least as provider of ultra-cheap credit to banks in return for dodgy collateral.

As of last week, the ECB's own balance sheet has grown 50% to 1.8 trillion euro versus 1.2 trillion in the same week in 2007. The entire increase has come from long-term refinancing operations (i.e. term lending to banks against collateral) and "other" securities held for its own account.

_________________________________________________________

Important P.S.

Henry Kissinger is no dummy, whatever you may think of his politics and career. He had this to say about China, the US economy and the dollar, during an interview with Le Figaro, France's newspaper "of record". (In my dear friend Debra's honour, I have kept the title of the article in the original French. The rest of the relevant passages I translated into English, with some help from Babel.)

«Les Chinois ne veulent plus de la domination du dollar sur l'économie»

Q. You just returned from Beijing. What is the feeling of those Chinese in government about the international financial crisis, which started in the summer 2008 in the United States?HK. I will give you my personal opinion, which is only that of an informed observer. I do not speak on behalf of the Obama administration, for which I have much respect, but to which I do not belong. There are always important political divergences between the Chinese and us, the Americans. They are not very serious, they do not threaten peace in the world, but they exist. They are managed by very intense diplomatic relations, by the existence of very many work groups between our two countries.

The Chinese do not trust America to carry out the great political affairs of the planet well. They find that ideology forms too large a part of the way in which Americans conceive international relations. On the other hand, the Chinese, before this financial crisis, regarded us as serious and reliable people in the fields of finance and the economy. They trusted our model and wished even to imitate it. The violence of the crisis, the irresponsibility shown by the great institutions of Wall Street much surprised and shocked the Chinese. We deeply disappointed them.

Today, they have accepted their losses, but they will never again trust us in financial matters. This is the great change. As they are pragmatic people, they understood it was necessary to manage this crisis in co-operation with us, so as to limit the damage to the real economies of our two countries. They take into account that a very large majority of their immense monetary reserves is in dollars and that their exports of consumer goods to America remain vital to the health of their manufacturing industries. The Chinese leaders managed this crisis in co-operation with their American counterparts during the last twelve months, and they will continue to do it. But nothing will be like before.

Q. You alluded to the fact that the director of the central bank of China declared, at the beginning of this year, that the dollar could not continue to be the world's reserve currency, and that the world should seek to create another standard, applying the model of the SDR (Special Drawing Rights ) of the IMF?

HK. It is clear that the Chinese do not want the dollar's domination of the worldwide economy any longer. They do not yet have a real solution, they know that it does not depend only on them, but they are patient people, who are accustomed to rise to long-term challenges. As always, they will only act very gradually.

.................

......................

Hmmm.. Bob Fisk a couple of weeks ago, now that ultimate realpolitik operator (and original China hand) Henry Kissinger. Anyone think warning rockets are being sent up? Eh?

Thursday, October 15, 2009

Ending The Happy Hour

Needless to say, this view is not shared by several academic analysts and gold-standard theorists - and most definitely not by commodity speculators who, however, are mostly talking their "book". Some even mention the possibility of hyper-inflation, a la Weimar Republic.

For everyone's consideration, then, here is another piece of the puzzle: foreign/international holders now own $3.5 trillion of Treasury debt or 50% of the total, up sharply from $1.06 trillion and 30% in 1999 (see chart below, click to enlarge).

The simple point is that powerful foreign creditors, e.g. China and the oil Arabs, now stand to lose a serious - record breaking serious - amount of money, should the US go down the inflation route to rid itself of onerous debt. It follows that they will not sit idly by, looking at their savings turn into so much dust in the wind (do I hear "oil embargo"?).

Judging from the increasing noise emanating from places like Beijing and the Gulf about dumping the dollar as the major global reserve currency, the Obama administration is clearly being sent overt warning messages. Happy hour at the bailout saloon should come to an end, they seem to be saying. Stop serving out the monetary booze and concentrate instead on bringing back a semblance of normalcy in interest and FX rates.

Tuesday, October 13, 2009

Six Month Sigmas

- First, the raw performance data going back to 1871 in chart form (click to enlarge).

- How unusual is such an event, from a statistical standpoint? Let's look at the next chart, a familiar distribution histogram (click to enlarge). The median 6-month performance is +3.1% (the mean is 2.7%) and the standard deviation around it (known as sigma, denoted by the Greek letter "σ") is 12.2%.

Back in March we were in -3σ territory and at the end of September at +3σ. A three-sigma event has, by definition, only a 0.27% chance of occurrence (i.e. 99.73% of the data are inside the -3 to +3 sigma band) if the data are normally distributed (which they are not, in the case of share prices). The swing from one extreme occurrence to the next has been very, very fast.

Back in March we were in -3σ territory and at the end of September at +3σ. A three-sigma event has, by definition, only a 0.27% chance of occurrence (i.e. 99.73% of the data are inside the -3 to +3 sigma band) if the data are normally distributed (which they are not, in the case of share prices). The swing from one extreme occurrence to the next has been very, very fast.How often does S&P 500 move from -40% to +40% within six months, i.e. how frequent are such sharply positive V-type reversals? We can identify only two previous occurrences, and they both happened between May 1932 and September 1933 (see chart below, click to enlarge).

How can we explain what has happened in the last six months? What is the market anticipating?

This extraordinarily rare performance indicates speculators' bets that Mr. Bernanke's massive monetarist experiment will succeed. To wit, that his enormous bailout of the financial system will prevent the credit crisis from mutating into a virulent economic crisis.

How accurate is the speculators' analysis? Well... let's just say that they're largely talking their own book. People who now call the shots in the Fed, Treasury and White House are confirmed monetarists from the Milton Friedman - Alan Greenspan school of thought, itself harking as far back as Irving Fisher, the infamous "permanent high plateau" economist who lost a fortune in the stockmarket after the 1929 Crash because he simply couldn't believe the Fed would be so conservative.

By reverse analogy, could it be that the economy will continue weakening despite the Fed's largesse? That's what I think, because today's fundamental economic problem is not a lack of adequate liquidity (and the Fed can only affect that), but a lack of enough earned income to properly service the enormous debt that households have assumed. In other words, it's a solvency problem, and it necessarily affects personal consumption expenditures, the very heart of the economy (70% of GDP).

Look at the chart below, tracking household debt as a percentage of total compensation of employees, which I use as a proxy for earned income (click to enlarge). In just the few years after 2000 it zoomed from 113% to 180%. That's a serious challenge to solvency, no matter how low the Fed keeps rates.

I am not going to attempt a conclusion, today. Instead, since I still have my quant hat on, I am left wondering what are the statistical chances of the Fed succeeding in overcoming a massive debt-to-income imbalance with just monetary tools.

I don't know the answer- and can't know - because the data sample is tiny: just one occurrence, and it's still going on.

Monday, October 12, 2009

Where The Debt Lies (..and Happy Columbus Day Mr. Krugman)

When Christopher Columbus sailed west from the Old World he was merely trying to discover a faster, more profitable way to reach the well-known trade riches of India and China; he had no notion of America or the New World's vast potential. In other words, he was clueless, if also lucky.

Just like Columbus played it safe with his royal backers and their establishment groupthink, so is Mr. Krugman today calling for known and accepted palliatives for our economy's troubles: more loans, low interest rates, a weaker dollar, more government deficit spending. Not surprisingly, he points his arrows at the Wall Street Journal and selected Federal Reserve members for their sotto voce remarks on raising interest rates, soon.

Well... what if both establishmentarian views are misguided? Should we be following our outdated Neoclassical and Keynesian maps to exit the crisis, or should we strike out in a new direction? Aren't new problems calling for novel solutions? I certainly think so and will soon come back with a post on Green Finance.

Meanwhile, on with today's post.

_______________________________________________________________

Like the oracle of Delphi, today's post title may be interpreted in two ways: the location of debt, or the untruth of debt. In fact, this post is about both.

- Let's start with where the debt is. The chart below (click to enlarge) breaks out marketable debt (i.e. bonds, bills, notes, commercial paper, ABS and MBS, etc., which trade on the open market). The total comes to $34 trillion and excludes loans held directly by banks and other financial institutions, plus the Treasurys in the Social Security trust fund.

Until 2000 all types of marketable debt were growing more or less at the same rate; the slope of all lines is similar. One notable exception was Treasurys; because of the short-lived Clinton surplus, borrowing needs for the federal government came down. But after the year 2000, mortgage-related debt started racing ahead and finally exploded spectacularly by 50% within a mere three years. In the 2004-07 orgy of new loan origination and securitization mortgage-related securities went from $6 trillion to $9 trillion. And we all known what happened after that...

What is happening now is that Treasurys are rushing in to fill the void (a.k.a. socializing losses).

- But wait a minute... what void? Look at the red line in the chart above: Mortgage securities are still valued at $9 trillion, after a full two years of record delinquencies, defaults and charge-offs (see chart below, click to enlarge).

Since the beginning of 2007 charge-offs for all real estate loans directly held by commercial banks come to a total of 9.5% (adding two years' quarterly rates). One would presume that mortgage lenders held on to the most attractive loans for their own books and securitized the rest, resulting in higher delinquency and charge-off rates for mortgage-related bonds. Indeed, we know that credit default swaps prices (CDS) to insure such securities against default went through the roof. Markit's various ABX indices of mortgage-related CDS collapsed anywhere from 60% to 95% (reverse scale to CDS pricing).

But even if this is not so, even if credit quality is identical between banks' own loans and those they securitized, shouldn't the value of real estate securities at the end of the second quarter 2009 be lower by about 10% to around $8 trillion, at most? And that's just face amount, never mind market value.

Therein, therefore, is where lies the lie on debt, the pretension that all's well in finance balance-sheet land. This "missing void", as it were, has been filled by no one other than the Fed itself, which last year bought $700 billion in mortgage-backed paper for its own account. Coincidence? Of course not...

Thursday, October 8, 2009

Mr. Bernanke's Class Warfare

It's been a while since I looked at the Fed's balance sheet. Here is an update.

In the one year that the Fed's total assets have increased $640 billion, its own capital has increased by a mere $10 billion, to $51 billion. In other words, the Fed's Asset-to-Capital ratio has gone from 36x to 42x, even as the quality of its assets has demonstrably deteriorated. Mortgages and agencies now make up 40% of its assets, up from a mere 1.1% a year ago.

This massive expansion and radical transformation of the central bank's balance sheet is the direct result of Mr. Bernanke's theory that the Great Depression happened because the Fed did not immediately provide enough liquidity and credit to the financial system in the aftermath of the 1929 Crash. In his view, this eventually precipitated bank failures, the evaporation of depositors' savings and the transformation of a financial crisis into an economic collapse.

I am not going to argue with Mr. Bernanke's eminent academic research; his historical analysis of the 1930's is probably spot on. But I have an increasingly growing suspicion that this analysis - and thus, his current actions - are irrelevant to today's situation; that Mr. Bernanke is a general trying to fight today's war with yesterday's tactics and weapons.

My oft-repeated premise of this reasoning by false analogy, is best exemplified by the French wasting enormous resources to build the Maginot Line before WWII, a superbly constructed and equipped static fortification, only to see it immediately by-passed by Guderian's blitzkrieg panzers in 1940. Why were the French so short-sighted? Because they became mesmerized by their analysis of WWI trench warfare, when millions of their youth were massacred defending or trying to capture ill-equipped trenches. The response to their flawless analysis of the past was, however, entirely irrelevant to their future.

Likewise, there are major differences between today and the 1930's, chief among them:

- The U.S. was then the largest creditor nation - today it is the largest debtor.

- The economy was then based on manufacturing, farming and capital investment - today it is based on consumer spending.

- The saving rate was then around 18% - today it is 4% and a couple of years ago it even was negative. The vast majority of people today don't have significant savings to lose; instead, they owe debts that are choking them and the economy.

- Inequality is rampant : today 90% of all American families have median financial assets of $132,00 or less, whereas the top 10% have $405,000 (2007 constant dollars). In gross terms, then, 90% of all families are more than likely covered by FDIC's $250,000 deposit insurance (Federal Deposit Insurance Corporation).

- By contrast, debt has exploded upwards: families now owe an average $126,000, more than double the $58,000 twenty years ago - and that's in constant 2007 dollars. If we look at just the middle class, i.e. the middle 70% of the population excluding the bottom 20% and the top 10%, things look even worse (see table below - click to enlarge).

I'm afraid that Mr. Bernanke's actions at the Fed end up preserving debt, owed to the top 10% of the population by the other 90% of the people. His measures are not really designed to safeguard the savings of that 90%, simply because they don't exist in any serious amounts.

Maybe Mr. Bernanke can justify his actions as "saving the financial system", but a cynic could easily perceive them as Class Warfare. Because, it is one thing if a private financial institution comes to the rescue of the financial system with its own money, much as J.P. Morgan did in the Panic of 1907. But it is another thing entirely when a public institution bails out a tiny percentage of financiers and mega-rich from a disaster of their own making, and then bills the entire operation to that 90%+ of the people who had nothing to do with it.

Worse than that, worse than being ethically wrong, Mr. Bernanke's actions are also economically useless. Sure, a couple of trillion in ready liquidity has deflected the liquidity crisis, just like couple of aspirin can bring down fever. But fevers and liquidity crises are symptoms, not diseases and the economy's real problem is simply too much debt relative to peoples' income.

Look at the income distribution table below and compare it with the debt table above (click to enlarge). For example, look at the 80-90 percentile: real median family incomes have increased 19% in 20 years from $95,700/yr to $114,000/yr, but debt has increased 188% from $63,300 to $182,200. Things are even worse at the lower percentiles.

Table: FRB 2007 Survey

Table: FRB 2007 SurveyInstead of ballooning the Fed's balance sheet and engaging in de facto class warfare, Mr. Bernanke should look for ways to reduce families' debt load, most likely through partial forgiveness and default. He can't do that by himself, of course; that's a job for Congress and the President. But, at least, Mr. Bernanke should not make it easy for zombie debt to keep existing and choking American families through the public's enforced largesse. He didn't ask them, did he?