Many historians view WWI and WWII as one world war separated by a brief period of peace. The punitive terms imposed on Germany after WWI directly caused the rise of Adolf Hitler and his Nazis to power and, inevitably, WWII - all in a Europe where WWI had not truly solved the underlying power structure.

Drawing a parallel to the Great Financial Crisis of 2007-10, I believe that the way it was handled by central banks and governments in the US, EU and Japan is now - inevitably - causing the current spate of trouble. Let's call them GFC I and GFC II.

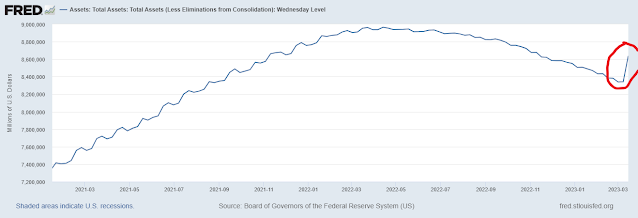

GFC I was "handled" by - literally - papering it over: Western central banks "printed" enormous amounts of money to save the financial/banking systems in their countries and drove interest rates below zero. This is a parallel to the punitive terms the Entente Powers imposed upon Germany at the Paris Peace Conference in 1919-20, in the sense that a "sane" financial/economic system cannot long operate under zero/negative interest rates without sowing the seeds of its own destruction.

For example, the ECB drove interest rates below zero from 2015 to 2022 (black line in chart below). It was thus only a matter of time and happenstance until inflation soared (red line) when it expanded QE massively during the COVID pandemic.

And just like WWII was massively more destructive than WWI, GFC II has the potential to wipe out much more than regional banks, or even global systemic banks. It has the potential of wiping out the public debt of countries like the US and Japan, or even the entire Western financial system. Unless governments and central banks get really serious in averting the fast rising dangers, we may well become witness to the "Nazification" of our Western economic/financial system. For example, look at how cryptos are reacting right now..

- We must immediately bring inflation down to as close to 2% (maximum) as possible. There is only one way to do so in a rational manner: QT.

- We must immediately eliminate budget deficits and eliminate the need for more public debt.

- We must immediately start the process of re-balancing socially unjust income and wealth excesses.