In a recent post I posited that there is nowhere to invest right now that makes any financial sense. Not in bonds, stocks, real estate, commodities and most certainly not in digital "assets" like cryptos and NFTs. A reader asked if there is nothing at all to invest in, and I replied with an old Wall Street dictum: "When in doubt, stay out". But, that's not very helpful, is it? So, I've been thinking about it a bit more...

In my considered opinion, the more relevant question to ask presently is: "How can I protect myself from what is likely coming?" Meaning, switch focus from making money to protecting money/assets.

The easy answer would be "stay in cash"... but, right now, cash is indeed trash since it yields nothing or nearly: around 1% at best if you are an individual or 2.30% if you are a large institution with access to the Fed's O/N reverse repo. With inflation at 8.30% your cash is depreciating at a furious, historically unprecedented rate. Sure, it's less trash than anything else, but losing 6-7% per year is no way to protect yourself.

Ah, but cash carries an opportunity premium: you can quickly invest opportunistically when things bottom out. In other times I would agree, but since I believe we are in for a long, drawn out bear market in everything instead of a sharp drop and even sharper rebound, the opportunity premium is, in fact, a very heavy discount given the very negative real interest rates. So, cash isn't it.

Alternatively, you could keep your assets and use hedges as protection. But hedging comes at a premium, the time/interest cost of futures, options, credit derivatives, etc. As interest rates rise, this cost goes up as well. Also, as with any hedge, it matters most who you buy it from - as buyers of CDS quickly discovered during the 2007-09 credit meltdown (Lehman, AIG Financial...). You hedge is only as good as the institution who underwrites it, and during times of turmoil those institutions become very vulnerable. Yes, I even include the likes of derivatives exchanges/clearing houses in this category because they are certainly not immune to systemic risk.

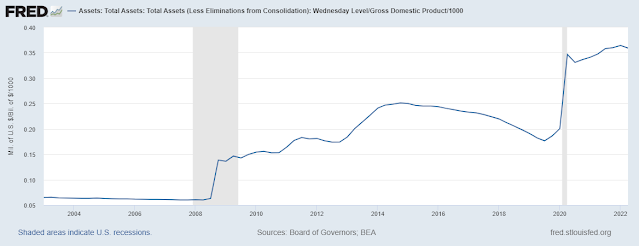

The Fed bailed everyone out last time as lender of last resort, but will it this time? Can it, this time? Its balance sheet assets have now reached an astronomic 36% of US GDP, up from 7% in 2007. One way to look at this 36% vs. 7% is as a measure of how much the dollar has been watered down, and within a very short time.

At which point does the world stop trusting the dollar as a global reserve currency? Ask Putin, who is demanding payment in rubles for Russia's oil and gas exports - and the many countries who are doing so, without exactly advertising the fact.

No cash, no hedge... what is left to protect ourselves, at least longer term?

The answer is this: forget ALL financial "assets" and focus on real, productive assets.

I shall continue with ideas fitting the bill in a follow-up post.

.png)

.png)