Let's analyse the common recession first.

I believe that the inventory accumulation/liquidation cycle for consumer merchandise no longer plays the same role in the US economy as it once did, for two reasons:

a) "Just in time" (JIT) delivery has become the norm everywhere and has progressed to the point where a major retailer can place an order with a manufacturer in China and be confident that his outlets will receive the goods on specific days and times, ready to be sold to the consumer exactly as ordered. It is all arranged by the huge companies that have integrated container ship liner operations with local logistics (eg AP Moeller, Maersk, MSC). This means that much less inventory is now being maintained by merchants vs. final sales and that consumer behavior signals get transmitted to the factory floor much faster than ever before.

There is very little slack left in the manufacturing-shipping-distribution-retailing network. In other words, a merchant seeing his sales going down can and will instantly cut back on his orders to avoid a big inventory accumulation. The level of retailing/logistics technology has reached the point where most of this work is actually done automatically as a cashier swipes a product's bar code at the point of sale.

We can see the result as a steady downward progression in the Inventory to Sales Ratio in the chart below (click to enlarge).

b) The de-industrialization of the US economy has reduced its sensitivity to manufacturing activity and employment, i.e. there are fewer jobs that get affected by the inventory adjustment process. Instead, workers in foreign factories will get affected - and faster than ever before, given how little slack there is within the JIT network.

The two factors taken together mean that inventory imbalances are less likely to be the proximate cause of US recessions. In other words, it is unlikely that we will be getting many "common" type recessions in the future - at least in the US.

However, the US economy is now structured in such a way that it is more vulnerable to "Category 5" type recessions, caused by personal consumption declines. These are the reasons:

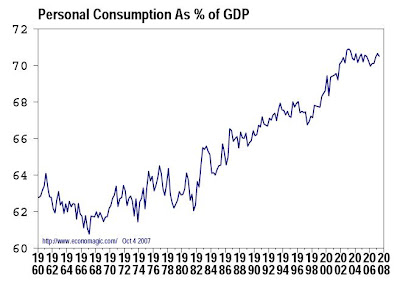

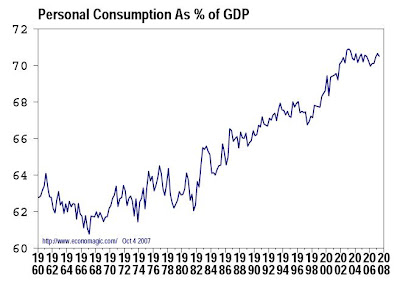

Personal consumption now accounts for 71% of GDP, the highest percentage ever (see chart below).

At the same time, such consumption has become more dependent on borrowing. We saw in previous posts how household debt increased much faster than incomes and we know that the saving rate is negative. All this means that unless incomes start rising much faster, personal consumption will be limited by the ability of households to borrow backed by the value of their assets, i.e. the wealth effect I discussed two days ago.

At the same time, such consumption has become more dependent on borrowing. We saw in previous posts how household debt increased much faster than incomes and we know that the saving rate is negative. All this means that unless incomes start rising much faster, personal consumption will be limited by the ability of households to borrow backed by the value of their assets, i.e. the wealth effect I discussed two days ago.

In addition, the ability to boost personal spending through tax cuts has been essentially eliminated after the repeated tax cuts of the current Bush administration and the parlous state of government finances (e.g. war spending).

In other words, the economy is now highly vulnerable to fluctuations in asset prices - mainly real estate, because this is the type of asset most commonly held by the average American (by contrast, 85% of all financial assets are held by a mere 10% of the population). In the past real estate values rose in a steady and measured pace with no overall extremes. All this changed starting as far back as 1992 and peaked in the 2005-06 bubble; the situation is now reversing rapidly, with housing prices falling in absolute terms for the first time since the Great Depression. The effect on household net worth for the vast majority of Americans is going to be severe. Rises is stock prices may create a false, or mirage sense of prosperity but this cannot last in the face of a 100 mph headwind caused by falling house prices. Remember - the vast majority of Americans own no stocks whatsoever, directly or indirectly.... but they do own homes, with mortgages attached.

There is no question whatsoever in my mind that the current situation will have a direct negative effect on personal consumption. We are seeing this happening already, as most retailers started to announce very meager sales increases on a month to month basis, significantly below the pace of inflation. The fact that personal consumption hasn't collapsed is probably due to what I call "wealth inertia": the vaguely delusional belief that "our house is still worth X", maintained because of so many prior years of increases. I am afraid that unless incomes start rising fast the economy may soon be hit by the next stage in the asset price cycle, which is none other than the "poverty effect".

If this were to happen - and we will know soon, as the most crucial period of Christmas sales starts to ramp up in a month - consumers will curtail spending in absolute terms, will seek to cut debt and replenish savings. This is the Katrina of recessions - a Category 5.

Final word... there is only one way out. Corporations need to immediately raise cash salaries and wages to boost confidence and maintain spending. Yes, this will cause an immediate hit to profits, but corporate earnings are already so elevated that the pace of LBO's, buybacks and special cash distributions is at an all time high. Better a bit of profit medicine than Katrina..

I believe that the inventory accumulation/liquidation cycle for consumer merchandise no longer plays the same role in the US economy as it once did, for two reasons:

a) "Just in time" (JIT) delivery has become the norm everywhere and has progressed to the point where a major retailer can place an order with a manufacturer in China and be confident that his outlets will receive the goods on specific days and times, ready to be sold to the consumer exactly as ordered. It is all arranged by the huge companies that have integrated container ship liner operations with local logistics (eg AP Moeller, Maersk, MSC). This means that much less inventory is now being maintained by merchants vs. final sales and that consumer behavior signals get transmitted to the factory floor much faster than ever before.

There is very little slack left in the manufacturing-shipping-distribution-retailing network. In other words, a merchant seeing his sales going down can and will instantly cut back on his orders to avoid a big inventory accumulation. The level of retailing/logistics technology has reached the point where most of this work is actually done automatically as a cashier swipes a product's bar code at the point of sale.

We can see the result as a steady downward progression in the Inventory to Sales Ratio in the chart below (click to enlarge).

b) The de-industrialization of the US economy has reduced its sensitivity to manufacturing activity and employment, i.e. there are fewer jobs that get affected by the inventory adjustment process. Instead, workers in foreign factories will get affected - and faster than ever before, given how little slack there is within the JIT network.

The two factors taken together mean that inventory imbalances are less likely to be the proximate cause of US recessions. In other words, it is unlikely that we will be getting many "common" type recessions in the future - at least in the US.

However, the US economy is now structured in such a way that it is more vulnerable to "Category 5" type recessions, caused by personal consumption declines. These are the reasons:

Personal consumption now accounts for 71% of GDP, the highest percentage ever (see chart below).

At the same time, such consumption has become more dependent on borrowing. We saw in previous posts how household debt increased much faster than incomes and we know that the saving rate is negative. All this means that unless incomes start rising much faster, personal consumption will be limited by the ability of households to borrow backed by the value of their assets, i.e. the wealth effect I discussed two days ago.

At the same time, such consumption has become more dependent on borrowing. We saw in previous posts how household debt increased much faster than incomes and we know that the saving rate is negative. All this means that unless incomes start rising much faster, personal consumption will be limited by the ability of households to borrow backed by the value of their assets, i.e. the wealth effect I discussed two days ago.In addition, the ability to boost personal spending through tax cuts has been essentially eliminated after the repeated tax cuts of the current Bush administration and the parlous state of government finances (e.g. war spending).

In other words, the economy is now highly vulnerable to fluctuations in asset prices - mainly real estate, because this is the type of asset most commonly held by the average American (by contrast, 85% of all financial assets are held by a mere 10% of the population). In the past real estate values rose in a steady and measured pace with no overall extremes. All this changed starting as far back as 1992 and peaked in the 2005-06 bubble; the situation is now reversing rapidly, with housing prices falling in absolute terms for the first time since the Great Depression. The effect on household net worth for the vast majority of Americans is going to be severe. Rises is stock prices may create a false, or mirage sense of prosperity but this cannot last in the face of a 100 mph headwind caused by falling house prices. Remember - the vast majority of Americans own no stocks whatsoever, directly or indirectly.... but they do own homes, with mortgages attached.

There is no question whatsoever in my mind that the current situation will have a direct negative effect on personal consumption. We are seeing this happening already, as most retailers started to announce very meager sales increases on a month to month basis, significantly below the pace of inflation. The fact that personal consumption hasn't collapsed is probably due to what I call "wealth inertia": the vaguely delusional belief that "our house is still worth X", maintained because of so many prior years of increases. I am afraid that unless incomes start rising fast the economy may soon be hit by the next stage in the asset price cycle, which is none other than the "poverty effect".

If this were to happen - and we will know soon, as the most crucial period of Christmas sales starts to ramp up in a month - consumers will curtail spending in absolute terms, will seek to cut debt and replenish savings. This is the Katrina of recessions - a Category 5.

Final word... there is only one way out. Corporations need to immediately raise cash salaries and wages to boost confidence and maintain spending. Yes, this will cause an immediate hit to profits, but corporate earnings are already so elevated that the pace of LBO's, buybacks and special cash distributions is at an all time high. Better a bit of profit medicine than Katrina..

Concerning corporation and wages.

ReplyDeleteI tend to remember that according to some USA laws, the only duty for a public company is to increase the value of shareholders' investments in the the company. Thus doing things which are against this duty is illegal.

If this is the case, the corporations cannot raise wages a lot. The CEO would end up in court or in jail.

Am I mistaken?

Dear hellasious,

ReplyDeleteyou raise 2 important themes. On the first point your argument can be countered this way : yes majority of citizens have a negative net worth (no fin assets but mortgage debt) but the minority who has a positive net worth ( 20 % of the population consume for the balancing 80 %)has the ability to continue to consume. the question is then : can the "rich" remain rich enough ? On the second point (wages) the question you raise is basically the debate about the repartition of the profits. If corporates raise wages, fine as a keanasian instrument, but the stock market might no like it. an as the stock market is part of the wealthy 10 %, see back to point 1 ...

best regards

Miju

Trickle down economics doesn't work. The rich just squirrel their money away in offshore accounts and whatnot. Real paper money in circulation is decreasing, as electonic dollars are increasing. You can have money in your account, and pay bills online, but you can't withdraw it as cash

ReplyDeleteGood post Hellasious.

ReplyDeleteWe'll see how the Christmas shopping season plays out.

That will tell all.

Can the asset-dependent consumer still hold up in the face of collapsing real estate values?

Bernard

Credit card balances are increasing faster than retail sales. It's a pretty sure sign that consumers are turning to credit cards to pay mortgages and bills.

ReplyDeleteI wonder if the credit card industry has a similar problem with teaser rates that the mortgage industry has. Consumers are rolling balances from one credit card to another when the teaser rates expire.

Watch credit card delinquency rates. I don't think we'll see a huge slowdown until they start to rise.

I just learned something new and very important.

ReplyDeleteI think the following excerpt alludes to what will ultimately crush the financial system:

Under the Basel Accord for every $100 of AAA securitized assets, a bank need only hold $0.60 of equity, to back up that debt. The theory is AAA assets are among the highest rated and thus the risk of default is virtually nil. However, for every BBB securitized asset, a bank would have to hold almost $5.00 of equity for every $100.

http://www.safehaven.com/article-8412.htm

In other words, if a AAA-rated security is downgraded to BBB, the bank will have post up almost 10 TIMES MORE CAPITAL.

Where are they going to get that capital from at that point?

Are they going to sell the security?

I don't think so--there will be NO BID.

Bernard

Today the BCE left the euro rate unchanged at 4%

ReplyDeleteWelcome to competitive devaluation of the western currencies (dollar + euro), where raising rates with the euro above 1.40 dollars is not an option.

What happens next?

Either inflation is coming and eats salaries alive, or deflation kicks in in the first stages of a consumer led recession (as producers try to slash prices).

Which is your opinon (given your insight and available data)?

Bernard,

ReplyDeleteYou have hit upon a very important element in the whole MBS/ABS situation. While AAA paper won't be downgraded to BBB in one step, the combination of a series of consecutive downgrades and SIV assets going back onto balance sheets (and thus having to be covered by equity) means that the process of painful adjustment will take a long time. In other words, the credit crunch will last.

THIS IS NOT a replay of LTCM, for the simple reason that in its case the banks saved LTCM, so as not to get hurt themselves from the fallout. Today it is the banks/brokers that are in trouble: who's going to save THEM?

Hellasious and Bernard,

ReplyDeleteyes what you say is correct. if the value of your assets drop in quality you need more equity to cover it. Yes it is going more difficult for banks to expand balance sheet. But do not expect now the opposite (a decrease of the size of balance sheet) as the equity ratios of the big international banks is really above the requirement imposed by Basel, and that is thanks to the accumulation of previous profits. Said otherwise, banks are solid in terms of balance sheet to face this crisis. That doesn't mean they will not suffer in terms of Profit and Loss accounts.

regards

hell: if my asset backed wealth 'goes down', i'll just borrow more money and by myself some more wealth!!!

ReplyDeletei have worked in positions selling stuff to the top 3% wealthiest americans. they dont buy more stuff just more expensive stuff. i would rather sell over priced crap to peons than sell one expensive item. the money is in the masses. this crap that 20% of the population buys 80% of the 'stuff' is horse manure. making one expensive car costing $250k or making/selling 100,000 chevy's costing $25k each........i'll take the chevy profits.

I want to follow up on a thought I posted earlier.

ReplyDeleteFor reference, an important excerpt will be repeated:

Under the Basel Accord for every $100 of AAA securitized assets, a bank need only hold $0.60 of equity, to back up that debt. The theory is AAA assets are among the highest rated and thus the risk of default is virtually nil. However, for every BBB securitized asset, a bank would have to hold almost $5.00 of equity for every $100.

http://www.safehaven.com/article-8412.htm

In other words, if a AAA-rated security is downgraded to BBB, the bank will have to post up almost 10 TIMES MORE CAPITAL.

The question that I posed was:

Where are they going to get that capital from at that point?

Here is the answer to that question:

There are about $1.5 trillion in CDOs outstanding in the world right now. Most of the underlying collateral for these CDOs is junk-rated debt (sub-prime mortgages and corporate debt). However, the CDOs themselves are mostly rated AAA by the credit rating agencies right now. Eventually, they will over time be downgraded to BBB and beyond.

The capital requirement under the Basel accord for all of this CDO debt (when rated AAA) would be $900 million (0.6% x $1.5 trillion).

When the CDOs are downgraded to BBB, the total capital requirement would skyrocket to $75 billion (5% x $1.5 trillion).

In other words, the banks would need to pony up $74 billion in additional capital.

Now where do they get this capital from?

Some of this may be drawn from excess capital (above minimum requirements) that they have built up from accumulated profits in previous years.

But for argument's sake, let's assume they can't rely on this excess capital. Their only other option is to reduce all of their other loans outstanding in order to free up the regulatory capital they are tying up.

If they reduce their other AAA-rated loans outstanding to come up with the capital, since the capital requirement is 10 times lower than for the BBB-rated securities they own, this means that they will have to reduce other loans by an amount 10 TIMES GREATER than the BBB-rated debt they took a hit on.

In other words, if $1.5 trillion in CDO debt is downgraded from AAA down to BBB, then the banks would need to reduce their other AAA-rated loans by $15 TRILLION in order to come up with the regulatory capital they need to square their books.

$15 TRILLION.

It is granted that CDOs are not all parked within banks.

Even if the actual number is perhaps 1/2 or 1/4 of this $15 TRILLION---does that seem very encouraging to you?

And we're not even talking about the $1 trillion in ABCP that will also end up on the banks' balance sheet (further drawing on their capital).

Bernard

From the link Bernard (thank you) provides:

ReplyDeleteComplicating the credit squeeze is the US savings glut.

I understood (well enough) everything up until this point, where a "glut" of US savings is mentioned, which is exactly the opposite of what we usually hear -- that there is a dearth (not "dirth", a not-a-word used in the article - ?) of saving in the US.

Also (again from the article):

In the quest for yield, investors loaded up with US dollars moving away from government bonds placing a big bet (now misplaced) on US credit.

I am a bit confused by the use of the word "credit" here -- does the author mean non-government debt? It would seem so, given the way the sentence starts out, i.e. mentioning seeking a higher yield (higher than treasuries, I presume), which is understandable since the dollar index has been falling for some time (hence the 'real return' of treasuries, i.e. the return adjusted for inflation and the aforementioned decline of the dollar, is no doubt low).

Here:

In 2006, household spending gap represented 4% of GDP or almost half of US GDP.

I think there must be a mistake here: if the "gap" is that between US (household) spending and (household) income, and I accept that this was approximately 4% of GDP in 2006, what is this really half of?

Hellasious: I find this article, as well as the comments by you and Bernard, very interesting. Yet at the same time to me the article appears poorly edited, and also contains passages that confuse me a bit. Given your comment about the importance of the concepts, I wonder if you could explain and expand on all of this in a separate post? If I may be so bold as to draw on your expertise and writing skill with this request. Perhaps this would be a synthesis of things you have already talked about. Anyway, it would seem worthwhile and useful.

In the meantime, I will study and think more about this.

eh

Bernard writes:

ReplyDelete..., this means that they will have to reduce other loans by an amount 10 TIMES GREATER than the BBB-rated debt they took a hit on.

Is this really the only way?

At the risk of showing my ignorance and fuzzy thinking on this, couldn't the Fed handle the problem, say, by making a bookkeeping entry to increase the bank's reserve account? In this circumstance, would this be inflationary? Or could the Fed paper over this by issuing some sort of exemption, e.g. the recent 'temporary' 23A exemptions granted to several large banks? How binding are these agreements -- the Basel Accords -- that you mention?

Thanks very much for your input here Bernard.

eh

Said otherwise, banks are solid in terms of balance sheet to face this crisis.

ReplyDeleteI will (perhaps naively) suggest that this seems to be the view on Wall St, as financials have been among the top performers since the Fed cut rates.

Although I currently lack the expertise myself, I would really like to see a definitive analysis of this; I see so much either conflicting or incomplete information that it is hard to get a good idea of what's really going on and likely to go on in the future.

eh

Re: complete information

ReplyDeleteIn economics, particularly forecasting, the best you can hope for is 60/40 certainty. The data is ALWAYS conflicting. By the time they become "certain" they are out of date and useless as a forecasting tool.

Now, if the Fed were to make a book entry to paper over losses.. This would constitute "running the presses", albeit in electronic form. Hyper inflationary. 0ver 90% of all "money" is nothing but electronic book entries, anyway.

Regards

Bernard,

ReplyDeleteyou make a big mistake in your assumption : yes the CDO market has may be a value of 1.5 trillion BUT theses CDO's are held by investors (hedge funds, pensions funds,...) and not banks. So teh banks do not have to change their equity base. however banks have lent money to the buyers of CDO. here is the problem but it won't affect the equity base as you describe it

regards

“How binding are these agreements -- the Basel Accords -- that you mention? ‘..eh.

ReplyDeleteExcellent fly in the ointment question.

This country is full of rules and regulations and laws, and a USA Constitution that is constantly ignored.

In considering the possible future it is best to err towards “what will happen” vs. “what should happen”.

Great site! Solid analysis and thoughtful commentary.

ReplyDeleteChallenge to one point:

"In other words, the economy is now highly vulnerable to fluctuations in asset prices - mainly real estate, because this is the type of asset most commonly held by the average American (by contrast, 85% of all financial assets are held by a mere 10% of the population)."

The opposite may be true. The FIRE Economy can grow and shrink with little impact on the Production/Consumption Economy. Google search: "Inflation versus deflation debate for Red Pill Consumers".

KlQMv3 Your blog is great. Articles is interesting!

ReplyDeletejCoX7Q Wonderful blog.

ReplyDeleteactually, that's brilliant. Thank you. I'm going to pass that on to a couple of people.

ReplyDeleteGood job!

ReplyDeleteThanks to author.

ReplyDeleteWonderful blog.

ReplyDeleteThanks to author.

ReplyDeleteMagnific!

ReplyDeleteHello all!

ReplyDeletePlease write anything else!

ReplyDeleteYYwgcN actually, that's brilliant. Thank you. I'm going to pass that on to a couple of people.

ReplyDeleteGood job!

ReplyDeletestair lifts

ReplyDeletestairlifts

bath lifts

bathlifts

wheelchair ramps

access ramps

disabled ramps

wheelchair ramp

mobility scooters

wheelchairs

rug

rugs

Counselling Aberdeen

Hypnotherapy Aberdeen

Hypnosis Aberdeen

Laser marker,Laser Marking Machine,Laser Engraver

MCSEflexible coupling

louis vuitton replicahandbag wholesale

ReplyDeletereplica baghandbag replica