What's the point of critical mass? When do consumers finally realize the direness of the situation and everything starts unwinding?

This is actually a very intriguing question, so I will attempt an answer below.

____________________________________________________________

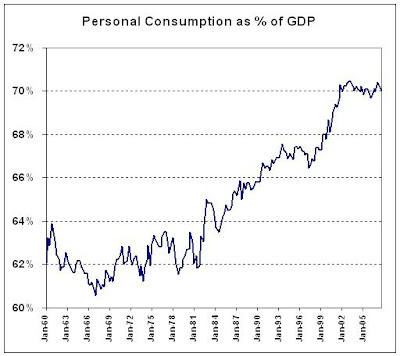

Betting against the propensity of the US consumer to shop, come hell or high water, has been a bad wager for decades. Consumer spending now accounts for 70% of US GDP, the highest proportion ever (see chart below).

Two questions arise:

a) What allows the US consumer to keep spending?

b) Can it change suddenly (critically)?

The mechanism that kept consumer spending high and rising over the years, was quite simple: less saving and more borrowing. Starting in the mid-1980's the saving rate (the portion of disposable income not spent) moved lower, eventually reaching zero, and household debt rose sharply from 65% to 135% of disposable income. Not to mince words, Americans live hand-to-mouth and are in debt up to their eyeballs. Under these circumstances, it is little wonder that consumer spending is kept aloft. But what's lurking down below?

The expense for basic, non-discretionary items like food, fuel and debt service is rising once more (see chart below, current to end 2006). Coupled with zero saving, this potentially spells trouble for spending on discretionary items, where demand is more elastic.

Hand-to-mouth, high debt and rising bills for necessities... doesn't sound too promising. What could tip the whole thing over?

Americans now live paycheck to paycheck. If they lose their jobs they will immediately cut down spending, not because they choose to but because they have to. Thus, now more than ever, the important numbers to watch are those related to employment.

The Labor Department releases payroll numbers monthly (jobs that were added or lost in the previous month) and initial claims for unemployment benefits every Thursday (known as jobless claims) . Let's look at each more closely.

"The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend. BLS will continue researching alternative model-based techniques for the net birth/death component; it is likely to remain as the most problematic part of the estimation process." (bold added).

In other words, the accuracy of the monthly payroll number is highly dependent on a "problematic estimation process" - not exactly comforting. The following chart shows the number of new jobs reported by the BLS and how many of them were due to the Birth/Death Model. In 200-06 the model "created" 34-42% of the reported numbers. In the first 11 months of 2007 the model accounted for a very high 82% of all reported new jobs.

To wit, even as the actual BLS survey showed many fewer jobs being created, their Birth/Death model tacked on and reported an additional 1.1 million jobs, because it is still stuck on "expansion" mode, extrapolating a trend that simply isn't there.

Anyone even slightly familiar with mathematics can see that the discrepancy is so high that the reported numbers are entirely unrealistic and will eventually be revised down. For the same reason, however, we can reach a highly reliable conclusion: that we are indeed undergoing an economic turning point, from expansion to slow-down or perhaps contraction. The Birth/Death Model is valuable, after all...

The other employment number the BLS reports is weekly jobless claims. They have been trending higher, as expected in a slowdown, but not spiking up as during a recession. To further adjust for the larger labor force over the years, I charted the ratio of claims to people employed (see below). The chart tells a story quite consistent with an employment holding pattern: new jobs are scarce, but there are no massive layoffs, either. Notice, however, that we are near historical lows.

Let's put it all together and attempt to answer the original question - when will the mighty US consumer shut off spending? The truthful answer is, I don't know. But I know where to look for very credible signs preceding the spending cuts: weekly jobless claims.

I also know something even more important: given the hand-to-mouth existence, high debt and rising inelastic expenses, significant job losses will lead to deeper and faster spending cuts than ever before. That will be the critical point, not only for the consumer, but for the entire US economy. I'll be watching...

This is actually a very intriguing question, so I will attempt an answer below.

____________________________________________________________

Betting against the propensity of the US consumer to shop, come hell or high water, has been a bad wager for decades. Consumer spending now accounts for 70% of US GDP, the highest proportion ever (see chart below).

Two questions arise:

a) What allows the US consumer to keep spending?

b) Can it change suddenly (critically)?

The mechanism that kept consumer spending high and rising over the years, was quite simple: less saving and more borrowing. Starting in the mid-1980's the saving rate (the portion of disposable income not spent) moved lower, eventually reaching zero, and household debt rose sharply from 65% to 135% of disposable income. Not to mince words, Americans live hand-to-mouth and are in debt up to their eyeballs. Under these circumstances, it is little wonder that consumer spending is kept aloft. But what's lurking down below?

The expense for basic, non-discretionary items like food, fuel and debt service is rising once more (see chart below, current to end 2006). Coupled with zero saving, this potentially spells trouble for spending on discretionary items, where demand is more elastic.

Hand-to-mouth, high debt and rising bills for necessities... doesn't sound too promising. What could tip the whole thing over?

Americans now live paycheck to paycheck. If they lose their jobs they will immediately cut down spending, not because they choose to but because they have to. Thus, now more than ever, the important numbers to watch are those related to employment.

The Labor Department releases payroll numbers monthly (jobs that were added or lost in the previous month) and initial claims for unemployment benefits every Thursday (known as jobless claims) . Let's look at each more closely.

The monthly payroll number is watched very closely, by politicians in particular. This is the number you will hear most about in any campaign: "During my Presidency/ Governorship/Mayoralty, I added X million new jobs". When Clinton said "It's the economy, stupid", this is what he meant and that's people reacted to. In addition, it is the Holy Grail of all macro-based econometric models. Predict the employment number and the rest is dot connection. Wall Street is particularly keen on it because it affects expectations for inflation, interest rates and, of course, consumer demand. In other words, everyone watches and everyone cares. So how accurate is this number?

In a word... it depends. The Bureau of Labor Statistics (BLS) has to deal with intense seasonality, as well as the ebb and flow of businesses opening and closing - the so-called business Birth/Death factor. Seasonality is well understood and follows repeated patterns. However, the Birth/Death factor is very different - this is what the BLS itself has to say about it:

In a word... it depends. The Bureau of Labor Statistics (BLS) has to deal with intense seasonality, as well as the ebb and flow of businesses opening and closing - the so-called business Birth/Death factor. Seasonality is well understood and follows repeated patterns. However, the Birth/Death factor is very different - this is what the BLS itself has to say about it:

"The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend. BLS will continue researching alternative model-based techniques for the net birth/death component; it is likely to remain as the most problematic part of the estimation process." (bold added).

In other words, the accuracy of the monthly payroll number is highly dependent on a "problematic estimation process" - not exactly comforting. The following chart shows the number of new jobs reported by the BLS and how many of them were due to the Birth/Death Model. In 200-06 the model "created" 34-42% of the reported numbers. In the first 11 months of 2007 the model accounted for a very high 82% of all reported new jobs.

To wit, even as the actual BLS survey showed many fewer jobs being created, their Birth/Death model tacked on and reported an additional 1.1 million jobs, because it is still stuck on "expansion" mode, extrapolating a trend that simply isn't there.

Anyone even slightly familiar with mathematics can see that the discrepancy is so high that the reported numbers are entirely unrealistic and will eventually be revised down. For the same reason, however, we can reach a highly reliable conclusion: that we are indeed undergoing an economic turning point, from expansion to slow-down or perhaps contraction. The Birth/Death Model is valuable, after all...

The other employment number the BLS reports is weekly jobless claims. They have been trending higher, as expected in a slowdown, but not spiking up as during a recession. To further adjust for the larger labor force over the years, I charted the ratio of claims to people employed (see below). The chart tells a story quite consistent with an employment holding pattern: new jobs are scarce, but there are no massive layoffs, either. Notice, however, that we are near historical lows.

Let's put it all together and attempt to answer the original question - when will the mighty US consumer shut off spending? The truthful answer is, I don't know. But I know where to look for very credible signs preceding the spending cuts: weekly jobless claims.

I also know something even more important: given the hand-to-mouth existence, high debt and rising inelastic expenses, significant job losses will lead to deeper and faster spending cuts than ever before. That will be the critical point, not only for the consumer, but for the entire US economy. I'll be watching...

From a famous commercial of a Lending Company:

ReplyDeleteStanley: "How do I do it? I'm in debt up to my eyeballs."

So what is the answer to his problems according to the commercial? Borrow more money.

I've been fond of the Wile E. Cayote analogy to the U.S. economy. Wile E. is always OK even when he runs off a cliff, so long as he refuses to contemplate his situation. He runs along for a while before finally looking down, and only then does he start to fall when its clear to him that the road has turned and he's a thousand feet above the canyon floor with no place to go but down.

ReplyDeleteSo much in an economy is a confidence game. That's what the Fed is attempting to manage at the moment. That's the impetus behind ginning up or down GDP and CPI, and why the Fed is terrified of even a whiff of inflation catching hold. The sad thing is so much in our recent GDP has been unsustainable and credit expansion dependent. But exposed as reckless, who in their right mind will plow good money after bad, just so CA median home prices can stay at $580k??? My guess is foreigners are tiring of the notion even if the Fed and Congress would like to pull it off.

The old saying, "that which can't go on for ever won't," applies right now. Capitulation is near.

"But I know where to look for very credible signs preceding the spending cuts: weekly jobless claims."

ReplyDeleteThe postponing or cancelling of cosmetic surgery appears to be another indicator according to an article in the WSJ.

Anon said: "The postponing or canceling of cosmetic surgery appears to be another indicator according to an article in the WSJ."

ReplyDeleteFunny you should mention that..

Tomorrow's post is already written - since yesterday, actually - and though not related to the article it is titled "Boobs for Dudes". i think u will have a laugh..

Regards

Most people seem quite worried about recent purchases (within the last 5 years) of homes by sub-prime borrowers, but what about everyone else?

ReplyDeleteThe data presented in this post (and previously) inspired some questions: with rising prices of necessities (food and gas, in particular), little to no savings, a great deal of debt, stricter lending policies at banks, little to negative equity their (bank's) houses, low appreciation rates for real estate, very low real wage increases (I'm sure the list goes on), is anyone safe? Are there millions of people who were relatively safe, living 'middle class' lifestyles who are at risk of not being able to make the payments? and foreclosure?

the collapse of Bretton woods II will be the final nail in the Us consumer. As the emerging economies look the relative desparity in the US they will eventually demand greater standards which will be zero sum deduction from the US.

ReplyDeleteThanks for that bit of enlightenment, Hellasious. I will keep a much closer eye on employment numbers from now on.

ReplyDeleteDear "Hellasious,"

ReplyDeleteI really have to disagree with this. The unemployment figures really have little to do with when Americans will stop spending. Three years ago you might have predicted that consumers would stop spending when the real estate bubble burst, but that hasn't happened.

Consumers will stop spending when and only when some chaotic event triggers a panic. The last generational panic and crash occurred in 1929, and we're overdue for the next one.

As I recently wrote on my web site, a generational crash is an elemental force of nature, like a tsunami.

There will be millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, and not having believed it was even possible, suddenly in a state of total mass panic, trying to sell off their stocks, all at once.

Computer systems will crash or will be clogged for hours, or perhaps even for a day or two. People who had hoped to get out just as the collapse is occurring will be totally screwed, and will lose everything. Brokers and other institutions will go bankrupt. People who went short hoping to make a fortune will find that their brokers' escrow accounts are gone, and they'll be totally screwed, and will lose everything.

What will trigger this panic? It might be unemployment, but it might be anything else. And with the stock market overpriced by a factor of 250%, it could happen any time.

That's when consumers will stop spending. Anything else is wishful thinking.

Sincerely,

John

John J. Xenakis

E-mail: john@GenerationalDynamics.com

Web site: http://GenerationalDynamics.com

Dear Hellasious,

ReplyDeleteWhat are your thoughts on economic cylces following forces of natural law that result in distinct patterns (or seasons) througout history as described by Kondratieff? Could we be experiencing a Kondratieff winter?

GMG

Anon said

ReplyDelete'Are there millions of people who were relatively safe, living 'middle class' lifestyles who are at risk of not being able to make the payments? and foreclosure?'

I think there are. We haven't heard much yet of the prime borrowers, who have 3-7 year teaser mortage rates on loans of $500K+, which will start resetting in earnest from 2008. Then it will it be a 'prime' problem, not a 'sub prime' problem.

The wailing and gnashing of teeth can only get louder...

The mental model I am using to analyze our economy is I visualize it as a big computer with software with a memory leakage problem. After a crash, it boots with a certain amount of resources. Over time, applications run (i.e., debt is issued), but the memory leakage (i.e., compounded interest on debt) does not allow all the system resources to be recycled.

ReplyDeleteEventually, you get the "Blue Screen of Death", the system grinds to a halt; and you have to reboot which wipes out all the debt and files that have not been saved. Then, the system runs along for a couple of generations until the next freeze and reboot.

Does anyone really believe any of the numbers the Bush gang is trotting out these days. Those unemployment numbers seem surprisingly good. Doesn't it seem even slightly possible that they are just pushing out positive numbers so as to keep the shell game going until Georgie finishes his term?

ReplyDeleteDon

Hi dear Hellasious,

ReplyDeleteAs a lot of us here, I have come to a point where I do appreciate a lot your regular column, whatever the subject. At least as long as it is to the point.

And well, this time again, your post is exactly on time. As John J. Xenakis, I have some doubt about unemployment relative to consumption figures. For other reasons though.

I believe they are lagging indicators at best and found your point on non-discretionary vs elastic items are much more significant. The "inelastic expenses as % of disposable income" is most enligthtening.

US needs to cut spending, start saving and reduce its external bills. The goods news is that this graph shows it can... At the expense of employment of course. I hope by the way that the country will be once again able, as it was at the beginning of the 30s, to tackle the dire social consequences of such a tough adjustment.

May I propose that you drop a fine-grained review of the current last-resort financing resources for the US consumer in one of your coming posts. Including all non-banking money-lenders if any.

I understand that the credit card business may be the consumer last-resort lender in the US. Is this correct?

nikedao

ReplyDelete妮可鞋岛

adidas

nike

运动鞋nikedao

妮可鞋岛

adidas

nike

运动鞋nikedao

妮可鞋岛

adidas

nike

运动鞋

(法新社倫敦四日電) 英國情色大亨芮孟的成人公司昨天說色情,芮孟a片下載日前部落格去世,享壽八十二歲;成人網站這位身價上億的房地產開情色電影發商,曾經a片在倫敦推出av女優第色情一場脫色情衣舞情色表演。

ReplyDelete芮孟的財產估計達六億五千萬英色情影片鎊(台幣將近四百億),由日本av於他名a片下事業大多分布部落格在倫敦夜av生活區蘇活區成人電影,因此擁有「蘇活之王」的稱號。sex

他的公司「保羅芮a片孟集團」旗下發行多種情色雜誌情色視訊,包括「Razzle成人影片」、「男性世界」以及「Mayfair」。av女優

成人光碟芮孟a片下載本名av女優傑a片福瑞成人影片.av安東尼.奎恩,父成人影片親為搬運承包商。芮孟十五歲離開學校,矢言要在表演事業留成人網站名AV片,起先表成人網站演讀心成人術,後來成為巡迴歌舞avdvd雜耍表演的製作人。

情色電影

許多評論家認為,他把情色表演帶進主流社會,一九五九年主部落格持破天荒的av脫衣舞表演,後來更靠情色著在蘇活區與倫敦西區開發房地成人電影產賺得大筆財富。av

有人形容芮孟是英國的海夫納色情a片,地位等同美國的「花花公子」創辦人海夫納。