Continued from yesterday's post...

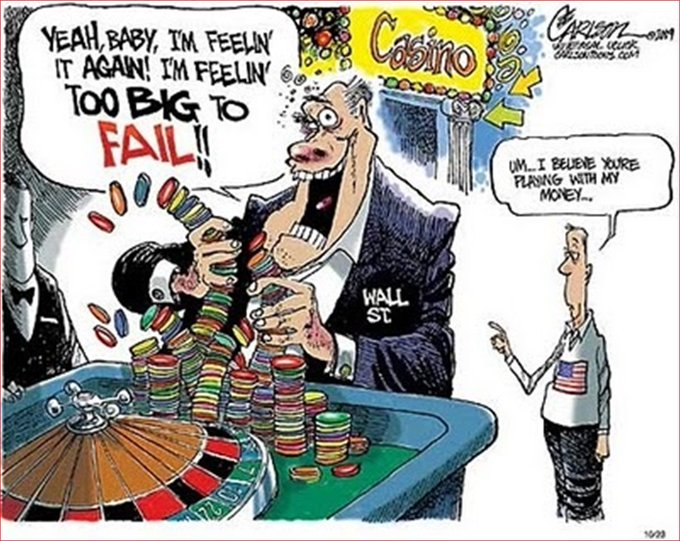

Equity markets in the US have become narrow, shallow and very volatile. Furthermore, they are highly and dangerously dependent on government/Fed liquidity. Therefore, they are inefficient and can no longer operate as efficient "clearers" for the productive allocation of capital. They are now more like a casino, and pose a threat to themselves, the public and the economy.

How do we fix them? Here are my suggestions:

- Sharply reduce high frequency trading (aka "flash" trading). The easiest way is to impose a very small transaction tax on each trade, say 0.1%-0.2%.

- Ban payments for trade flow. Right now large firms (eg Citadel) pay for executing other brokers' trades because they can profit from arbitrage,

- Ban commission-free trading, at least for retail investors. This may happen anyway if (2) is enacted.

- Ban CFDs and spread betting on all listed and unlisted financial instruments, worldwide.

- Ban all "dark" and "grey" off-exchange equity markets. Easiest way would be to deem any trade done there as legally null and void. Clearers will immediately refuse to clear such trades.

- Increase margin requirements for equity derivatives.

- Ban "naked" short selling, re-impose the "uptick" rule on short sales.

- Rethink the wholesale automation of trade execution. The total elimination of the "friction" created by people handling trades results in a very "slippery" market environment, one prone to high volatility.

- Wean markets from their dependency on Treasury/Fed liquidity. This is not easy, as money is like water - it will always find a way to flow through the tiniest crack. Perhaps a first step is to stop the Fed buying any corporate securities, domestically and abroad.

I don't have a suggestion for a fix on this situation, maybe a first step would be a moratorium for all new issues, which reached an all time high of $66 billion in January. There were 19 new ETFs launched in the first 19 days of 2021 alone.

I will be doing more research on ETFs and SPACs (special purpose acquisition corporations) over the next few days.

Let's leave the seriousness aside and have some fun ..... =)

ReplyDeleteI'll venture a guess that over the short to medium term (one to two year time span), there will be a major correction... 20-30% or more....

Over the long term.... 10 year time frame, I bet that we will print the current currency into oblivion.....

Indeed, let’s have some fun 🤩 ... the mean ratio of total market cap to GPD over 40 years in 0.80. Today it is at 1.90.

ReplyDeleteA “correction” back to the mean produces a drop of..almost 60%... if it goes below the mean, as it often does the drop could be even bigger. Fun... 😱😱

And still on a tear... new all time high today. Priced for perfection and no post-pandemic competitors left standing.

ReplyDelete