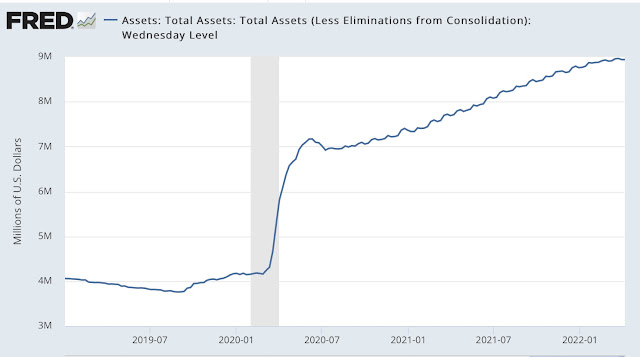

The Fed has all but officially announced that it will soon start shrinking its bloated balance sheet by approx. $90 billion per month. And rightly so given the explosive inflation we are experiencing. After all, inflation is a monetary issue: explosive money printing ALWAYS results in explosive inflation.

The Fed Created $3 Trillion In Mere Months….

..And Inflation Soared A Few Months Later

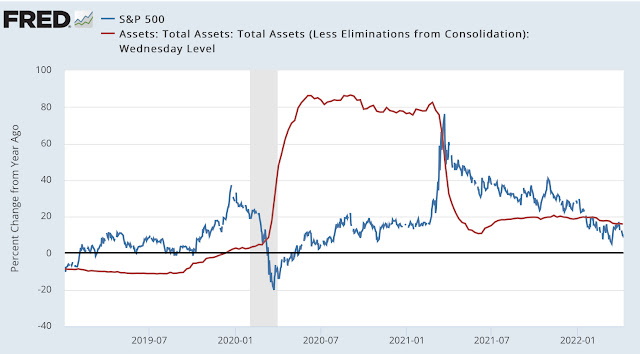

The money flood has found its way into every nook and cranny of the economy, from auto prices to looney “assets” like meme stocks and NFTs. And, of course, into plain vanilla assets like the S&P 500: print money ==> stocks go up.

Explosive Money Creation Resulted In Explosive Stock Prices

The chart above shows the yoy money growth (red line) and yoy change in S&P 500 (blue line): the correlation is obvious. Now, if the Fed actually does go into a Quantitative Tightening mode (QT) by selling bonds outright from its portfolio in order to shrink its balance sheet, the red line will move below zero. Will asset prices follow? IMHO, yes.

Stay tuned, and carry a big parachute!

No comments:

Post a Comment