The Fed raised rates by 75 basis points yesterday (0.75%), and the media focused on it being the "biggest increase since 1994". Sounds like the Fed is really fighting inflation, right? I think some perspective is necessary, before we start applauding...

As always, a picture is worth a thousand words:

You will be excused if you can't quite see the Fed Funds line today, because it has barely budged from the bottom, despite that "biggest increase since 1994" (ok, it should be a smidgeon higher at 1.50-1.75%). But, ok, the market is already discounting a couple more rate hikes, to about 3.50% - that's the green line, the yield on the 2-year Treasury, often used as a proxy for where Fed Funds will be in 12 months.

Last time inflation was at today's levels, Fed Funds and the 2-year were both at around 8%. Can it happen again? Well, unless inflation cools off immediately to 5% or less I can't see how we can avoid it. Thus, the trillion(s) dollar question is, will inflation cool off immediately to 5% or less? Honestly, I cannot see how it can happen, without persistent quantitative tightening (QT) and a significant, demand-destroying recession.

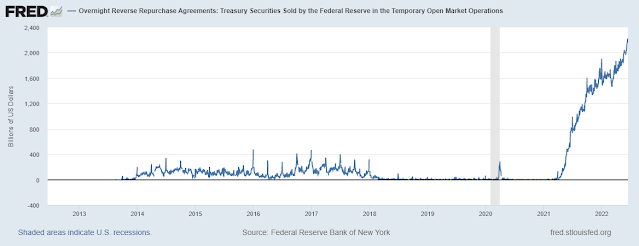

Banks and large institutional investors, ie those who have access to the Fed's reverse repo facility (an overnight deposit to the Fed collateralized with Treasurys), are voting loudly with their money. The reverse repo amount now stands at $2.16 trillion, a new record, as money seeks the safest haven possible from credit and interest rate risk.

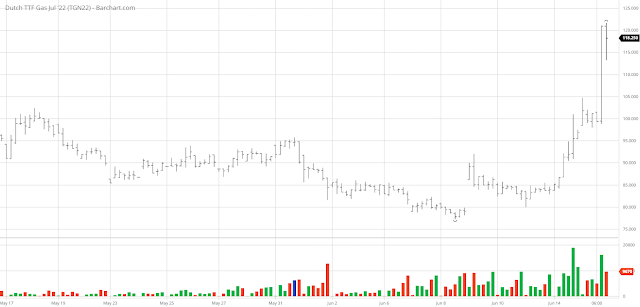

===> And just as an aside, European Natural Gas prices soared to 118 yesterday, up from 85 a couple of days ago, as Russia announced it will cut deliveries through the Nordstream pipeline by 30% "to repair compressors". Prices were at 18-19 a year ago. No, I don't think inflation is going away any time soon.

not related, I know...

ReplyDeletehttps://en.wikipedia.org/wiki/Mortality_rate#:~:text=As%20of%202020%2C%20the%20CIA,will%20be%207.7%20per%201%2C000.

U.S. crude death rate will be 8.3 per 1,000, while it estimates that the global rate will be 7.7 per 1,000.[3]

i just thought it startling that U.S. death rate is higher than the global average.... I mean, most of the world is not developed...

ReplyDeleteStatistics are the easiest way to confuse an issue :) The rest of the world is very very young... need I say more?

ReplyDeleteI dunno... U.S. average age is 38.1... china average age is 38.4... U.S. crude death rate is 8.3... China crude death rate is 7.41...

DeleteI would say the rest of the world is kinda young because the old people die off really fast?... which should affect the crude death rate negatively...

DeleteIndia, median age 28.7… case closed 😊😊

Delete???

Deleteexactly... India's crude death rate is also 7.3.... a 7.3-7.4 seems normal in semi-developed countries....and has little to do with median age.... I mean within reasonable limits... (Japan is not a reasonable limit).......

and India and China's health care is terrible... to put it mildly....

For a developed Asian country...

Singapore (average age: 42.23), (Crude death rate: 4.78)

Korea (average age: 43.7), (Crude death rate: 6.4)

I am wondering what the U.S. (and many other western countries) is doing to get such a high death rate...

or to put it in another way.... I agree that the baby boomers cause a demographic bulge which means a country will sooner or later have a spectacularly high crude death rate... however, that should be happening much later... and is not yet witnessed in places like Singapore and Korea, whose bulge is ahead of the U.S.... and not yet witnessed in places like China, whose bulge is the same as the U.S.

DeleteI would say something else is affecting U.S. crude death rates.... and it is quite a lot... it is almost 50-100% higher than what you get in developed Asia...

From the World Bank:

Delete"The crude mortality rate is a good indicator of the general health status of a geographic area or population. The crude death rate is not appropriate for comparison of different populations or areas with large differences in age-distributions. Higher crude death rates can be found in some developed countries, despite high life expectancy, because typically these countries have a much higher proportion of older people, due to lower recent birth rates and lower age-specific mortality rates."

sighzz... I am over compensating in favour of the U.S. ... comparison is with places with older populations but same development... or places with lower development but same age populations.... which I would argue over compensates for any such phenomenon....

Deleteand the crude death rates in the western countries is really remarkably high... I somewhat don't buy the hand-waving that it is not comparable... if so, there has to be a why... like I said... I am over compensating in U.S. favour... and it is still lagging by a significant margin....