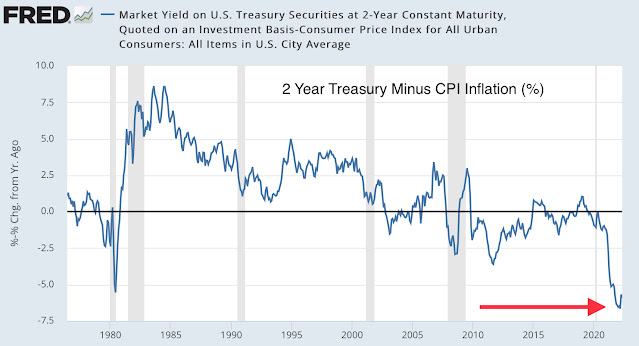

Sometimes a single picture (or two) can fully answer the two questions currently on everyone’s mind:

- How far behind the tightening curve is the Fed? - VERY

- Can it really engineer a soft landing? - NOT BLOODY LIKELY

Here is the proof, in one picture.

The difference between 2-year Treasury yield and CPI inflation is at a 42 year negative record low (red arrow). I’m using the 2-year Treasury yield as a proxy for where the market believes Fed Funds will be by the end of 2023 (approx. 3%, up from 1% today), if it keeps the current schedule of tightening.

So, the chart tells us that:

- There needs to be much more tightening to bring real rates back to normal, ie the Fed is very far behind the curve and,

- So much extra tightening will inevitably result in a recession, ie a hard landing. For comparison, look at 1980.

As for quantitative tightening (QT), the Fed hasn’t even started yet. The second picture shows that Fed’s balance sheet assets (Treasury and mortgage bonds) are at 36% of GDP, the highest ever. This translates to $9 trillion of excess liquidity pumped into the economy which needs to be removed, at least partly, if inflation is to be tamed. The Fed has indicated it is willing to start by removing about $90 billion/month, or 1% of the excess every month. It will help fight inflation, but not by very much - significantly more needs to be removed.

So, two charts, same answers: the Fed is very far behind the curve and needs to be very aggressive to fight inflation, resulting in recession. Does it have the guts to do so, as Volcker did 40 years ago? I doubt it, but let’s give Powell the benefit of the doubt 😜

PS To be clear: the Fed needs to remove an amount equal to approx 12% of GDP in liquidity from the system. The faster, the better - but don’t hold your breath, you will suffocate waiting.

The song title is "your answer"

ReplyDeletehttps://www.youtube.com/watch?v=n6im9cLaCIg

https://www.youtube.com/watch?v=HME86NWvbJM

ReplyDeletewith subtitles

“Accept all the taunts” 🎶🎶🎶

ReplyDeleteErrrrrmmmm … not bloody likely 🤣

may you never have to do otherwise my friend... =)

DeleteHow can someone prepare for coming recession? Asking as a recent college graduate that doesn’t want to be crushed by this whole thing. Been reading this blog for 2 weeks now. More insightful than my economics professor.

ReplyDeleteBy H. - thank you very much for your kind comments!

DeleteHow to prepare… get a good job in a productive sector of the economy (avoid finance if possible) and limit spending to necessities plus a bit more. Save as much as you can, invest wisely for the long term, do not trade in and out of investments. Invest in what you know, this will give you an edge in choosing your investments. Still, right now most broad portfolio choices (stocks, bonds, commodities, real estate) are essentially un-investable. Cash (ie a “savings” account) is probably best at the moment.

Above all, enjoy your life and invest in yourself!! Good luck!!

just add a bit... your life is probably going to be very hard.... it is what it is... play the long game... there is hope yet for your children and your children's children...

DeletePS … addition: think and act out of the box. Do your research and dare to be innovative, don’t be afraid to fail, learn from mistakes and don’t repeat them. Dream BIG.

Delete