The UK has made an unholy mess of things. The Boris-Brexit nonsense, the inept handling of COVID and now the Truss unfunded tax cuts which collapsed the gilt market and brought most pension funds to within a hair of going under (via LDI leverage). In my 40 year career in financial markets I have never seen sovereign debt of a major G7 nation collapse as fast and spectacularly as UK's gilts.

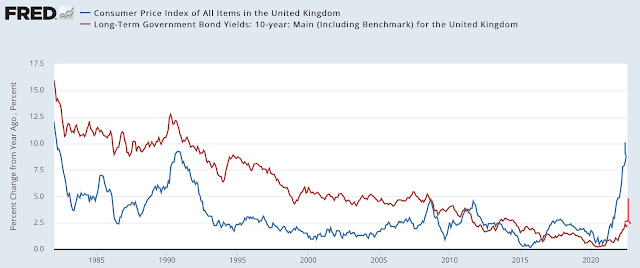

I am afraid that we are witnessing only the opening act of this drama. Even at current sharply higher yields, gilt returns are still far below inflation - see chart below. If you are a buy and hold fundamental investor (say, an insurance company) would you buy right now at negative real interest rates when national politics are cratering? Or would you unload the stuff from your portfolio and stay away for a while? At the very least, you will not invest more.

Black Swan Warning: has anyone modeled the UK going bankrupt? Because gilt prices dropping off a cliff sure points that way. And I don’t think the IMF has enough money for a rescue of this size, this time around.

UK 10 Year Gilt Yield (red) And Inflation (blue)

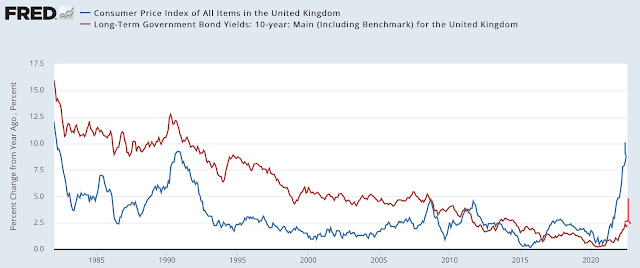

Speaking of Black Swans: what’s the fundamental difference, if any, between the chart above and the chart below?

US 10Year Treasury Yield (red) And Inflation (blue)

Right now a US bankruptcy is entirely unimaginable, of course. Then again, so was a UK one just 3 months ago and look at it now: the UK Credit Default Swap has zoomed from 10bp to 43bp, a reading that puts its imputed probability of default at 0.72%, just a touch below Portugal’s. Moreover, Fitch just reduced its credit rating outlook to negative, meaning the AA- rating is likely to be downgraded to A+ shortly. Not good.

UK 5 Year Credit Default Swap

With so much global debt created in the last 10-15 years, even a hint of fiscal impropriety results in an immediate and disproportionately large straw/camelback effect. “Basically we've moved from looking not too dissimilar from the U.S. or Germany as a proposition to lend, to looking more like Italy and Greece," former Bank of England Deputy Governor Charlie Bean told Sky. And within days, I might add - see chart below.

UK 10Y Gilt Yield Zooms To Near Italian And Greek Levels

Can the US be the next black swan? As the world’s largest economy, the US has traditionally been the global safe haven; but what if it loses that advantage? Events that were once considered unthinkable in America have already happened: a sitting President rejects election results, claims fraud and prompts his loony followers to storm Congress in a thinly veiled attempted coup. A far right Supreme Court bans abortions and rejects a ban on semi-automatic weapons. The next President, the oldest ever to assume office, ignominiously pulls out of Afghanistan in a haphazard, disorganized fashion and hands the country back to the Taliban. And more...

The UK mess is very instructive and should act as a warning to anyone planning unfunded giveaways and tax cuts on the other side of the Atlantic. We really don't want black swans flying West.

Posted by M. Burry on Twitter recently, very interesting. Re: black swans ahead...

ReplyDeletehttps://themarket.ch/interview/russell-napier-the-world-will-experience-a-capex-boom-ld.7606

This also could be huge...

ReplyDelete"Lots of people don’t know what happened yesterday.

To put it simply, Biden has forced all Americans working in China to pick between quitting their jobs and losing American citizenship."

https://twitter.com/jordanschnyc/status/1580889341265469440?t=e2xWsLc1bA-phmXeVWloUg&s=19

Thank you for the news C. Indeed, this can have a very major impact on the global economy. America is starting to look inward again, after decades of neglecting the strategic importance of domestic manufacturing. But, it may be way too late.

Delete"Every American executive and engineer working in China’s semiconductor manufacturing industry resigned yesterday, paralyzing Chinese manufacturing overnight.

ReplyDeleteOne round of sanctions from Biden did more damage than all four years of performative sanctioning under Trump."

https://www.youtube.com/watch?v=NiwROYqJ1E8

ReplyDeleteTalking about new world orders:

ReplyDeletehttps://www.politico.com/news/magazine/2022/10/17/fiona-hill-putin-war-00061894

I have the feeling that a new world order is definitely evolving, and much faster than people appreciate. There seems to be a denial/disregard of the dangers involved in this shift, be it China's slowly evolving bid for global hegemony or Russia's war. Markets, in particular, have most definitely not priced in the risk of something going seriously wrong in this process, which I now place at least at 30%.

DeleteAmerica's sole superpower status is finished, yet its thinking on monetary and fiscal policies is still set as if it is the year 2000. I know that it is extremely hard for Americans, low and high, to accept they are no longer the only rooster in the coop, but the sooner they do and bend accordingly to the winds of change, the lesser the chance that they will be blown away violently.

aye... there is an enormous risk of confrontation.... especially as the politicians on both sides are using the other as a bogey man to cover up their own problems...

ReplyDelete