One of these days the Fed will openly admit that high inflation was caused by the massive creation of money in 2020-21. It may then also admit that keeping all this extra cash sloshing around is keeping inflation high (duh).

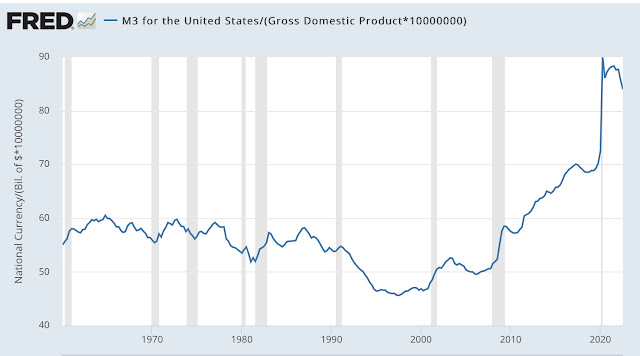

Here’s a chart of M3 as a percentage of GDP: lots more money chasing goods and services that are growing at a slower rate than money is going to result in …drumroll…. Lots of inflation. Pretty obvious, right?

M3 Money Supply - Percentage Of GDP

In dollar terms, during 2020-21 the Fed created a massive extra $7 trillion - and most of it is still on its own balance sheet, which expanded from $4 trillion to $9 trillion in the same time. Clearly, the Fed needs to get rid of all - or most - of this extra cash in order to tame inflation. It is currently engaging in quantitative tightening (QT) at a maximum of $95 billion per month, a pace that will take 50 months to shrink its balance sheet back to 2019 levels. Can and should it speed up the pace? Yes it can, and yes it should.

Wait a minute, you say. Won’t withdrawing all this extra liquidity damage the economy? No, it won’t because lots of this extra cash isn’t being put to productive use. Instead, it just sits as overnight reverse repo with the Fed (O/N RR), ie banks and money market funds are parking it. The amount of O/N RR is currently at $2.1 trillion (chart below), and the Fed pays 4.30% or $95 billion per year, to borrow this money back from those it issued it to. Nuts.

Fed O/N Reverse Repo At $2.1 Trillion

So, what is the Fed waiting for? Why isn’t it draining this inflation-producing liquidity lake as fast as it can? What is it afraid of? I don’t have a definitive answer, but I think the Fed is concerned that it will cause a liquidity crunch and precipitate a stock market crash.

Sure, that’s a possibility. But letting inflation continue largely unchecked will soon create a much more ominous problem: the distinct possibility that bond interest rates will rise unchecked and result in a vicious cycle that ends in sovereign bankruptcy.

For now, the path is clear: drain away at least $2 trillion as soon as possible and stay the course on increasing interest rates.

I think you underestimate the impact of the excess liquidity on the economy. The Fed "determines' short term rates but not long term rates. The excess liquidity is currently holding down LT rates. If the excess liquidity is drained too quickly, it will drive LT rates significantly higher. It will create the same situation as UK faced just a few months ago. It will also tank the housing market. That would qualify as a severe, if not catastrophic, economic damage. No?

ReplyDeleteBy H.

DeleteThanks for the comment!

My concern is that unless inflation comes down well below current long bond yields, investors and traders will start revising their future inflationary expectations upwards and thus raise yields in the secondary bond market. Ditto for labor costs/salary demands, where strikes are now becoming more common, particularly in Europe.

I agree that raising borrowing costs is damaging for the economy, I’m already experiencing this in my day to day functions as borrowing costs rise. But, higher prices are worse - much worse, in fact. I am currently experiencing a spike in prices for our necessary capital goods so great that it makes investing in new equipment absolutely prohibitive, we will not be able to profitably recoup the investment. Same holds for the housing market: spiking prices there are actually driving inflation higher and MUST come down, shelter is by far the largest component of CPI (32%).

As for UK gilts, the market tanked for two reasons coming together to create the perfect storm: an announcement for huge unfunded tax cuts, coupled with highly margined derivatives positions going underwater and demanding more collateral. Folly coupled with greed, basically.

It's because the money has been lent to governments, that have spent the money.

DeleteSo pull the liquidity, and governments have to pay it back. How do they pay it back? Same as always, make the plebs poorer with more tax, less services. ie. Force austerity on others.

Thanks for your reply. I agree with you that inflation is a huge problem. But I am still not convinced there is an easy solution here. Whatever the Fed attempts, something big will likely break. Always appreciate your insight!

DeleteThanks again A. There are no easy solutions to major problems, unfortunately. I totally agree, something will probably break no matter what the Fed/Treasury does. I am certain there is no "soft landing" possible here if inflation is to be killed. The Fed/Treasury do not want to be blamed for a recession, so they are using their inflation fighting weapons at "single shot" mode instead of automatic. I believe this to be a mistake and that inflation must be killed ASAP, even at the cost of a recession.

DeleteAllow me another "weapons" comment: generals almost always prepare for future wars by using lessons and strategies used in previous wars. For example, static trench warfare in WWI caused France to build better trenches afterwards, ie the Maginot Line - and then came the Germans in 1940 and did the unthinkable by attacking in a mechanized blitzkrieg through the Ardennes, completely sidestepping the Maginot Line.

DeleteLikewise, today's Fed is focusing almost entirely on interest rates, fighting the inflation war of the 1970-80s instead of combating today's problem, which is excess liquidity of enormous proportions.

While the Fed SEEMS to be somewhat successful in easing headline inflation, it is a mirage created by one item only: energy. Dig deeper into the data and things get ugly, with price and wage rises on everything else remaining stubbornly high.

Going back to "weapons": excess liquidity is inflation's major weapon. If we don't disarm it, it will continue to beat us and eventually win the war.

hi Hell,

Deletelove your writing... very sharply argued. I am largely in agreement with you, though I would use different words.

Current interest rates are too far below inflation, creating a huge subsidy for borrowers. If this persists it will create bubbles everywhere because people could borrow and invest in anything stupid and still make money. This in turn would create ever higher inflation that would encourage ever more borrowing... remember the casino economy of the past few years?

From that perspective, it is important for the Fed to show that the casino economy is ended.. or in slogan terms... the Fed must not stop until Elon Musk is a bankrupt...

Thank you for the kind words AKOC. I don't think high inflation AND low interest rates will persist for much longer. Bond investors are not fools, they will just go on a buying strike. The secondary bond market is already showing some very troubling signs, eg lower liquidity. If/when the bond market loses its patience... watch out because the 10 year Treasury yield will go ballistic.

DeleteThe US simply cannot afford to borrow at much higher rates, thus something must be done before it's too late: inflation must be killed AND Congress must reduce budget deficits. Both need to happen concurrently and they need to happen fast.

Will the Fed/Congress act as needed? I don't know...

hmmm... bond investors have been on strike for quite some time... ( Chinese holdings of US bonds has been flat for ten years, despite a huge trade surplus).... its only apparent now that the Fed has stopped QE...

Deleteif we rule out higher interest rates ... I think the most likely solution will be more QE... will be nice if congress did something, but it sure don't look like it....