The Japanese business establishment just got a shock: Fast Retailing Co. Ltd announced salary increases as high as 40% for its employees at retailer Uniqlo. After decades of stagnating wages, Japan's employers must now contend with a combination of sharply rising cost of living and a shrinking labor pool (sound familiar, USA?).

With 130.000 employees, Fast Retailing is a veritable giant, and its outsized wage hikes will certainly affect employment and salary patterns across the entire nation. Keep in mind, Japan is the world's third largest economy (it is sometimes easy to forget that!), so what is going on there has global significance.

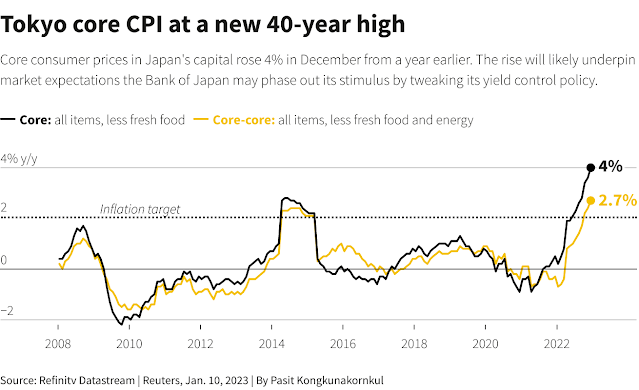

Inflation is now a real concern for the Japanese. Just look at what is happening in Tokyo, considered a major indicator for the country as a whole (see chart below).

The Bank of Japan is definitely concerned. It recently raised the interest rate band for 10-year JGBs to 0.50% driving rates to the highest in 8 years (see chart below). Though BOJ was quick to deny it is abandoning its super easy monetary policy, actions speak louder than words.

Here's my bottom line thought: If even Japan is now on the inflation bandwagon, then the world has turned 180 degrees from deflation/easy money to inflation/tight money. The implication for financial markets going forward long term is profound - never mind the short term back-and-forth imbedded in CPI, etc announcements - that's just so much noise.

We have entered a New Era: there will not be any more QE's, interest rates are not going back to zero, equity valuations (P/E's mostly) will be adjusted lower, government budgets will increasingly reflect a new reality. Massive deficits will no longer be tolerated (as the UK snafu showed us a couple months ago) and if governments try to go that way they will be immediately punished.

Japan is showing us the way.

No comments:

Post a Comment