The debt limit is almost upon us - yet again. Lots of hot air will be expelled by Republicans and Democrats alike, but they both ultimately ignore the fundamental problem: the US is under a tremendous debt burden and it should not be increased any further. In other words, in extremis, I am all for NOT raising the debt limit.

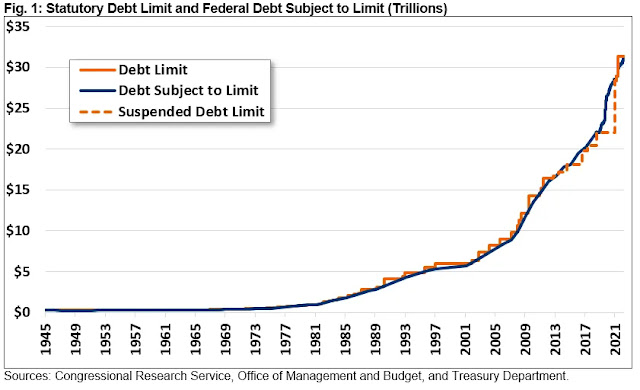

The chart below shows how the debt/debt limit has exploded upwards, particularly in the last 5 years or so, rising almost vertically.

Perhaps the threat of a debt default will bring Congress and the White House to their senses and - finally - agree on a sane fiscal policy that erases the soaring budget deficit by cutting spending AND raising taxes.

Here are some ideas on the latter:

- Impose a national sales tax

- Raise gasoline/diesel fuel taxes by $1/gallon

- Raise corporate taxes

- ... and here's a really radical one: tax capital gains as regular income, from all sources

Tax increase will only enable deficit spending. Taxes as a percentage of GDP has held pretty steady since 1950s. OTOH, federal net outlays as a percentage of GDP has been increasing steadily, especially in the last 3 years. We need to address deficit spending as a priority. Tax increase should only be the last resort.

ReplyDeleteFederal Net Outlays as Percent of Gross Domestic Product

https://fred.stlouisfed.org/series/FYONGDA188S

Federal Receipts as Percent of Gross Domestic Product

https://fred.stlouisfed.org/series/FYFRGDA188S

Btw, your suggestions for tax increase will eventually bring us to the level of European taxation. I don't think it has worked out well for Europe (compared to the US.)

DeleteI agree with you; the answer is not to raise taxes, it is to cut spending.. especially the loss to corruption.

DeleteSome possible mechanics:

1) Military procurement: Stop putting underpaid Colonels in charge. The person in charge should be well paid, maybe a million a year, but will be held personally accountable for cost overruns, inefficiency.

2) Research: Cut the research mandate of all universities and their funding. Set up research institutes with the mandate to do actual research, not publish papers.

3) Health insurance: By default, government will foot 80% of the bill, the patient will foot 20%... It discourages wasteful spending, while ensuring most have access to healthcare. Law needs to be tweaked to account for employment, etc... also put pressure on hospitals to reduce their charges, they are ridiculous. See Singapore for a working example.

I wrote a follow up post on the issues raised above. The bottom line is this: we need some kind of a balanced budget amendment to enforce fiscal discipline, precisely because more revenue could drive more deficit spending.

DeleteAs for Europe vs the US: I am a strong supporter of the European socio economic model. I know it is difficult to apply it to the US, but in the end it will have to. Self evident European institutions like public health and public education (college level) are entirely absent in the US, to its shame and detriment.