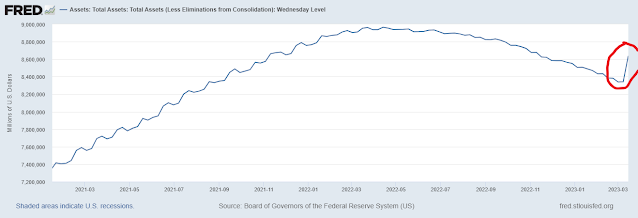

Well...There goes QT.... In just a couple of days the Fed has pumped back in as much money as it drained in the last 4-5 months.

Do you think inflation will follow? Unless we go into a full, blown out Crash yes, inflation is going back up ...

Federal Reserve Balance Sheet Assets Jump Sharply

PS The Fed may flood the system with liquidity if it needs to, but the real problem here is counterparty risk exposure between financial institutions. As many of you may know, the entire global financial system (and thus the global economy) depends on the smooth functioning of the interbank market for foreign exchange, money (ie deposits) and their derivatives. It is, by far, the largest market in the world and depends on “lines” granted by banks to each other, ie how much do they trust each other to fulfill their obligations arising from trading. Will they deliver on settlement date, will they return the money when due, etc.

When banks’ interbank credit departments get spooked they immediately slash their lines - and when that happens it’s basically all over for the bank whose lines are being cut - it can then only go to the Fed as lender of last resort.

Problem is, when one domino falls it is followed by others. As one bank gets its lines slashed it must do the same with lines it has itself extended to smaller banks, and so on and so forth. The bigger the bank that gets in trouble the worse the result down the line. For example, Credit Suisse is amongst the 30 largest globally systemic banks in the world. You can safely bet that it’s counterparties are taking a very serious look at their exposure to it. In fact, I’m pretty darn certain that bank officers are re-examining ALL of their credit lines to all banks right now.

I think it is instructive to look at interest rates in the UK following the pension crisis. Except for the spike during the crisis, yield on the 30 year gilt has been trending higher and is significantly higher than last summer. I think there is a good chance that the Fed will continue to raise interest rate, at least in the near term.

ReplyDeleteFrom TradingEconomics - "The Bank of England voted by a majority of 7-2 to raise interest rates by 50 basis points to 4.0 percent during its February meeting, pushing the cost of borrowing to the highest level since late-2008. It was the 10th consecutive rate hike amid policymakers' efforts to combat high inflation and despite the risks of an expected economic recession this year. Meanwhile, the central bank dropped its pledge to keep increasing rates "forcefully" if needed and said inflation had probably peaked, suggesting it might start reducing the pace of rate increases soon."

https://tradingeconomics.com/united-kingdom/interest-rate

my model seems kinda accurate eh... =)

ReplyDeleteanyway... anon... I think you are right....the Fed can do both QE and raise interest rates, after all, interest rates in Zimbabwe are 69%.... still have some catching up to do...

Wanna see Jon Stewart destroy Larry Summers?

ReplyDeletehttps://twitter.com/TheProblem/status/1636668703692697605?t=94WGsxnfoH7EFxWG00e6QA&s=19