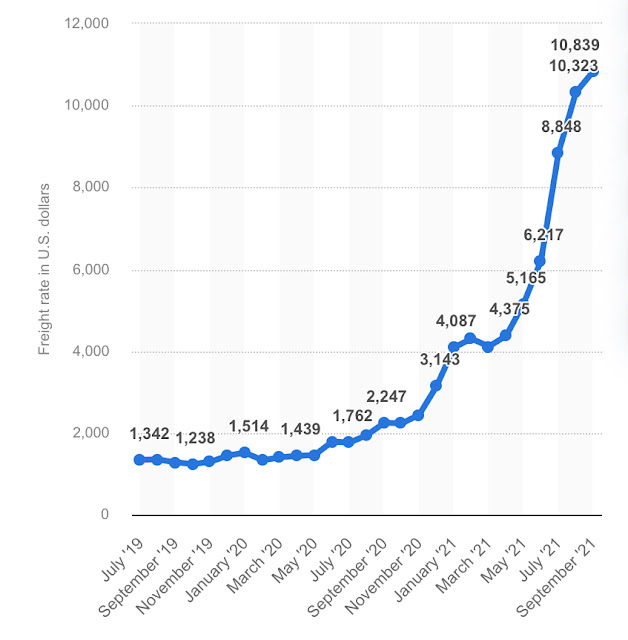

Producer prices are rising at a rate not seen in half a century. That’s bad enough, but it’s not even the whole story. Unlike 1970, 1980 and 2008, when the spike in the PPI index was mainly due to a very sharp increase in crude oil prices (anyone remember “Peak Oil”?), today it involves all commodities and all forms of energy inputs. The rise is very, very broad-based and will impact every industry and every product. Add the phenomenal increase in shipping costs (up 800%) and our reliance on far away Chinese goods, and you have all the ingredients for a perfect inflation storm.

Looking at a chart of PPI and CPI and referring to the previous facts, I think it is difficult to conclude that CPI will be transitory and/or remain “only” at its current 5.4% level. Unless, of course, the Fed and ECB pull their heads from the QE sand and take action, right now.

I fear that with their current ostrich-like behavior Powell and Lagarde are going to go down in history as the worst central bankers in history. Unless they act…

PS Charts of a broad based commodity index and a container shipping index are below..

Global Container Shipping Cost Index

https://www.youtube.com/watch?v=ag7kzZDdBfw

ReplyDeletethe comment section seems to share your view point. =)

Good video Akoc.

Delete