Given the current debt limit squabble in Congress, how likely is a US default in two weeks? Don’t ask me, look at how the market is pricing such a tail risk.

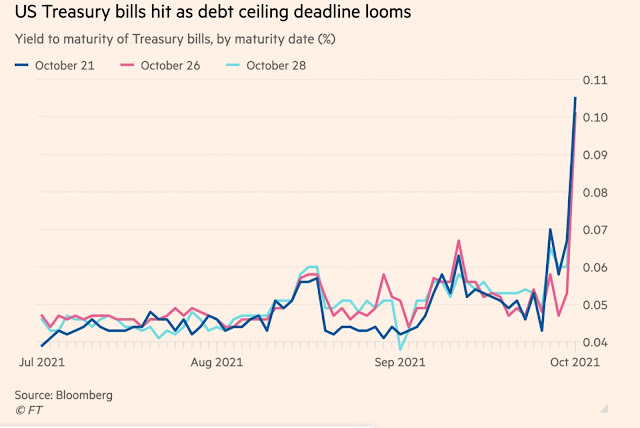

- Yields for Treasury bills coming due after mid October more than doubled yesterday, shooting up from 0.04% to 0.14% intraday and ending at 0.11%.

- Five year Credit Default Swaps (CDS) rose to 15 points yesterday, up 50% in just one month. The US is now in 10th place on the list of sovereign risk, behind even Ireland. Remember, Ireland was one of the PIIGS requiring bailout funds from the EU.

- Donald Trump would become President.

- A President would scoff at scientists and recommend bleach as a viral remedy.

- A huge angry crowd would attempt a coup by storming and occupying the Capitol,

- At least 30% of all Americans would believe that elections were rigged and stolen.

- America would be so incredibly split in politics, ethics, beliefs and wealth (it happened before, and it precipitated the Civil War).

One of the most intriguing strategies in speculation is to bet on highly improbable tail events. The cost is very small, but the reward can be enormous. If you are wrong you lose little, but if you win you win very, very big.

Do the risk/reward math…(hint: you end up with the devil’s very own 666 😱)

...that basically the entire south east of the country is immersed in conspiratorial thought processes that cause them to be fanatically opposed to Covid vaccines. Putin is laughing all the way to the bank indeed... The discord he's sowed is paying off handsomely.

ReplyDeleteI had a queer idea... If I was the U.S., I would default on only China's debt.

ReplyDeleteWhy?

1) China is not really buying U.S. bonds any more, so who cares if they stop buying it;

2) It prevents China from selling what they have and creating a spike in the interest rates;

3) It is unlikely to affect overall U.S. credibility, after all is any other nation intending to challenge the rule based order in that way? The move can be dressed up as a defense of the global systems and rules. In fact other nations are likely to join as it allows them to default as well.

4) It sows chaos in your enemy.

5) It is ethical; If China does not defend the rules based order, why should it be able to profit from it.

I think #3 would not happen. It’s a very interconnected financial world we live in. Other investors would get the signal that the US is weaponizing its debt and would sell/stop buying them, too.

DeleteAlso, China would immediately ask to be paid in yuan for all its exports. That would drive the CNY exchange rate much higher, driving US consumer prices/inflation much higher.

And the US wouldn’t save much, anyway. China holds only around 3-4% of US debt.

hmmm.... let me carry on the war games...

DeleteYes, 3-4% is a but low; if such a move is made, it should be a sudden strike to seize all assets in a flash. So maybe, we do not limit it to treasuries but go for all assets.

Weaponizing debt.... yes, the world would see it so. I am not sure the world would see it negatively though, at least not if the move is made against China... btw, China has been weaponizing trade for a long time (ask Australia), the world sees it negatively but does nothing. I think you have quite a comfortable margin there.

The kicker is the Yuan.... Sure, China can ask to be paid in Yuan... the problem is it will have to pay for everything in Yuan (cause it has nothing left)... and who will want the Yuan, which at that moment will be falling off a cliff.

Let’s step back from the brink for just one moment and discuss basics… ;)

Delete1. I strongly believe that China’s plan is to overtake the US and become the world’s leading superpower.

2. The rest of the world, including the US, sees this clearly.

3. China is not only the world’s leading manufacturer/exporter, it is fast becoming a huge domestic consumer, too.

4. Xi Jinping’s recent change of course towards Common Prosperity is aimed at creating a big, prosperous middle class, ie expand domestic consumption even further.

5. Given #4 the rest of the world cannot and will not go against China.

6. The US is, essentially, panicking and trying to contain China with just a couple of military allies in the Pacific.

7. China cannot become a superpower without turning the yuan into a global reserve currency. It is already taking steps to do it by reducing its dependence on imported dollar-priced fossil fuels.

8. The yuan in this scenario will strengthen, not weaken.

The question is this: when will China pull the trigger? I think, pretty soon.

I also believe very strongly that China’s next strategic step will be Taiwan. And it’s escalating there, all the time..

Hmmm...

DeleteI am not sure I agree with the general view of China. When will China pull the trigger in a military sense? I think the answer is never. In fact, China's goal is to never pull the military trigger.

When will China pull the trigger in the political sense? It has already done so. The goal is not an equal place at the table. The goal is subjugation. For that purpose, the objective is to capture or destroy the political and financial systems of the west.

I agree, China does not want to pull the trigger in a military sense. But it definitely wants to be the #1 global Empire, therefore it needs to dethrone the US financially, economically and socially. I also agree that the process has already started.

DeleteMay you live in interesting times… it’s Chinese curse, isn’t it?

laugh... "may you live in interesting times"... is a Chinese meme from around 1990s.... seems to have died out; maybe too close to reality. =)

Deletemore seriously, the wall street guys that are dealing with China are truly ill informed (to put it mildly). They are not dealing with someone who interested in making money with them; they are dealing with someone who is interested in eliminating them. The goal of the CCP is not to make money; it is to control money....

If you are in to stats; the percentage of Chinese leaders that came to a good end is incredibly small; I think around 1%.... of the top leadership, only Mao and Deng. A soldier likely has better odds surviving the battle of Somme.