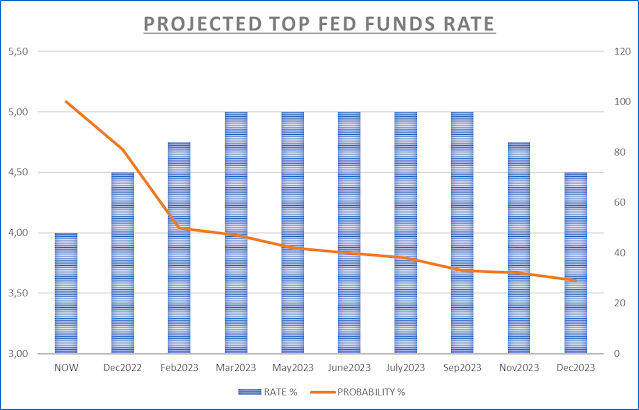

Markets seem to be monothematic these days: it's all about the Fed. How fast will it raise rates and, even more crucially, how high will it raise them from today's 3.75-4.00% band. With this in mind, here's a chart I came up with with data from the CME's Fed Funds futures market.

The blue bars (left scale) show the Fed Funds rate and the orange line (right scale) shows the highest probability associated with this rate, as implied from the futures market.

Interpreting the chart, the market is betting that the Fed will immediately temper its hikes to 50 basis points next month, giving that scenario an 81% probability, and will subsequently raise by only 25 bp, but give this a lower probability of 50%. Further, the chart says that rates will top out at 5.00% by March and stay constant until late next year, but with ever lower certainty. To be clear, the orange line involves the rate that shows the highest probability - others are for lower or higher rates.

on the other side of the pool... I know a lot of HK stocks look really, really cheap now... but these companies can be forced by the mainland to invest into failing enterprises... I would advice against buying anything now... especially not the banks.. they only look good on paper...

ReplyDeleteIMHO markets are teetering on a knife's edge. One day (week) they panic about inflation/Fed, the next they become super excited about the end of inflation/Fed. In terms of the chart in the post, if the maximum expected Fed funds rate moves from 5% to 5.50% the market will tank. If its nudged down to 4.50% the market will jump. It's a rather precarious balance and only suitable for people who love playing craps.

ReplyDeletedoes 0.5% really make that much difference? I mean in reality, not in sentiment...

ReplyDeleteYes, it does. Both on a market sentiment basis and on a valuation model basis. To make it short and simple, when you apply a 5.50% discount rate into a valuation model (for example a net present value calculation) you end up with a lower result than at 5.00%. and it gets more involved from there when other, much more sophisticated valuation models are applied.

DeleteSadly, the market is now ruled by "quants" instead of solid, fundamental business analysts/investors like Warren Buffet. Even worse, because quants know how sensitive their models are and how widely they are used they are extremely trigger happy. They know they have to beat the other quants to the punch and, therefore, it becomes a stampede for the exit.

Thanks for the reply Hell, the obsession with minor changes of interest rate make more sense now... think you are right; the models are becoming the stock market... not sure it is a good thing; but it sure is fascinating to watch... =)

DeleteIndeed, it truly is madness out there... One day it's euphoria, then the next it's gloom and doom and so it goes on and on. To think this could last 10 years...

DeleteWhat if the FED had not increased rates, or just increased them to between 2-3%, but instead engaged in aggressive QT? Would that have solved the inflation problem? Your thoughts?

ReplyDeletehttps://www.theguardian.com/commentisfree/2022/nov/15/the-guardian-view-on-mass-unemployment-inflation-will-drop-without-this-pain?CMP=share_btn_tw

DeleteWould aggressive QT have triggered a recession?

DeleteIt was QT the created runaway inflation in the first place, so more QT will certainly not help; instead, it will make things worse. More money, fast = more inflation, fast.

DeleteNow there’s an idea: change the blog’s title to Sudden Cash 😂

What created runaway inflation was QE, not QT anon.

Deleteactually, if I was the Fed, I would not worry too much about inflation... what is done is done... if I can hold inflation at 10% for the next 10 years, I would consider it a good job... what I would worry about is being forced to print again because of another crisis... now that would be a recipe for run away inflation...

ReplyDeleteHolding inflation at 10% for the next 10 years is quite a drastic shift in policy. If inflation persists at 10%, it will decimate existing LT bond holdings (think pension!) Who really believe the Fed can 'control' inflation rate anyway? Or we won't be here in the first place LOL.

DeleteLT bound holders ... collateral damage? ...=)

DeleteI think the situation is more serious than most people realize.... it is not about what we want, or what is fair... its about the long term viability of the western way of life... some damage will have to be taken... better the pensioners than the young. =)

Hell is more qualified to comment on this. But at 10% interest rate, a lot of businesses will fail, and we will likely enter serious stagflation/depression...

Deleteyeah... kind of... but if a business needs negative real rates to stay alive, maybe it should not be in business...

DeleteI’m sorry, of course it was QE which created runaway inflation. Somehow I misread QT as QE … dyslexia is setting in 😱😱

ReplyDelete