In the previous post I laid out the context for transiting our present socioeconomic paradigm from permanent growth (Permagrowth) to steady state, a condition I will call Permaflat. In this post I examine the financial/monetary aspects of such a transition. But first, a bit of history.

The last yoke on unchecked money creation was removed in 1971 when the US went completely off the gold standard (ok, going to zero bank reserves in 2020 is also significant, but in other ways). It was not an entirely bad idea, given the severe pressures created on the monetary system by OPEC's oil price shock. Some ten years later, things got really ugly when inflation spiked to 15% and the Fed (ie Paul Volcker) had to throw the country into a deep recession in order to kill it.

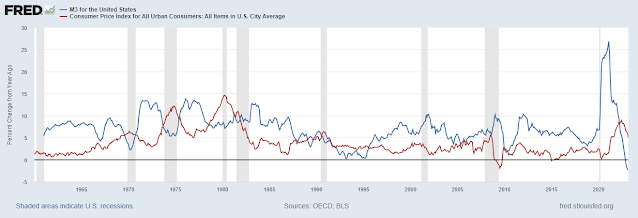

The relation between excess money creation and inflation is pretty obvious to anyone with a passing familiarity with basic monetary economics: if you create more money than is needed by the underlying economic growth you end up with inflation, created by the existence of money alone. For example, if you create 10% more money but the underlying economy only grows by 5% you could ultimately end up with inflation around 5%. It's really a cocktail napkin calculation, but it's close enough.

If you need proof look at the chart below: M3 annual growth in blue, CPI inflation in red. The recent huge spike in money supply growth is scary, to say the least.

this is a good video... not just on economics but on how people think...

ReplyDeletehttps://www.youtube.com/watch?v=U0XntlILeHU

Zero money growth means something like gold standard ? But this is exactly what our economists have accused to be at the origin of the depression of the 1930's. You propose a new Great Depression ?

ReplyDeletesome might argue this is a depression... constantly declining real wages, decreasing life span, great depression level male prime age unemployment...

DeleteDear Arnoult: I propose not a Depression but a... Flatation :) Some may feel it like a Permarecession, however. One thing is for sure: we can't keep on inflating our balloon without eventually bursting it.

DeleteAs for what caused the Great Depression, it was the bursting of a massive speculative bubble in everything, including debt.

DeleteI think that you are right of course, that is exactly the engineer's job to make the technological world go round. Furthermore the tools do exist since the 1950's, in French "Asservissement des système linéaires continus". Those tools that Meadows and co used in their 1972 book "The limits to Growth" and which the old economists like Hayek did not understand because those tools did not exist when they were students.

DeleteHowever if flatation can be introduced and maintained (and it must or we will all die), then it will be very difficult to explain to poorer countries that they must stand still to assure their own future. Except if in your flatation scenario, some (we) will have to decrease their wealth while some others will be allowed some more growth ?

And just a small remark here : in "The Limits to Growth" one of the curves was exactly your flatation/permaflat scenario. But we also all die because of the pollution curve that goes to infinity. Nothing impossible, I think, but a lot of work to find the solutions. And 50 years lost.

DeleteDear Arnoult,

DeleteThank you for your insights, very appreciated. Yes, in a perfect world we would need to re-define our (Western) standard of living as "lower" in order to allow less developed nations to achieve a higher standard. Human beings, however, are historically terrible at sharing/rebalancing and almost always resort to war when things get nasty. So, I must admit that on some days I'm not hopeful - but on other days I resume my optimism :).

In re pollution curve: here I disagree. I am certain that a combination of "flatation" and technological advance cam actually reduce pollution. For example, clean energy from solar, wind and - why not? - fusion.