When inflation first started rising during the pandemic, the Fed insisted it was the temporary effect of supply chain disruptions. And then it kept rising… and rising… and the Fed kept insisting. And then… war happened, and prices of everything from gasoline and food, to fertilizer and cement soared.

Was it the pandemic? Is it Putin? Or, is it because the Fed printed almost $6 trillion in a mere year and a half? You know what I think…yup, I’m with Milton (Friedman) on this.

The Fed is now (ever so slowly) coming to terms with monetary reality, and is starting to talk tough on inflation, planning to raise rates and even -gasp!- shrink its balance sheet by selling bonds outright to the tune of $90 billion per month.

So, how far behind the inflation curve is the Fed, how tough does it have to get to tame it?

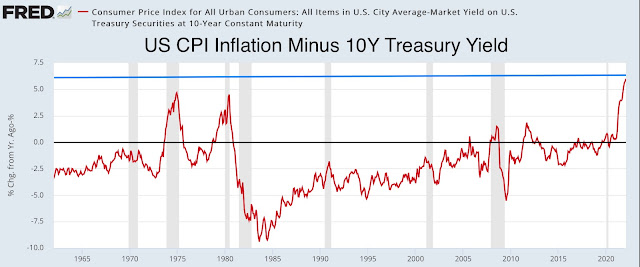

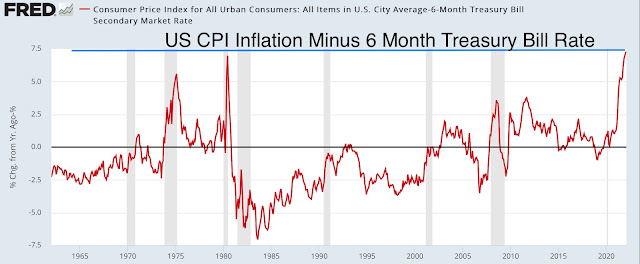

In a word, very! Look at the two charts below: the spread between inflation and Treasury bond and bill yields is at all time highs and must come down fast, one way or another. Which way will it be? My bet is… both: interest rates will rise and inflation will eventually subside due to lower aggregate demand resulting from a recession.

*90 billion per month, not trillion ;)

ReplyDeleteMeh... just wait a few months :) hahahaha

DeleteThe Fed will increase rates until something breaks. The question is what will the Fed do then ?

ReplyDeleteyou know, what really bothers me is that both the interest rate and gold price are going up together.... does not really feel like my grandfather's interest rate hike,

ReplyDeleteIt seems like gold is just hovering and waiting for the Fed to reverse course (from QT to QE) as soon as the market breaks like it did in Mar 2020. I know Hell hates gold but this time may be different and would like to hear his take on this.

Deleteaye... that feels right... like no one really believes in this interest rate rise thing...

DeleteI am not saying their belief is right or wrong, just saying they don't really believe the fed

DeleteThe Fed is in a real bind, probably for the first time in its history. Inflation is soaring because the Fed itself printed trillions and kept (is still keeping) interest rates near zero AND there is every prospect of a sharp recession AND a likelihood of a major break in the stock market. Naturally, the Fed absolutely hates being blamed for these upcoming (?) events, so they are exceedingly timid in their action.

DeleteBut, it is exactly this timidity that exacerbates the situation. IMHO, the Fed should become 100% decisive and announce “we will do whatever it takes” to kill inflation ASAP. Yes, this will create a sharp market drop initially but will also reassure markets that the Fed is on top of the situation. After a brief bear market, they will stabilize.

If, instead, they continue being wishy washy markets will wallow in uncertainty and continue dropping in a prolonged bear market.

This is a very U.S. centered blog... the rest of the world is already going bankrupt at the slightly elevated interest rates... see Sri Lanka, I think more are going to follow... can you imagine what will happen if the Fed really jacks rates to combat inflation... Its going to be lord of the flies out here... =)

DeleteI'm afraid you're right...

Deletebtw, the only case where I can think of, where both interest rates and gold price to rise, is when the value of the underlying currency is depreciating.

ReplyDelete